Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The FTX saga, despite Sam Bankman-Fried’s appeal, has concluded with the former FTX CEO receiving a 25-year sentence. The ramifications of this landmark trial will endure.

In November, the former CEO of the now-defunct cryptocurrency exchange was convicted on seven counts of fraud and conspiracy to launder money. His late-March sentencing resulted in more than two decades behind bars.

During the trial, three former close associates testified against Bankman-Fried, alleging that he directed them to use FTX funds for various purposes, including paying Alameda’s debts, making political donations and acquiring luxury real estate in the Bahamas. They confessed to fraud and are awaiting sentencing.

In his defense, Bankman-Fried acknowledged making mistakes in risk management but vehemently denied any accusations of theft.

Crypto dream turned into nightmare

FTX, once valued at $32 billion, collapsed in late 2022, filing for bankruptcy amid a broader cryptocurrency crash. The company’s downfall was attributed to the misuse of customer funds for risky investments through a closely associated hedge fund, Alameda Research. Bankman-Fried, the founder of FTX, also used customer funds for personal high-risk ventures, contributing to the company’s demise, according to the court’s decision.

Bankman-Fried is not the only crypto figure facing legal woes. Recently, Terraform Labs and its former CEO Do Kwon were held accountable for fraud in a New York City case, with Kwon detained in Montenegro since early last year.

Changpeng Zhao, former CEO of Binance, faces sentencing in late April for failing to enforce anti-money laundering protocols at his company. He agreed to a $50 million fine and resignation as CEO.

The fallout from FTX’s collapse extended beyond financial losses, tarnishing the reputations of notable figures associated with FTX. This event triggered a chain reaction of crypto failures within the industry, from which it has yet to fully recover. Additionally, the incident prompted regulatory scrutiny and dampened public sentiment toward cryptocurrencies at a crucial time when the asset class was gaining mainstream acceptance.

No one cares until crash arrives

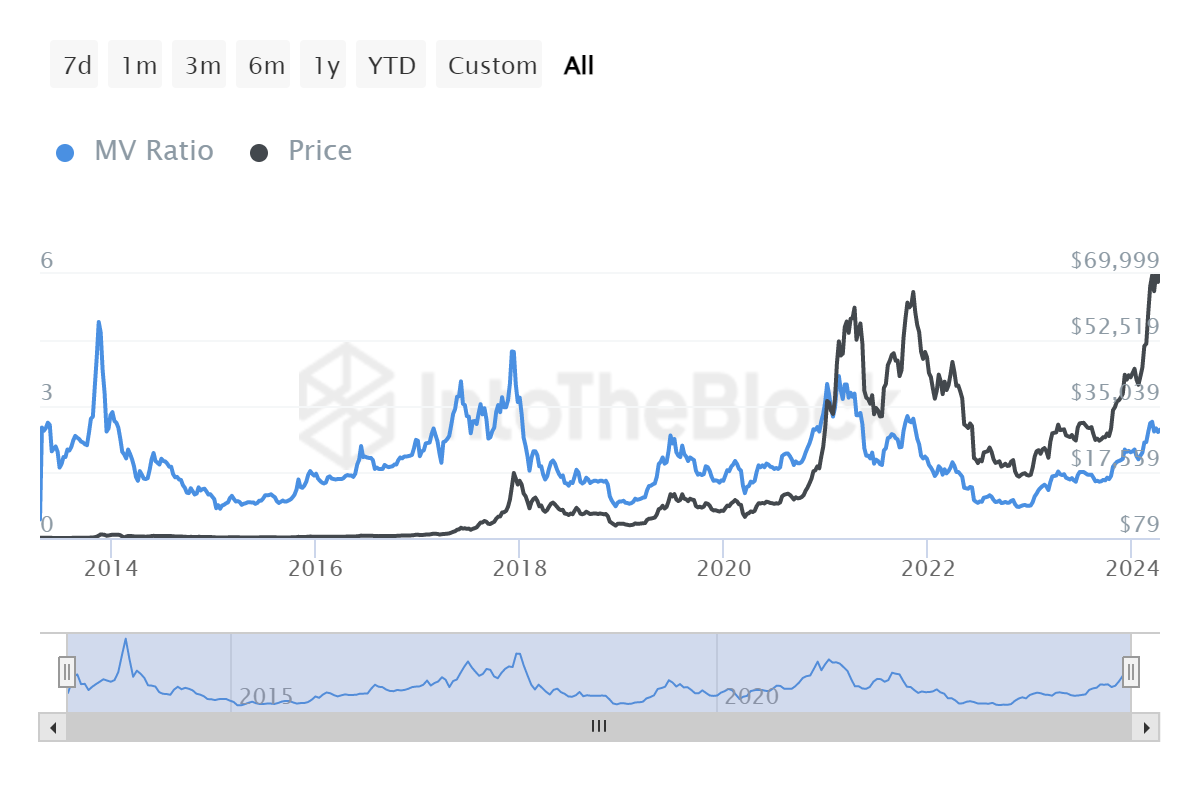

During significant market surges, investors often overlook risks. Bankman-Fried rose to prominence in the wake of the crypto market influx after 2020, attracting new investors from traditional finance. Michael Saylor’s $250 million investment in Bitcoin marked a turning point in this new era.

The Sequoia FTX eulogy underscores how VCs sometimes neglect due diligence when entering the crypto money-making machine.

Alameda Research was heavily backed by FTT tokens, operating under the assumption that FTT prices would remain stable and clients would not withdraw from FTX. The problem was not that FTX customers and investors trusted SBF and his partners without verification — they simply did not care at the time.

Regulators to choose paradigm

Of course, the easy solution to the problem would be regulation. As SEC Chair Gary Gensler emphasized following the FTX situation: “The alleged fraud committed by Mr. Bankman-Fried is a wake-up call to crypto platforms that they must comply with our laws. Compliance protects both investors and those invested in crypto platforms with time-tested safeguards, such as proper customer fund protection and business line separation.”

However, turning the crypto industry into traditional finance may not eliminate fraud entirely. Efforts to enhance regulatory frameworks and promote self-regulation within the crypto industry are likely to yield better results.

These questions are critical during all-time market highs, as ignoring them now we risk losing our own future.