Welcome to The Market’s Compass US Index and Sector ETF Study, Week #571. As always it highlights the technical changes of the 30 US Index and Sector ETFs that I track on a weekly basis and normally publish every third week. Past publications can be accessed by paid subscribers via The Market’s Compass Substack Blog*.

*This week, in celebration of the Hanukkah and Christmas Holidays it is also being sent to free subscribers in a not so veiled attempt to lure them to become paid subscribers.

To understand the methodology used in constructing the objective U.S. Index and Sector ETF Individual Technical Rankings visit the MC’s Technical Indicators page at www.themarketscompass.com and go to “us etfs”. What follows is a Cliff Notes version* of the full explanation…

*The technical ranking system is a quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength of each individual 30 U.S Index and Sector ETFs that can range between 0 and 50.

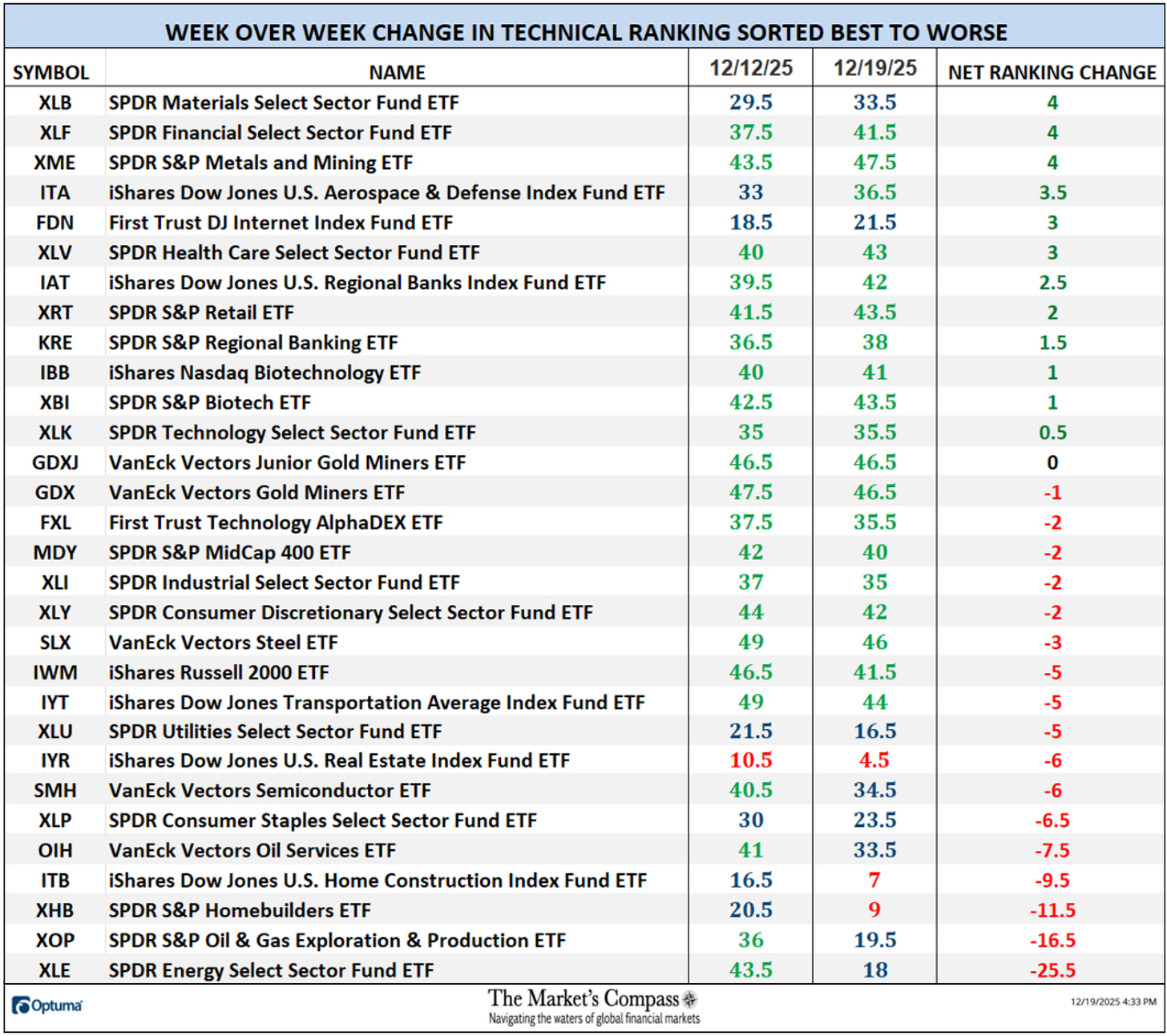

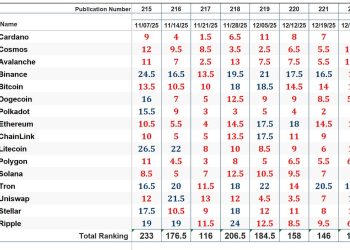

Total US ETF Ranking or “TER” fell last week, dropping 7.85% to 1010 from 1096 the week before.

Twelve ETF TRs gained ground last week, one was unchanged, and seventeen had TRs that fell with three dropping double-digits. Nineteen ETF TRs ended the week in the “green zone” (TRs from 35 to 50), eight ended the week in the “blue zone” (TRs from 15.5 to 34.5) and three ended in the “red zone” (TRs between 0 and 15) vs. the previous week when there was twenty two in the “green zone”, seven in the “blue zone”, and only one was in the “red zone”. The average TR loss on the week was -3.07 vs. the week before average TR gain of +1.22. Energy and Homebuilding ETFs drove the Average TR loss lower last week. Excluding the bottom five, the average TR loss would have been -0.81.

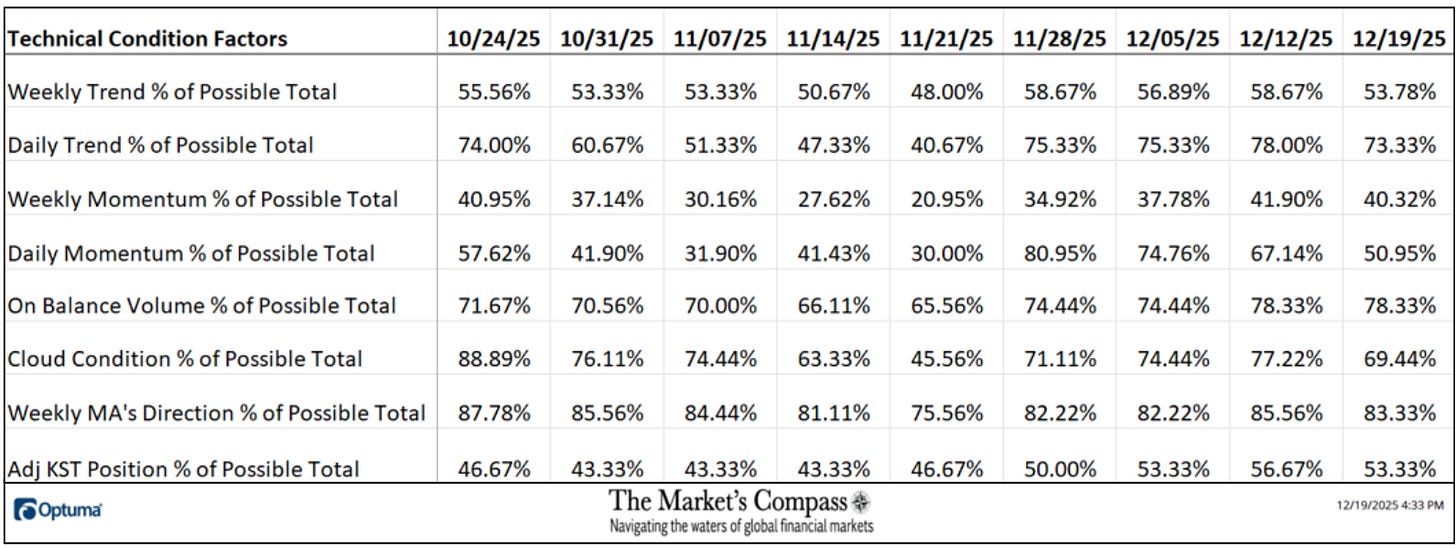

*The Technical Condition Factors are derived from a calculation of the total Individual US Index and Sector ETF Technical Rankings. What is shown in the excel panel below is the total TCFs of all thirty TRs. A few TCFs carry more weight than the others, such as the Weekly Trend Factor and the Weekly Momentum Factor in compiling each individual TR of each of the 30 ETFs. Because of that, the excel sheet below calculates each factor’s weekly reading as a percentage of the possible total.

To fully understand the construction the of The Technical Condition Factors visit the MC’s Technical Indicators page at www.themarketscompass.com and go to “us etfs”.

One technical takeaway would be for example, if the DMC Factor or DMCTF rises to an extreme between 85% and 100%, it would suggest a short-term overbought condition. Conversely, a reading in the range of 0% to 15% would suggest an oversold condition was developing. This past week a reading of 50.95% was registered in the DMCTF or 107 out of a total of 210 positive points, which was down from 67.14% the previous week.

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 30 ETFs are improving internally on a technical basis confirming a broader market move higher (think of an advance/decline calculation). Conversely if all eight TCFs fell over the week it confirms a move lower in the broader market. Last week seven TCFs lost ground and one was unchanged

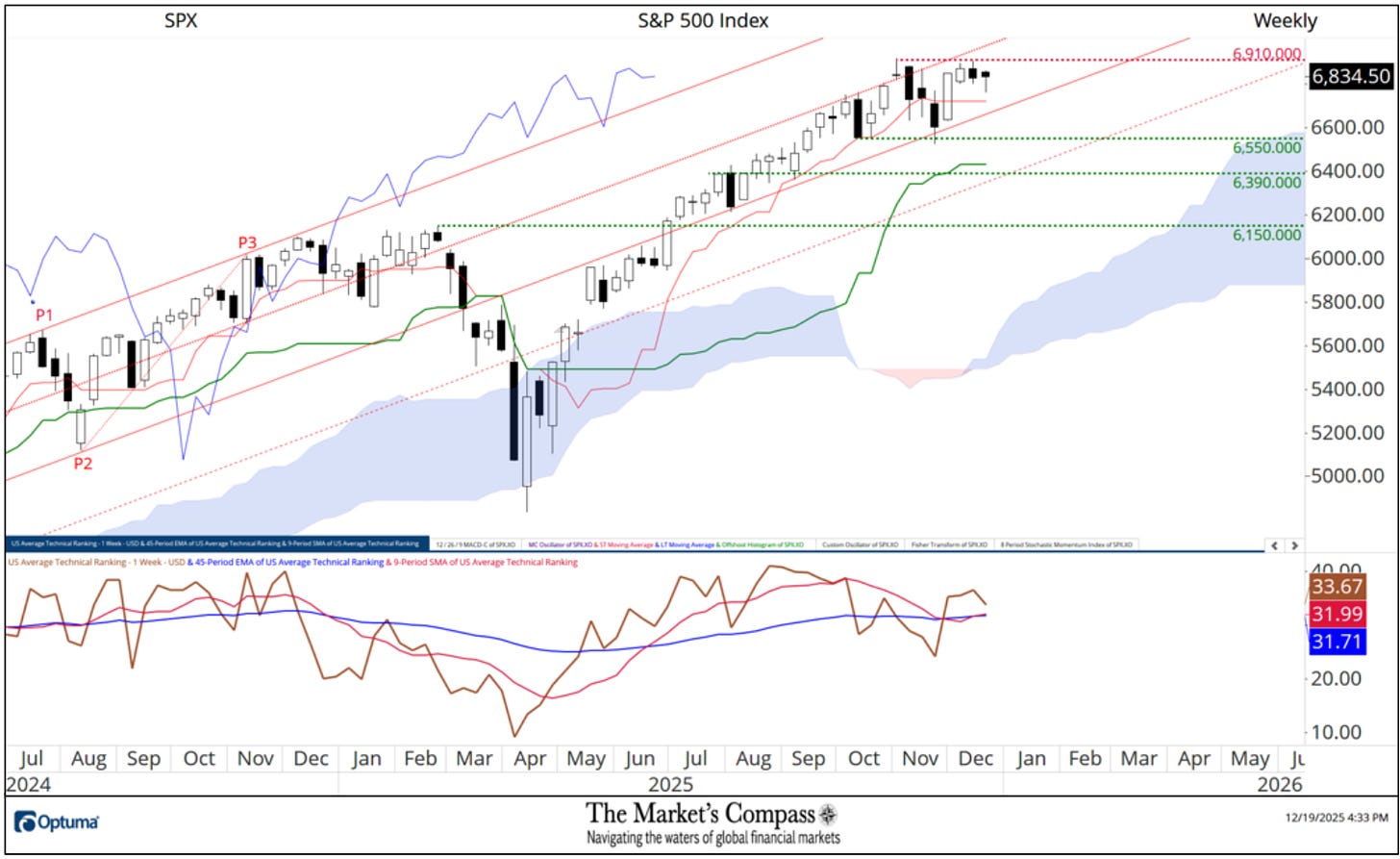

The Total US ETF Technical Ranking (“TER”) Indicator is a total of all 30 ETF rankings and can be looked at as a confirmation/divergence indicator as well as an overbought oversold indicator.

The series of higher weekly closing lows and higher weekly closing highs since April remains intact and three weeks ago the S&P 500 Index registered a record weekly closing high. Yet the Total US ETF Ranking or “TER” failed to confirm the high.

The Weekly Average Technical Ranking (“ATR”) is the average Technical Ranking of the 30 US Index and Sector ETFs we track. Like the TER, it is a confirmation/divergence as well as an overbought/oversold indicator.

For the past three weeks prices have struggled to overtake the October intra-week highs but have continued to hold above support offered by the Lower Parallel (solid red line) of the Schiff Modified Pitchfork (red P1-P3) on a weekly closing basis since early July giving me the confidence to suggest the Median Line (red dotted line) will be overtaken in the weeks to come. That said, the Average Technical Ranking Oscillator did not confirm the late October highs and the 9-Week Simple Moving Average (red line) is contending with resistance at the longer-term 45-Week Exponential Moving Average (blue line).

*An in-depth comprehensive lesson on Pitchforks is available on my website…

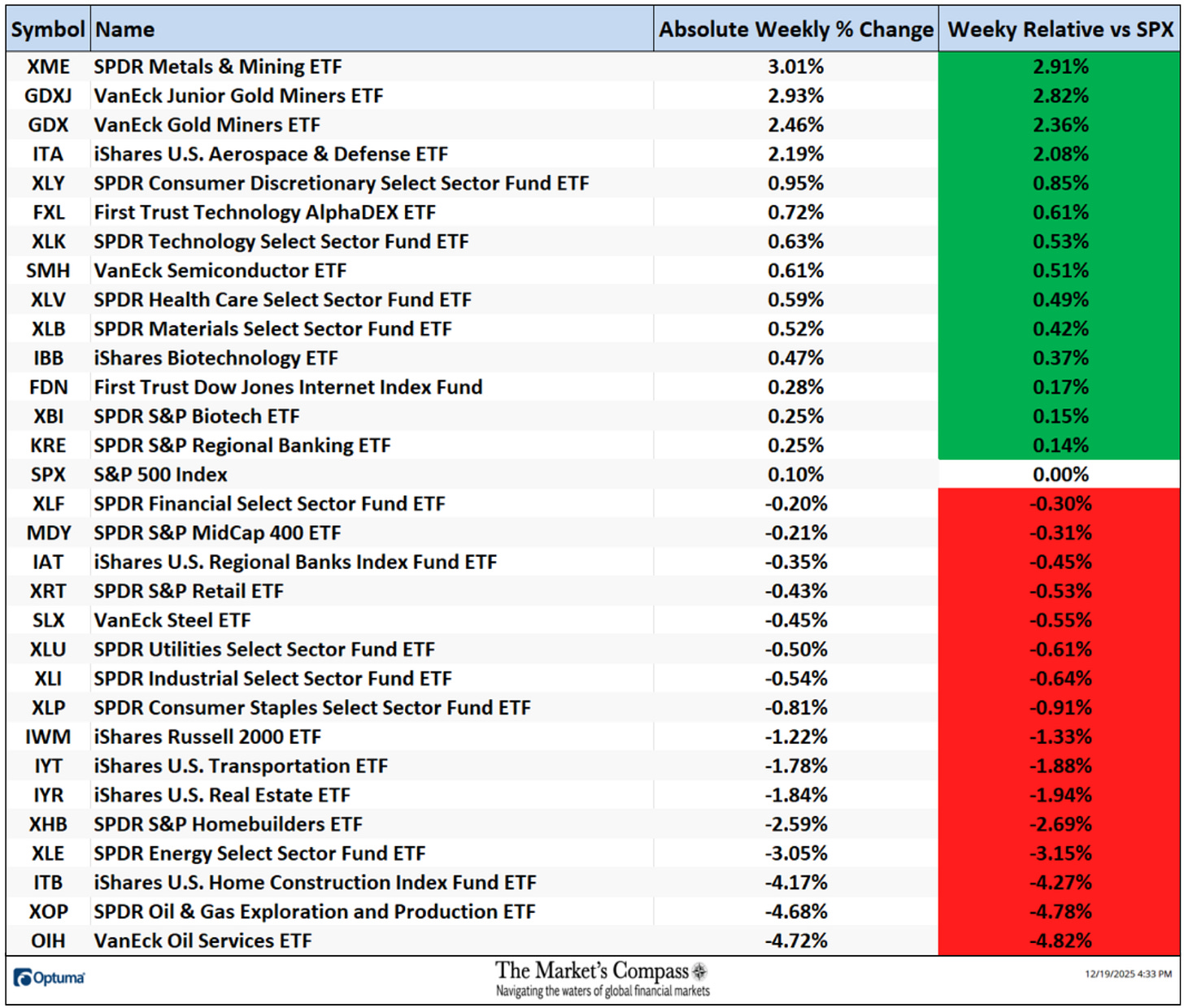

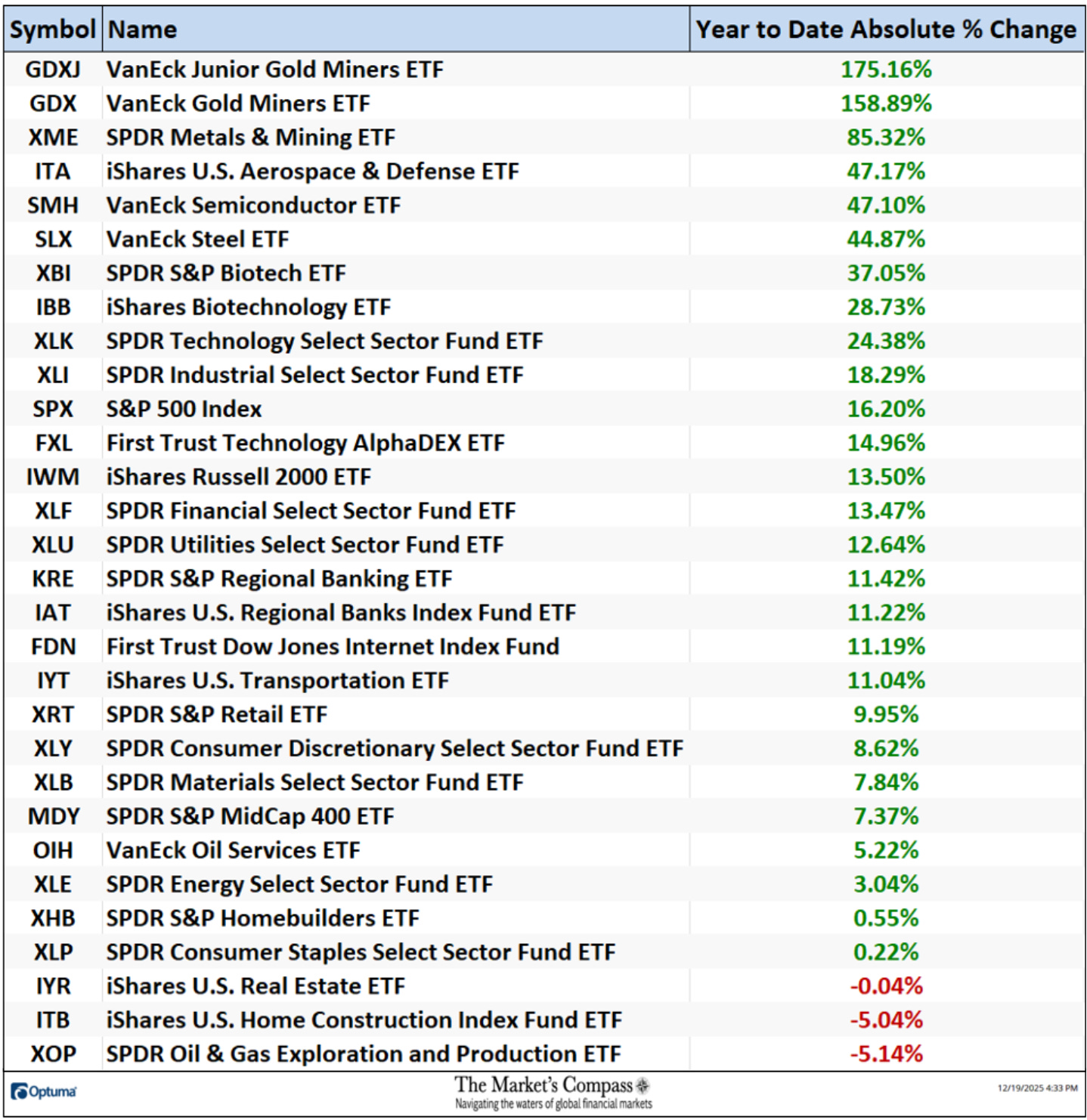

Fourteen of the US Index and Sector ETFs that I track in this Study gained ground on an absolute basis last week bettering the +0.10% gain in the SPX Index. Sixteen underperformed the S&P 500 Index on a relative basis. The standout gainers last week were the metals and mining ETF (XME) and gold ETFs (GDX and GDXJ).

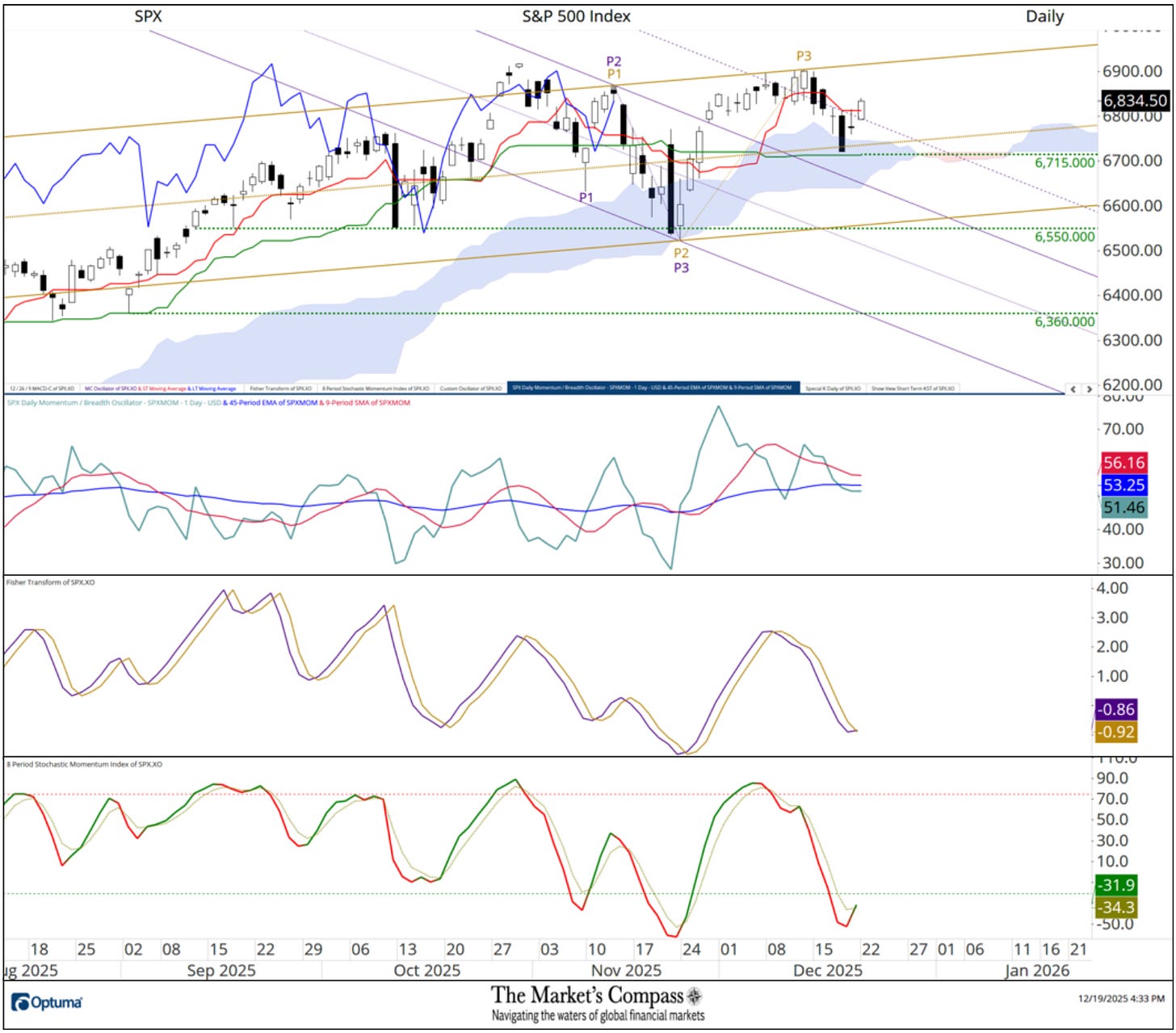

A week ago, last Friday, the SPX Index rolled over, and the selloff deepened last Wednesday with the large cap index falling below Cloud support leading me to draw the new Schiff Modified Pitchfork (gold P1-P3). Wednesday’s drop fell short of a full test of support at the Kijun Plot (green line at 6715.00) and over the next two days recovered from the short-term oversold condition as witnessed by the Stochastic Momentum Index in the bottom chart panel. With it, the Fisher Transform (center momentum panel) is hinting at a turn. The SPX Daily Momentum / Breadth is neutral with the shorter-term Moving Average (red line and longer-term Moving Average (blue line) both tracking sideways. Barring a break of support at the Median Line and the Kijun Plot I believe that a challenge of the Upper Parallel (solid gold line) is in the cards.

The YTD Average Absolute Price precentage fell slightly to +27.55% last week from +27.59% the previous week.

For readers who are unfamiliar with the technical terms or tools referred to in the comments on the technical condition of the SPX can avail themselves of a brief tutorial titled, Tools of Technical Analysis and an in-depth comprehensive lesson on Pitchforks is available on my website…

Charts are courtesy of Optuma whose charting software allows the Technical Rankings to be calculated and back tested.

To receive a 30-day trial of Optuma charting software go to…