Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Gaining momentum

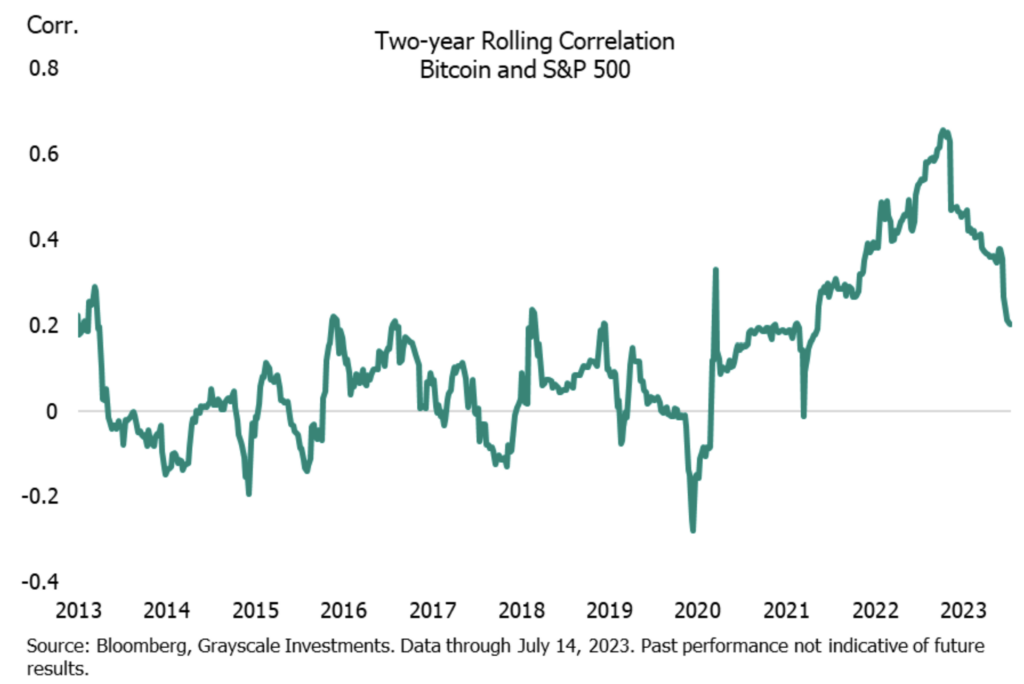

Over the past decade, Bitcoin has shown a correlation of 0.17 with the S&P 500, lower than other alternative assets like the S&P Goldman Sachs Commodity Index, which has a correlation of 0.42 with the S&P 500 during the same period.

While Bitcoin’s correlation with the stock market has historically been low, recent years have seen a slight increase. Over the last five years, the correlation has risen to 0.41.

Bitcoin’s relationship with the S&P 500 saw a negative correlation of -0.76 on November 11, 2023, and then hit a positive correlation of 0.57 in January 2024. This shift from negative to positive correlation points to Bitcoin’s changing perception among investors.

Comparing stock and Bitcoin

The S&P 500 is a stock market index that monitors the performance of 500 leading companies listed on U.S. stock exchanges. Renowned as a barometer for the U.S. economy, it is favored by risk-averse traders for its consistent historical performance and diversification across various industries.

Holding positions in the S&P 500 with a long-term perspective has historically yielded annual gains nearing 10%.

When comparing Bitcoin and the S&P 500, one notable difference is their volatility. Bitcoin’s performance is often likened to a roller-coaster ride, evident in its drastic swings from plunging over 64% in 2022 to rallying 160% in 2023. This volatility can be challenging for crypto traders to navigate.

In contrast, the S&P 500 exhibits relatively stable performance, averaging about 9% to 10% annual returns and serving as a benchmark for the U.S. economy. While the S&P 500 may offer lower overall returns compared to Bitcoin, its consistency and long-term track record make it a favored choice for risk-averse investors.

What correlation usually means

The correlation between Bitcoin and the S&P 500 can be attributed to factors such as declining inflation numbers and the U.S. Federal Reserve’s decision to pause interest rate hikes. This created a favorable environment for risk-on trading, leading to bull rallies for both Bitcoin and the S&P 500 index despite the bearish sentiment following the 2022 correction.

When the correlation between Bitcoin and traditional equity markets like the S&P 500 and Nasdaq increases, while its correlation with Gold decreases, it suggests that Bitcoin is behaving more like a risk-on asset rather than a safe haven. When investors are feeling venturous, they often swing toward stocks and digital coins for a chance at juicier profits.

If institutional and retail investors are increasingly involved in both equity and cryptocurrency markets, their simultaneous buy and sell decisions could cause the price movements of these assets to align.

Both Bitcoin and the S&P 500 thrive in periods of loose monetary policy, characterized by central banks stimulating the economy through measures like interest rate cuts and quantitative easing.

This environment boosts asset markets by injecting liquidity and lowering borrowing costs. Consequently, investors flock to both traditional and crypto markets, driving up prices. However, when central banks tighten monetary policy by raising interest rates, as seen recently, it can dampen market enthusiasm and impact asset prices.

BTC beats S&P 500

In 2023, Bitcoin surged by 160%, while the S&P 500 gained 23%. However, it is essential to consider past performance, as Bitcoin experienced a significant 64% crash in 2022, compared to the S&P 500’s 19% decline. These contrasting performances highlight the perspective needed when comparing Bitcoin’s volatile gains with the more stable returns of the S&P 500 index.

Fidelity’s research indicates that Bitcoin has historically provided significant returns, averaging 186.7% annually from August 2010 to August 2022. However, since the launch of the Bitcoin futures market in 2018, its average annual returns have been around 8.8%.

While past performance suggests potential for high returns, Bitcoin’s extreme volatility should not be overlooked. Investors should be aware that its value can both rise and fall dramatically, as evidenced by recent fluctuations.

To assess Bitcoin’s risk, Fidelity conducted simulations adding different amounts of Bitcoin to a traditional 60/40 portfolio. The study found that even a small allocation of Bitcoin significantly increased portfolio volatility. For instance, replacing 1% of stocks or bonds with Bitcoin contributed about 3% to overall portfolio volatility, with risks increasing exponentially as allocation levels rose.

Tech-driven surge

Bitcoin’s recent price surge aligns with optimism in technology stocks on Wall Street, reflected by the rise in the Nasdaq 100 Index relative to the S&P 500 (NDX-SPX ratio). This positive correlation suggests that movements in technology stocks influence Bitcoin’s market. Traders monitoring Bitcoin may track the NDX-SPX ratio for insights.

Despite potential fluctuations, optimism prevails in the crypto market due to factors like the upcoming halving-induced supply reduction and increased ETF demand, fueling predictions of Bitcoin reaching $150,000 and beyond.

Ali Martinez suggested that Bitcoin’s price trajectory might parallel that of the S&P 500 ($SPX), raising the question of whether the recent drop from $32,000 to $25,000 represented the final opportunity to buy at a low price.

He speculated whether this decline could signal the beginning of an upward trend, leading to a scenario where Bitcoin only moves in one direction, upward.