Welcome to The Market’s Compass Emerging Market’s Country ETF Study, Week #537. As always, it highlights the technical changes of the 20 EM Country ETFs that I track on a weekly basis and publish every third week. Paid subscribers will receive this week’s unabridged Emerging Market’s Country ETF Study sent to their registered e-mail. In celebration of the Easter Holiday, free subscribers will also receive the full version (in a thinly veiled attempt to lure them into becoming paid subscribers). Past publications can be accessed by paid subscribers via The Market’s Compass Substack Blog. Next week I will be publishing The Market’s Compass Developed Markets Country ETF Study. On Sunday I will publish the latest edition of The Market’s Compass Crypto Sweet Sixteen Study which I publish on a weekly basis and tracks the technical changes of sixteen of the larger capitalized Cryptocurrencies.

To understand the methodology used in constructing the objective EM Country ETF Individual Technical Rankings visit the mc’s technical indicators page at www.themarketscompass.com and select “em country etfs”.

To understand the methodology used in constructing the objective EM Country ETF Individual Technical Rankings visit the mc’s technical indicators page at www.themarketscompass.com and select “em country etfs”.

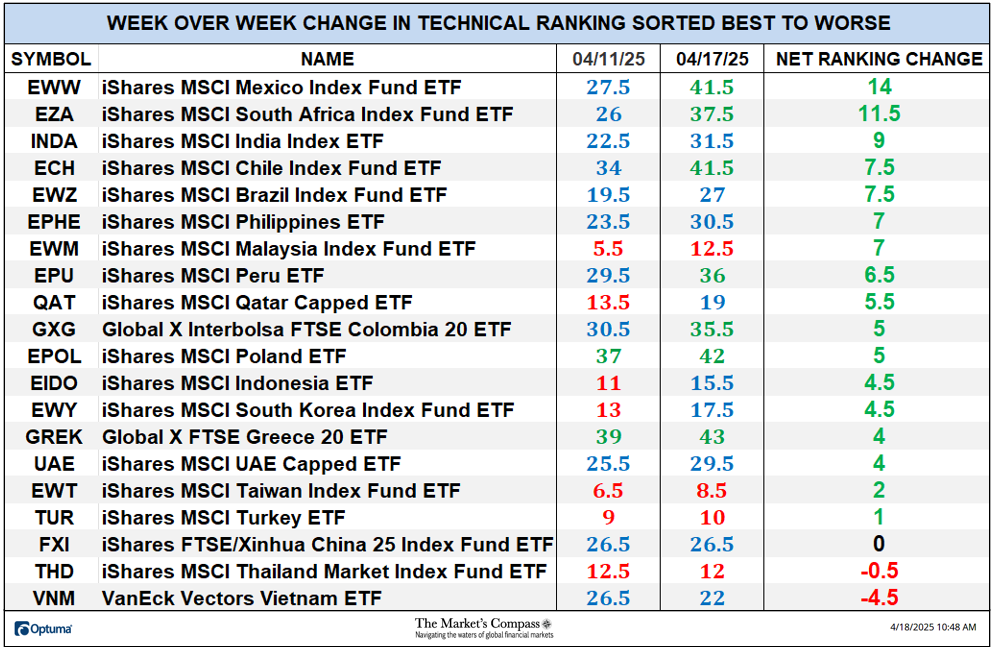

This past week The Total EM Technical Ranking or “TEMTR” rose +22.92% to 539 from 438.5 the previous week, which was another sharp rise of +28.78% to 438.5 from 340.5 three weeks ago. The Total Lat AM EM Ranking led the other two geographic regions higher, rising 28.7% to 181.5 from 141. The EMEA EM Total Technical Ranking rose 20.7% to 181 from 150 the previous week. The Total Asia-Pacific EM Ranking rose 19.7% to 176.5 from 147.5.

Seventeen of the twenty EM Country ETFs I track in these pages registered improvement in their TRs over the Good Friday Holiday shortened week ending April 17th, one was unchanged, and two ETF TRs fell. The average TR gain was +5.03 vs. the previous week’s average TR gain of +4.90 when fifteen out of twenty gained ground, two were unchaged, and two fell. Seven of the EM Country ETF TRs ended the week in the “green zone” (TRs between 34.5 and 50), nine were in the “blue zone” (TRs between 15.5 and 34) and four were in the “red zone” (TRs between 0 and 15). That was a improvement from the previous week when only two were in the “green zone”, eleven were in the “blue zone” and seven were in the “red zone”. All five of the Lat/ AM ETFs registered improvement in their TRs with four out of the five entering the “green zone”.

*To understand the construction the of The Technical Condition Factors visit the mc’s technical indicators page at www.themarketscompass.com and select “em country etfs”.

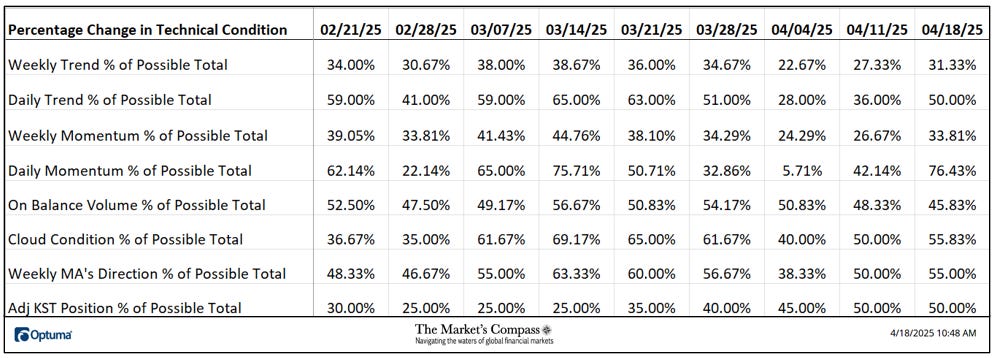

This past week a 76.43% reading was registered in the Daily Momentum Technical Condition Factor (”DMTCF”) or 107 out of a possible total of 140 positive points. That was higher from the week before reading of 42.14% or 59 which was a major lift from the deeply oversold condition three weeks ago, of 5.71% of only 8 out of 140 points.

As a confirmation tool, if all eight TCFs improve on a week-over-week basis, more of the 20 ETFs are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely if all eight TCFs fall on a week-over-week basis it confirms a broader market move lower. Last week six TCFs rose, one was unchanged, and one fell.

*A brief explanation of how to interpret RRG charts visit the mc’s technical indicators page at www.themarketscompass.com and select “em country etfs”. To learn more detailed interpretations, see the postscripts and links at the end of this Blog.

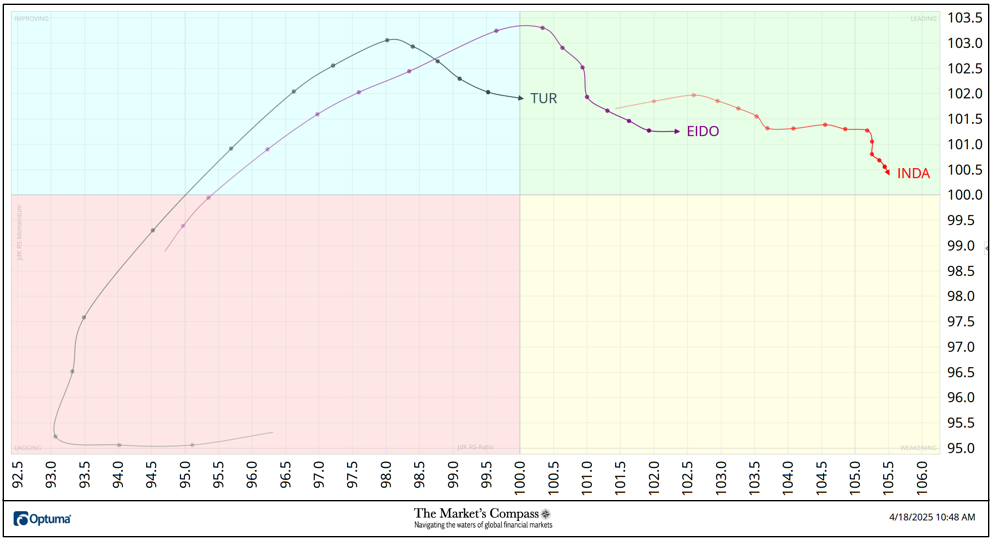

The chart below has three weeks, or 15 days*, of Relative data points vs. the benchmark, the EEM (the Emerging Markets ETF), at the center, deliniated by the dots or nodes. Not all 20 ETFs are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain.

*Because of the holiday shortened week, there are only 14 days of data points

When I published the last EM Country ETF Study on March 31st, I highlighted the iShares MSCI Turkey ETF (TUR) which had fallen sharply from the Leading Quadrant through the Weakening Quadrant and ending up in the Lagging Quadrant. Before rolling over last week the TUR rose sharply into the Improving Quadrant exhibiting Positive upside Relative Strength Momentum (note the distance between the daily nodes) as it rose into the Improving Quadrant. The iShares Indonesia ETF (EDIO) lifted up out Laging Quadrant three weeks ago into the Improving Quadrant but after marking positive Relative Strength and Momentum two weeks ago it has rolled over and has begun to track sideways although it remains in the Leading Quadrant. The standout Relative Strength performer had, over the previous two weeks been the iShares MSCI India Index Fund ETF (INDA) until it rolled over last week, losing upside Relative Strength Momentum.

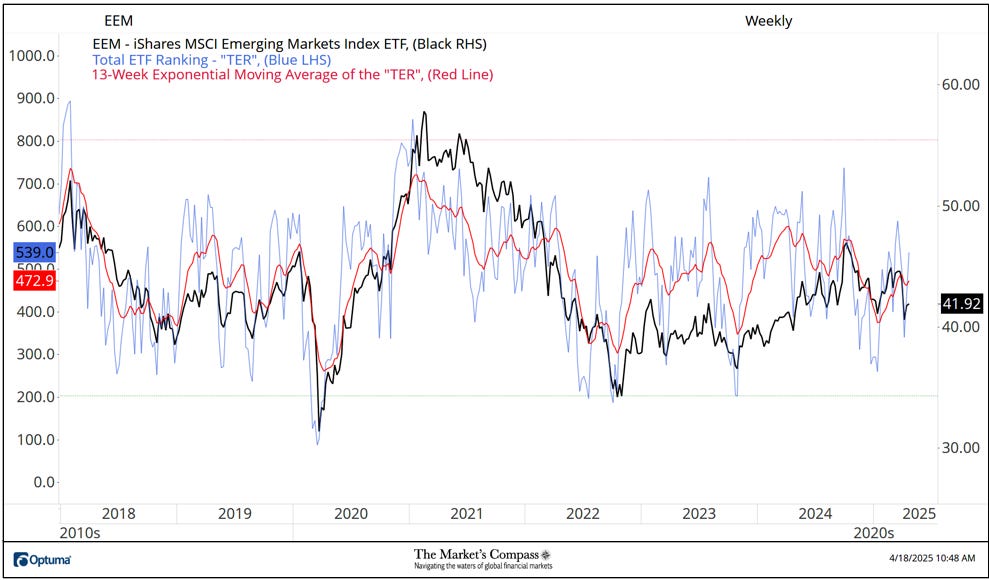

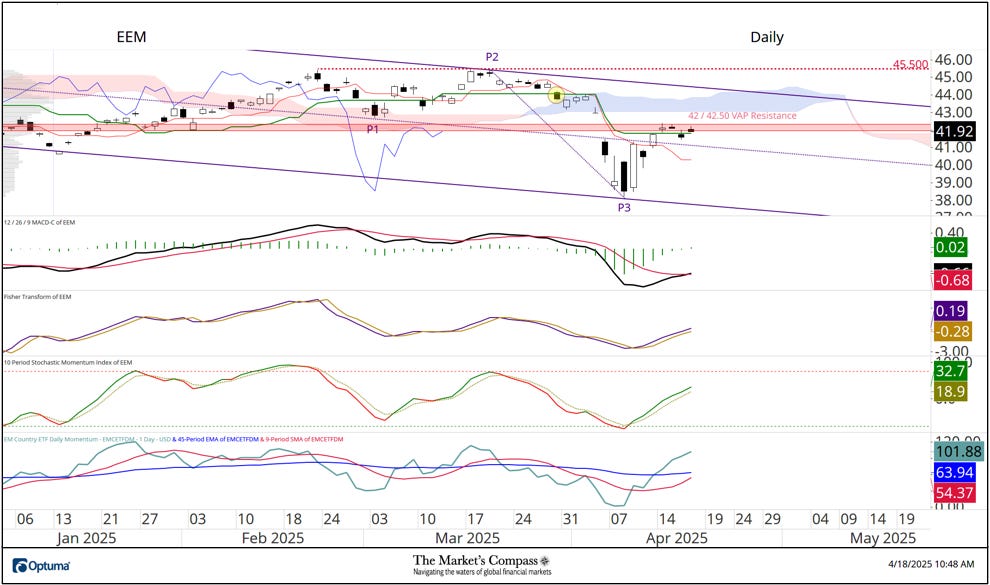

When Trump dropped the “tariff bomb” on the financial markets three weeks ago the EEM printed a lower weely price low below the January 10th weekly closing low of 41.02 to close three weeks ago at 40.58 in concert with the “TER” falling to 340.05. That said the TER did not print a lower low and has since risen back to 539.5 but, it would be premature to declare that it was a non-confirmation of the price lows, but the 13-Week Exponential moving average of the “TER” is hooking higher. More on the longer-term technical condition of the EEM follows…

The Average Weekly Technical Ranking (“ATR”) is the average Technical Ranking (“TR”) of the 20 Emerging Markets Country ETFs we track weekly and is plotted in the lower panel on the Weekly Candle Chart of the EEM presented below. Like the TER, it is a confirmation/divergence or overbought/oversold indicator.

Four weeks ago, prices were teetering on support offered by the Lower Parallel (solid red line) of the longer-term Standard Pitchfork (violet P1 through P3) after being capped at price resistance at 45.50 for the second time the week before. The following week prices broke below support at the of the longer-term Pitchfork and the Cloud. Prices traded lower two weeks ago before a temporary reversal in Trump’s Tariff plans led to a sharp intra-week turnaround. I have since drawn a new Schiff Pitchfork (red P1 through P3). Prices have retaken the ground above the Median Line (red dotted line) of the shorter-term Pitchfork but have been capped at the Kijun Plot (green line) and the Cloud last week. Both MACD and the Stochastic Momentum Index rolled over through their signal lines but (thanks to the price reversal at P3) there is a hint of stabilization in the shorter-term Stochastic Momentum Index. That in itself is not enough to suggest that a sustainable low is in place.

Learn about Pitchforks and Internal Lines in the three-part Pitchfork tutorial in the Market’s Compass website, www.themarketscompass.com

More on the technical condition of the EEM in Thoughts on the Short-Term Technical Condition of the EEM but first…

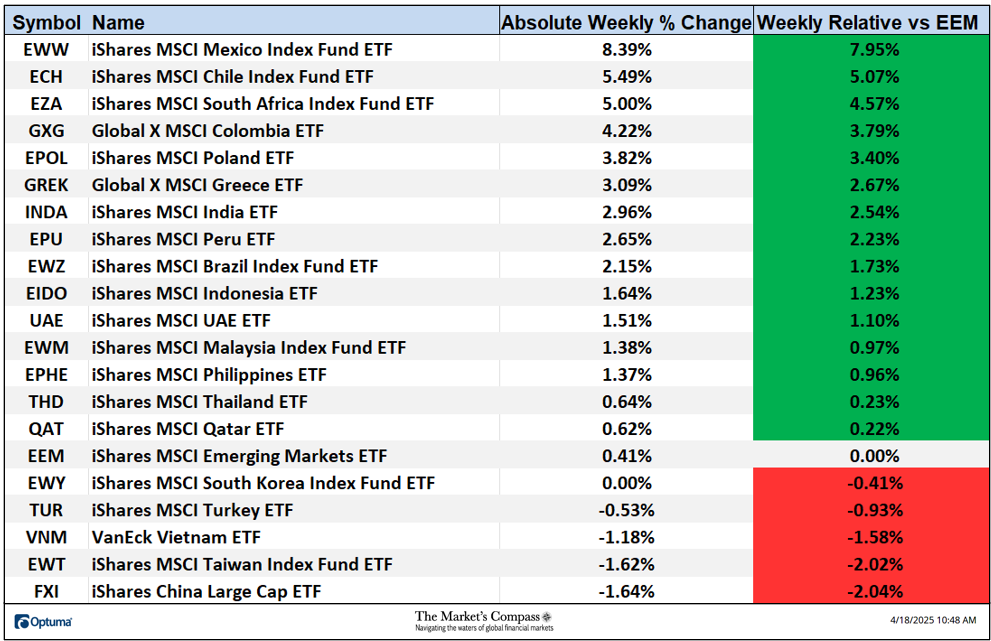

*For the four-day Holiday shortened week ending April 17th. Does not include dividends if any.

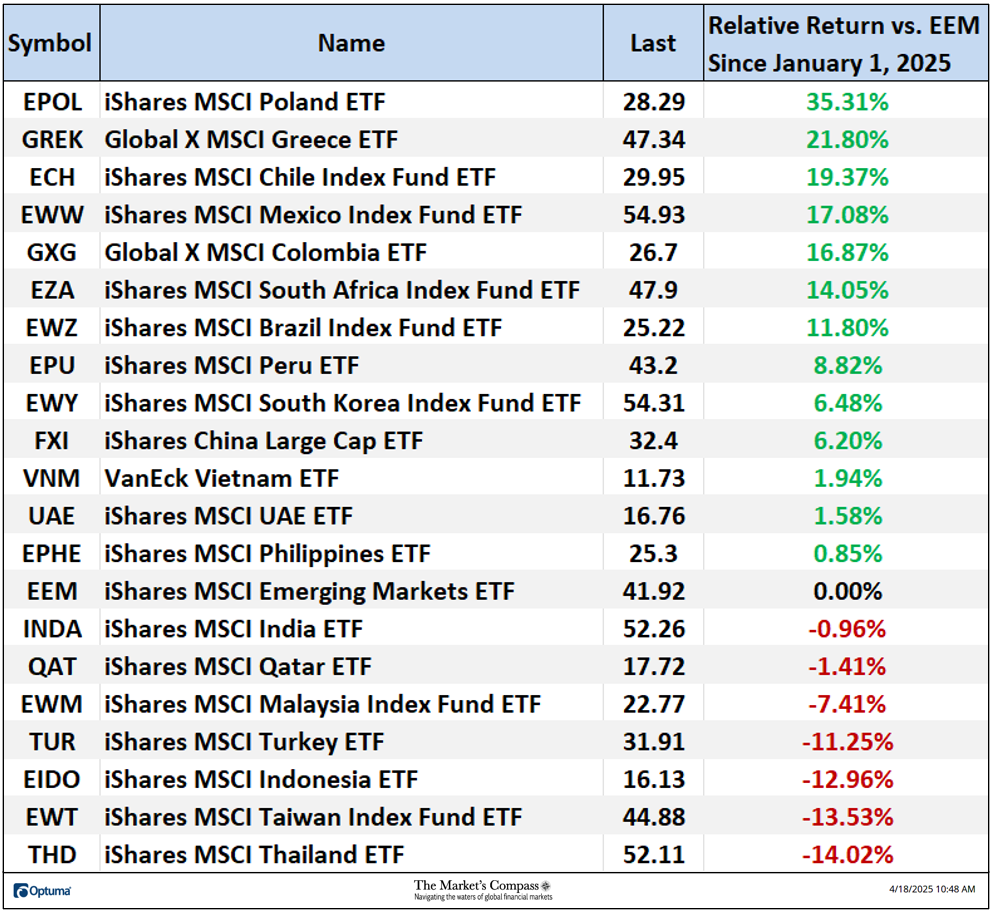

Fifteen of the twenty EM Country ETFs were up on an absolute basis last week (the iShares MSCI South Korea Index Fund ETF (EWY) was flat on the week) and four traded lower. Fifteen EM ETFs outperformed the 0.41% gain in the EEM on a relative basis. The average four-day absolute gain in the EM ETFs was +2.00% adding to the previous week’s average absolute gain of +3.82% helping to reverse the -6.80% average absolute loss registered three weeks ago.

At the time of our last missive on the shorter-term technical condition of the EEM (highlighted with the yellow circle) prices continued (for weeks) to track sideways in a 3 point range. That was until the following week when prices fell sharply lower below support afforded by the Cloud and VAP support (volume at price) thanks to the “Tariff Bomb”. Two more days of extended price weakness brought about an oversold condition as witnessed by 10-Day Stochastic Momentum and more importantly, my EM Country ETD Daily Momentum / Breadth Oscillator and a sharp price reversal unfolded which led to me to draw the new Standard Pitchfork (violet P1 through P3) and a week ago last Friday, the EEM overtook the Median Line (violet dotted line) of the Pitchfork. That said, with the oversold fuel mostly spent, the rally has stalled at what was once VAP support now turned VAP resistance. It is premature to suggest the nadir was reached at P3. Only a follow through rally that overtakes VAP resistance, massive Cloud resistance and the Upper Parallel (solid violet line) of the Pitchfork would suggest that the correction has run its course. Buyers beware of another “Trump Card” (tip of the hat to Stephen Suttmeier for that one).

All the charts are courtesy of Optuma whose charting software enables anyone to visualize any data including my Objective Technical Rankings. The following links are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…