By James Van Straten (All times ET unless indicated otherwise)

The total cryptocurrency industry is now under $3.2 trillion in market capitalization, as over $300 billion has been wiped out since Jan. 6, taking away all early gains for the year, according to the TradingView metric TOTAL. As a result, bitcoin (BTC) is now hovering above $93,000 but has been making a succession of higher lows starting from Dec. 30.

Adding to the bearish sentiment, market is digesting the unconfirmed reports from DB News which suggest that the U.S. government has been given the green light to liquidate as much as 69,370 BTC ($6.5B) from the Silk Road seizure. This makes the political theatre between the outgoing and incoming U.S. administrations even more intriguing, as president-elect Donald Trump, who is just few days away from being sworn in on Jan. 20, vowed not to sell any of the bitcoin held by U.S. authorities, which, according to Glassnode data, amounts to 187,236 BTC.

The onslaught in the crypto industry stems from an extremely high DXY index, above 109, which measures the value of the U.S. Dollar relative to a weighted basket of major foreign currencies. In addition, for a brief moment, the U.S. treasury yields were rising before retreating slightly yesterday. The benchmark for 10-year yield was as high as 4.73%.

The inflation concerns that paddled the selloff in the broader market is picking up alongside growth expectations, LondonCryptoClub told CoinDesk. “The combination of rising growth and inflation expectations alongside rising term premia as the market struggles to digest huge treasury supply to fund these deficits is pushing U.S. yields higher, which is dragging global yields higher, excluding China.”

However, turmoil is occurring across the pond in the U.K., with gilt yields continuing to march higher this morning. Records were set today, as the 30-year U.K. jumped to almost 5.45%, the highest level since 1998. While the benchmark U.K. 10-year challenged 4.95%, the highest since 2008, the treasury was forced to intervene in the market to calm investors, according to reports from The Telegraph.

LondonCryptoClub mentioned the key reasons for the turmoil, “the U.K. is under pressure after a disastrous budget which has increased borrowing needs with little to no positive growth impact, exacerbating the negative debt/GDP dynamics and driving a larger fiscal deficit.”

As a result, the not-so-Great British pound, falling yet again, is now 1.22 against the dollar, the lowest level since November 2023, and has fallen almost 4% in the past month.

Today, Jan. 9, is declared a mourning day in the U.S. to remember the death of former President Jimmy Carter. Therefore, the stock market will be closed. So, all eyes will be turning to the jobs report on Friday. The market is in a good news is bad news scenario as rate cuts for 2025 get pushed back with only one rate cut expected for 2025.

A strong jobs report could remove this rate cut, with unemployment expected to come in at 4.2%, while nonfarm payroll is estimated at 154,000. A hot jobs print could send the dollar to 110, putting further pressure on risk-assets.

Stay alert!

What to Watch

- Crypto

- Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s latest release.

- Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

- Jan. 15: Derive (DRV) to create and distribute new tokens in token generation event.

- Jan. 15: Mintlayer version 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 154K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 73.8 vs. Prev. 74.0.

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

- PPI MoM Prev. 0.4%.

- Core PPI MoM Prev. 0.2%.

- Core PPI YoY Prev. 3.4%.

- PPI YoY Prev. 3%.

- Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending on Jan. 11. Prev. 6.8%.

- Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

- Core Inflation Rate MoM Prev. 0.3%.

- Core Inflation Rate YoY Prev. 3.3%.

- Inflation Rate MoM Prev. 0.3%.

- Inflation Rate YoY Prev. 2.7%.

- Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

- GDP MoM Prev. -0.1%

- GDP YoY Prev. 1.3%.

- Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending on Jan. 11. Initial Jobless Claims Prev. 201K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

Token Events

- Governance votes & calls

- Gitcoin DAO started discussions on the launch of Allo.Capital, an entity focused on building tools for on-chain capital allocation.

- Compound DAO is discussing the creation of a New Chains Business Unit to expand into other blockchains.

- Unlocks

- Jan. 11: Aptos to unlock 1.13% of its APT circulating supply, worth $98.85 million.

- Jan. 12: Axie Infinity to unlock 1.45% of its circulating supply, worth $14.08 million.

- Jan. 14: Arbitrum to unlock 0.93% of its circulating supply, worth $70.65 million.

- Token Launches

- Jan. 10: Lava Network (LAVA) to be listed on KuCoin and Bybit at 5 a.m.

- Jan. 10: Bybit to delist FTM (FTM) at 5 a.m..

Conferences:

Token Talk

By Shaurya Malwa

A parody token just got its own parody.

AI Agents upstart ai16z, a platform mimicking venture fund a16z that uses AI to manage user funds, saw a mockery of its token raffle among smallcap speculators in the past day, running to a peak of $130 million market capitalization as of European morning hours.

Where ai16z tried to blend AI with investment, LLM — short for “Large Language Model” laughs at the very concept, suggesting that if AI can be anything, it can certainly be a meme with no real utility.

X users were quick to dub LLM as the “McDonald’s version of $ai16z,” mixing fast food with AI, creating a narrative where the only intelligence was in the marketing.

Some thoughts about $LLM: it’s the perfect token to mock $ai16z.

1. It uses an AI-related term but is actually a funny meme without any utility, much like $fartcoin.

2. It emerged organically and has a perfect distribution—everyone had a chance to buy it even before pf bonding.…— 冷静冷静再冷静 (@hexiecs) January 9, 2025

It has no inherent utility or technological backing; its value is purely speculative and community-driven, based on the meme’s popularity and the humor it brings to the crypto conversation.

I bought it because it was funny — But now, it’s turned into a community + the ticker is ideal for the meta we’re in + the word play on the ticker can’t be funnier.

— him (@himgajria) January 9, 2025

AI Agent projects virtuals (VIRTUALS), ai16z (AI16Z) and the broader category are down more than 20% since peak on average in the past weeks amid criticism of their claimed AI models, as a CoinDesk analysis previously noted.

Derivatives Positioning

- The annualized one-month basis in BTC and ETH CME futures has retreated to 6%-7%, the lowest since the election day. The positioning continues to moderate, with ETH open interest dropping to a one-month low of $2.9 billion, according to data source Amberdata.

- Annualized funding rates in perpetual futures tied to large cap tokens now hover at around 5%, down significant from last month’s excessively bullish 80% to 100%. However, the OI-normalized CVD continues to signal net selling pressure in the market.

- In options market, front-end skews now show bias for BTC and ETH puts, but longer duration continue to reflect a bullish bias.

- Notable block trades include a large short trade in the BTC $55K put expiring on March 29. In ETH, traders shorted calls at strikes $4,800, $5,500 and $6,000.

Market Movements:

- BTC is down 1.24% from 4 p.m. ET Tuesday to $93,307.05 (24hrs: -1.8%)

- ETH is up 0.23% at $3,307.13 (24hrs: -1.15%)

- CoinDesk 20 is down 1.18% to 3,954.73 (24hrs: -2.28%)

- Ether staking yield is up 1 bp to 3.15%

- BTC funding rate is at 0.0061% (6.66% annualized) on Binance

- DXY is up unchanged at 109.19

- Gold is up 0.72% at $2,683.8/oz

- Silver is up 1.71% to $30.86/oz

- Nikkei 225 closed -0.94% at 39,605.09

- Hang Seng closed -0.2% at 19,240.89

- FTSE is up 0.63% at 8,303.24

- Euro Stoxx 50 is unchanged at 4,997.63

- DJIA closed +0.25% to 42,635.20

- S&P 500 closed +0.16% at 5,918.25

- Nasdaq closed unchanged at 19,478.88

- S&P/TSX Composite Index closed +0.49% at 25,051.70

- S&P 40 Latin America closed -0.87% at 2,204.98

- U.S. 10-year Treasury is down 2 bps at 4.68%

- E-mini S&P 500 futures are down 0.1% to 5,953.0

- E-mini Nasdaq-100 futures are down 0.18% at 21,323.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 42,874.00

Bitcoin Stats:

- BTC Dominance: 57.85

- Ethereum to bitcoin ratio: 0.035

- Hashrate (seven-day moving average): 785 EH/s

- Hashprice (spot): $55.7

- Total Fees: 7.57 BTC/ / $722,439

- CME Futures Open Interest: 176,215 BTC

- BTC priced in gold: 34.8 oz

- BTC vs gold market cap: 9.90%

Basket Performance

Technical Analysis

- The chart shows BTC’s downward momentum is weakening.

- While prices continue to chalk out lower highs, the momentum oscillator RSI is now moving in the opposite direction, diverging bullishly to signal a potential price bounce ahead.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $331.7 (-2.85%%), up 0.99% at $335.00 in pre-market.

- Coinbase Global (COIN): closed at $260.01 (-1.63%), up 0.55% at $261.45 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.62 (-2.23%)

- MARA Holdings (MARA): closed at $18.34 (-3.84%), up 0.11% at $18.36

in pre-market. - Riot Platforms (RIOT): closed at $12.02 (-3.14%), unchanged in pre-market.

- Core Scientific (CORZ): closed at $14.05 (-0.5%), up 0.36% at $14.10 in pre-market.

- CleanSpark (CLSK): closed at $10.09 (-5.79%), unchanged in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.15 (-4.93%), down 1.08% at $22.90 in pre-market.

- Semler Scientific (SMLR): closed at $50.19 (-9.14%), unchanged in pre-market.

- Exodus Movement (EXOD): closed at $37.78 (-3.89%), up 0.21% at $37.86 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$568.8 million

- Cumulative net flows: $36.37 billion

- Total BTC holdings ~ 1.140 million.

Spot ETH ETFs

- Daily net flow: -$159.4 million

- Cumulative net flows: $2.52 billion

- Total ETH holdings ~ 3.627 million.

Source: Farside Investors, as of Jan. 8.

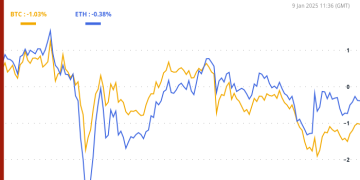

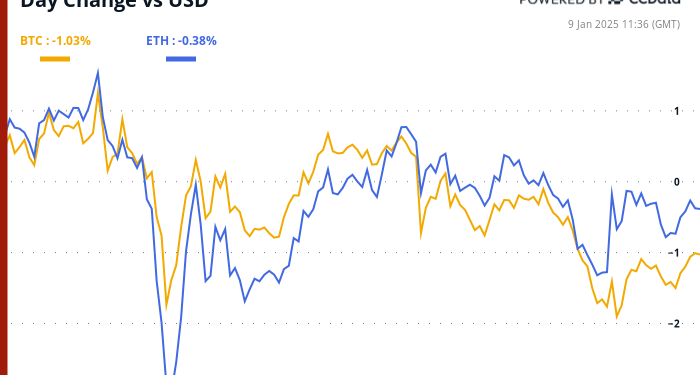

Overnight Flows

Chart of the Day

- The MiCA-led decline in tether’s (USDT) market capitalization has stalled.

- So, the ongoing decline in BTC may lose momentum. USDT, the world’s largest dollar-pegged cryptocurrency is widely used to fund crypto purchases.

While You Were Sleeping

- Bitcoin ETFs Suffer $582M Net Outflow, Second-Highest Tally Ever (CoinDesk): Bitcoin and ether ETFs saw $582M and $159M in outflows Wednesday as the Fed’s December FOMC meeting minutes noted inflation risks from Trump’s policies and a possible slowdown in rate cuts.

- XRP May Surge 40% As ‘Trump Effect’ Boosts Ripple Sentiment (CoinDesk): XRP, up 300% since November amid optimism for Trump’s crypto-friendly policies, could see another 40% surge as technical analysis highlights a bullish breakout from its descending triangle pattern.

- Bitfinex Relocates Derivatives Services to El Salvador (The Block): Bitfinex Derivatives is relocating to El Salvador after obtaining its second license to operate under the nation’s crypto-friendly framework, allowing it to enhance its services and strengthen its regional presence.

- Bond Market Selloff Jolts Global Investors As Trump Worries Grow (Reuters): A global bond price drop on Wednesday pushed yields to multi-year highs in the U.S., U.K., and Eurozone, driven by inflation risks, heavy bond issuance, and concerns about Trump’s tariff threats.

- China Consumer Prices Weaken Further, Adding to Deflation Worries (Bloomberg): China’s inflation slowed for a fourth month in December, with CPI up just 0.1% year-on-year, the National Bureau of Statistics reported, highlighting deflation risks amid global inflation pressures.

- Asia’s Central Banks Face a Formidable Challenge: An Ascendant U.S. Dollar (CNBC): The U.S. dollar’s post-election rally has devalued the currencies of Japan, China, South Korea, and India, raising import costs for these nations and complicating their central banks’ economic strategies.

In the Ether