Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Vitalik Buterin, Ethereum’s creator, has always looked for ways to make the network more decentralized. A recent study by Toni Wahrstätter expands on Buterin’s ideas about changing how Ethereum rewards its validators to support this goal.

The study focuses on what is called “anti-correlation penalties.” Right now, large groups that run many Ethereum validators can save on costs, which tends to pull the network toward a few big players. But if many validators controlled by one operator fail at the same time, it can be a risk for the whole network. This is where the new idea comes in: if validators run by the same operator often fail together, they could get a penalty, which would encourage more diverse and independent validators.

In a nutshell, if more validators miss their chance to confirm transactions (attestations) than usual, they could get a penalty. This would help keep Ethereum decentralized, making it less likely that one big validator has too much control.

Wahrstätter’s analysis looks at data from over 40 days, which includes around 9.3 billion validator activities. The research imagines applying Vitalik’s proposed formula to this data to see what would change.

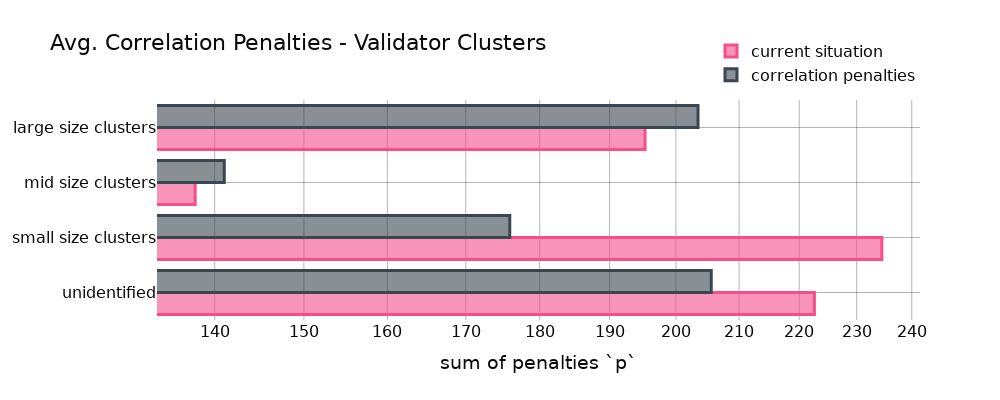

For staking operators — the entities running the validators — the effects would vary by size. Large operators might face higher penalties under the new system, while smaller operators could benefit. This fits with the idea that the penalties would discourage large-scale centralization. Interestingly, a category with unidentified validators, possibly solo stakers, also showed up, hinting at the diversity of the network.

The analysis also considered different software clients used by validators. The idea was that if validators using the same software fail together, they might face higher penalties. The findings were subtle, showing small changes for different clients, suggesting that the software is reliable.