Welcome to this week’s publication of the Market’s Compass Developed Markets Country (DMC) ETF Study #560. It highlights the technical changes of the 21 DM Country ETFs that I track on a weekly basis and publish every third week. There are three ETF Studies that include the Market’s Compass US Index and Sector (USIS) ETF Study, the Developed Markets Country (DMC) ETF Study and the Emerging Markets Country (EMC) ETF Study. The three Studies are normally published every three weeks and are sent to my paid Substack subscriber’s email. There is also a Weekly publication that is sent to paid subscribers every Sunday titled The Market’s Compass Crypto Sweet Sixteen Study that tracks the technical condition of sixteen of the larger cap Cryptocurrencies.

In celebration of the first day of Autumn I am sending this week’s Study to free subscribers as well!

To understand the methodology used in constructing the objective DM Country ETF Individual Technical Rankings visit the mc’s technical indicators page at www.themarketscompass.com and select “dm country etfs”. What follows is a Cliff Notes version* of the full explanation…

*The technical ranking system is a quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength of each individual DM Country ETF that can range between 0 and 50.

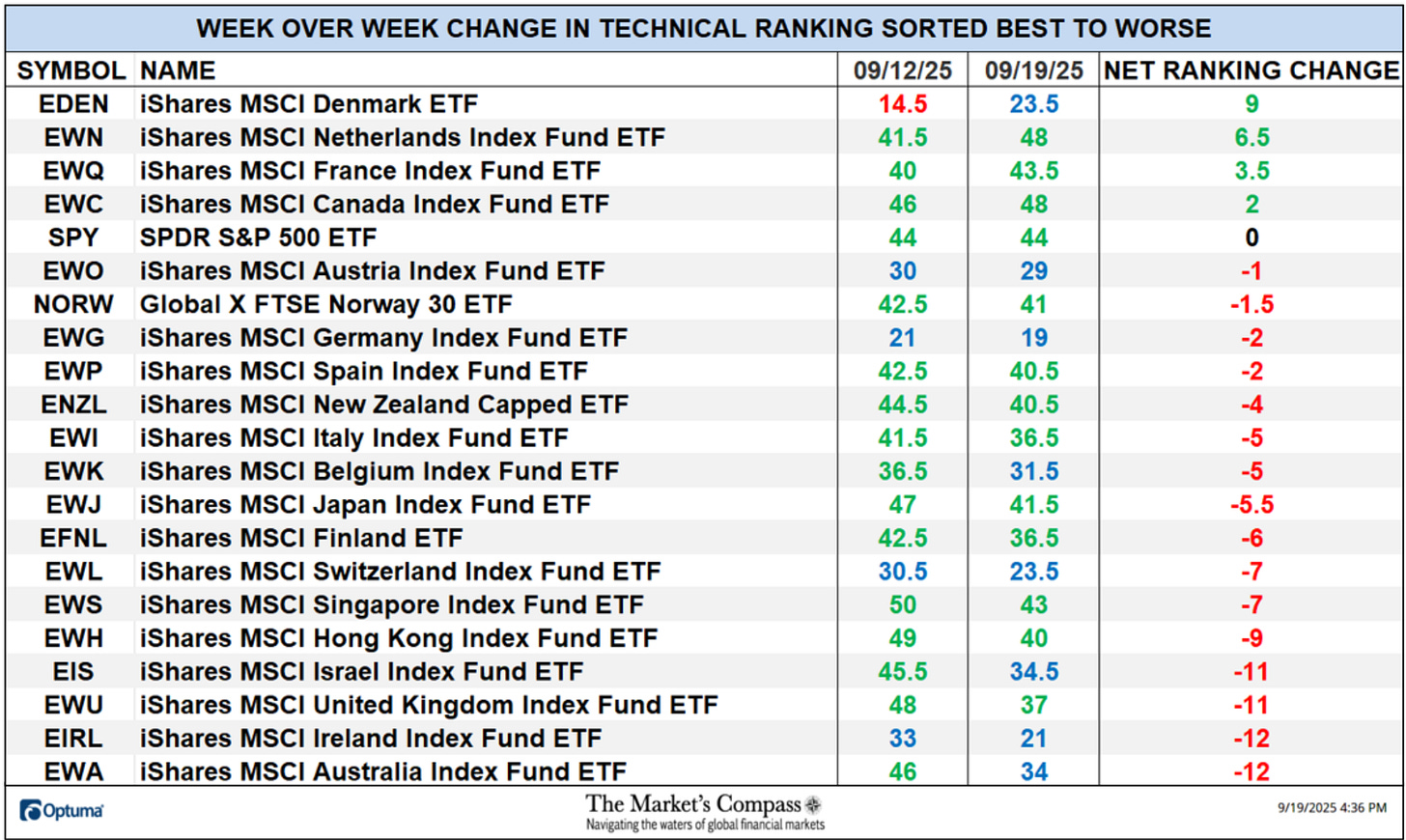

The Developed Markets Total Technical Ranking or “DMTER” fell -9.57% last week to 756 from 836 which was a rise of +10.14% from 759 three weeks ago.

At the end of last week, only four ETF TRs rose, one was unchanged and sixteen fell (four ETFs had TRs that dropped double-digits). Thirteen were in the “green zone” (from 35 to 50), and eight were in the “blue zone” (from 15.5 to 34.5). The week before there were sixteen TRs in the “green zone”, four were in the “blue zone”, and one was in the “red zone” (from 0 to 15). The average TR loss for the week was -2.40, adding to the previous week’s average TR loss of 3.14.

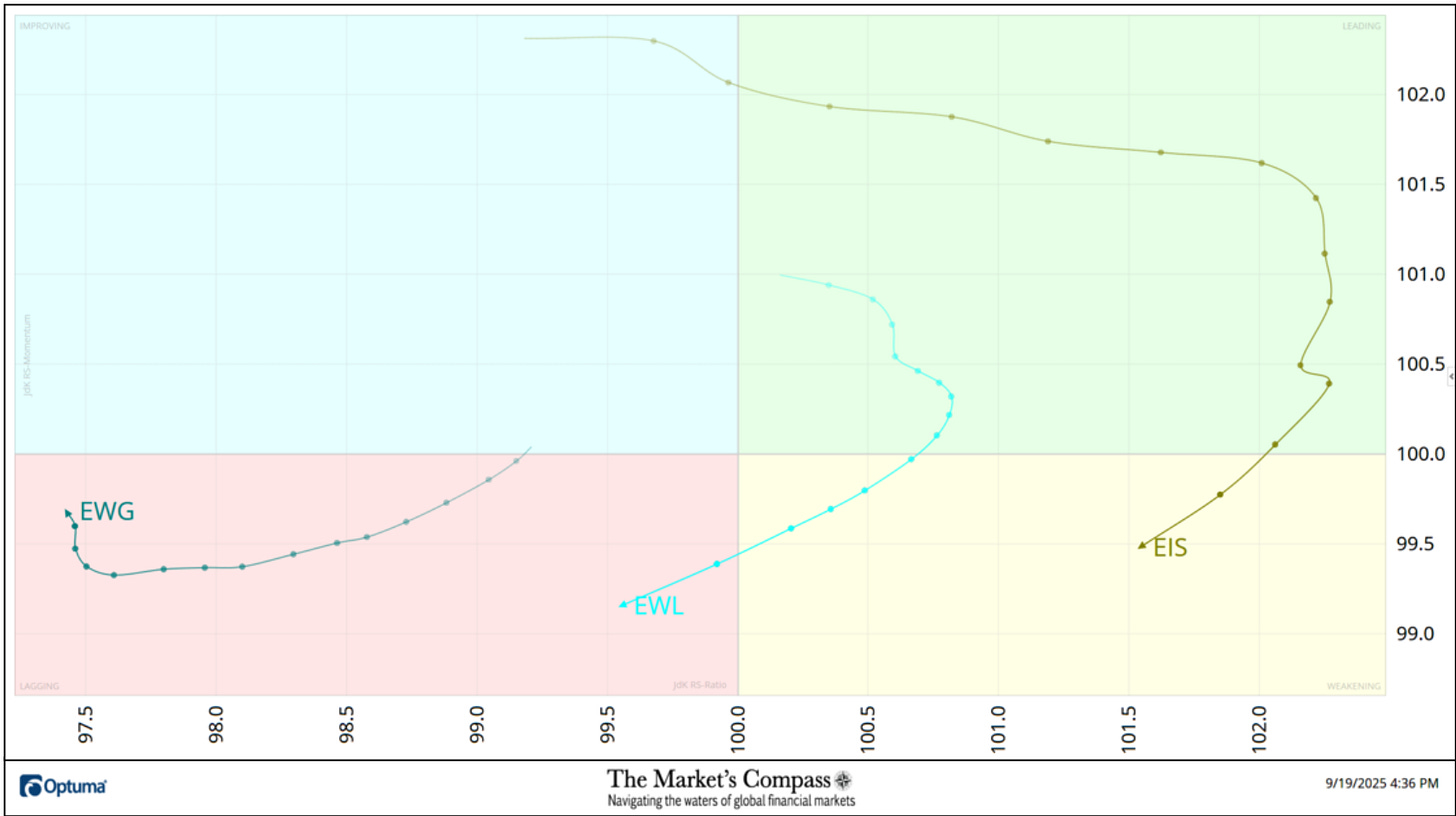

The Relative Rotation Graph, commonly referred to as RRGs were developed in 2004-2005 by Julius de Kempenaer. These charts are a unique visualization tool for relative strength analysis. Chartists can use RRGs to analyze the relative strength trends of several securities against a common benchmark, (in this case the URTH) and against each other over any given time period (in the case below, daily) over the past three weeks. The power of RRG is its ability to plot relative performance on one graph and show true rotation. All RRGs charts use four quadrants to define the four phases of a relative trend. The Optuma RRG charts uses, From Leading (in green) to Weakening (in yellow) to Lagging (in pink) to Improving (in blue) and back to Leading (in green). True rotations can be seen as securities move from one quadrant to the other over time. This is only a brief explanation of how to interpret RRG charts. To learn more, see the post scripts and links at the end of this Blog.

Not all 21 ETFs are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain.

In the last DM ETF Study published on September 2nd for the week ending August 29th I brought attention to the iShares MSCI Israel Index Fund ETF (EIS) which had risen out of the Lagging Quadrant into the Improving Quadrant exhibiting positive Relative Strength Momentum. Although momentum began to slow, it nonetheless continued to notch positive Relative Strength until it began to roll over a week ago, last Tuesday displaying negative Relative Strength Momentum and late last week it fell into the Weakening Quadrant. The iShares MSCI Switzerland Index Fund ETF (EWL) has made a negative three quadrant move by falling out of the Leading Quadrant, dropping through the Weakening Quadrant and into the Lagging Quadrant at the end of last week it was underperforming the URTH on a Relative Strength basis. The iShares MSCI Germany Index Fund ETF has been a standout Relative Strength underperformer vs. the benchmark, as it has tracked sideways in the Lagging Quadrant until it hooked slightly higher at the end of last week.

*To understand the construction the of The Technical Condition Factors or TCFs visit the mc’s technical indicators page at www.themarketscompass.com and select “dm country etfs”. For those who unfamililar a shortened version* is explained below…

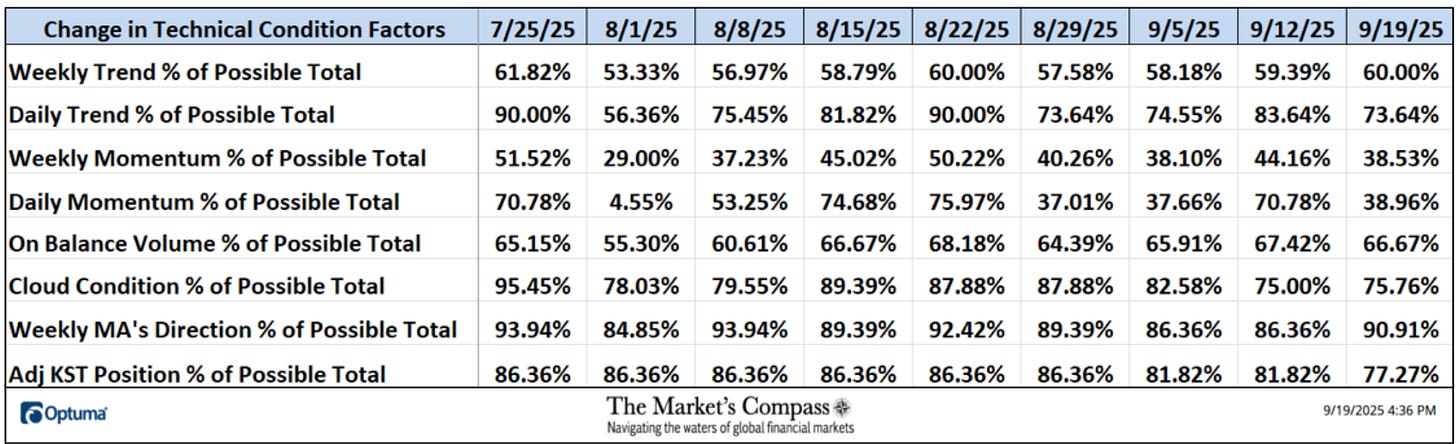

*The Technical Condition Factors are utilized in the calculation of the Individual DM Country ETF Technical Rankings. What is shown in the excel panel below is the total TCFs of all twenty-one TRs. A few TCFs carry more weight than the others, such as the Weekly Trend Factor and the Weekly Momentum Factor in compiling each individual TR of each of the twenty-one ETFs. Also, the TCFs number of inputs vary. Because of that, the excel sheet below calculates each factor’s weekly reading as a percentage of the possible total which normalizes the inputs. The basic explanation is that the eight TCFs can range between 0% and 100%.

The Daily Momentum Technical Condition Factor (“DMTCF”) fell to 38.96% last week from a 70.78% reading the previous week.

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 21 ETFs are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the 21 TCFs fall on a week over week basis, more of the ETFs are deteriorating on a technical basis confirming the broader market move lower. On a week-over-week basis three TCFs rose and five fell.

An explanation of The Total DM Technical Ranking Indicator and the technical interpretation of it, visit the MC’s Technical Indicators page at www.themarketscompass.com.

It is simply a confirmation/divergence indicator as well as an overbought/oversold indicator.

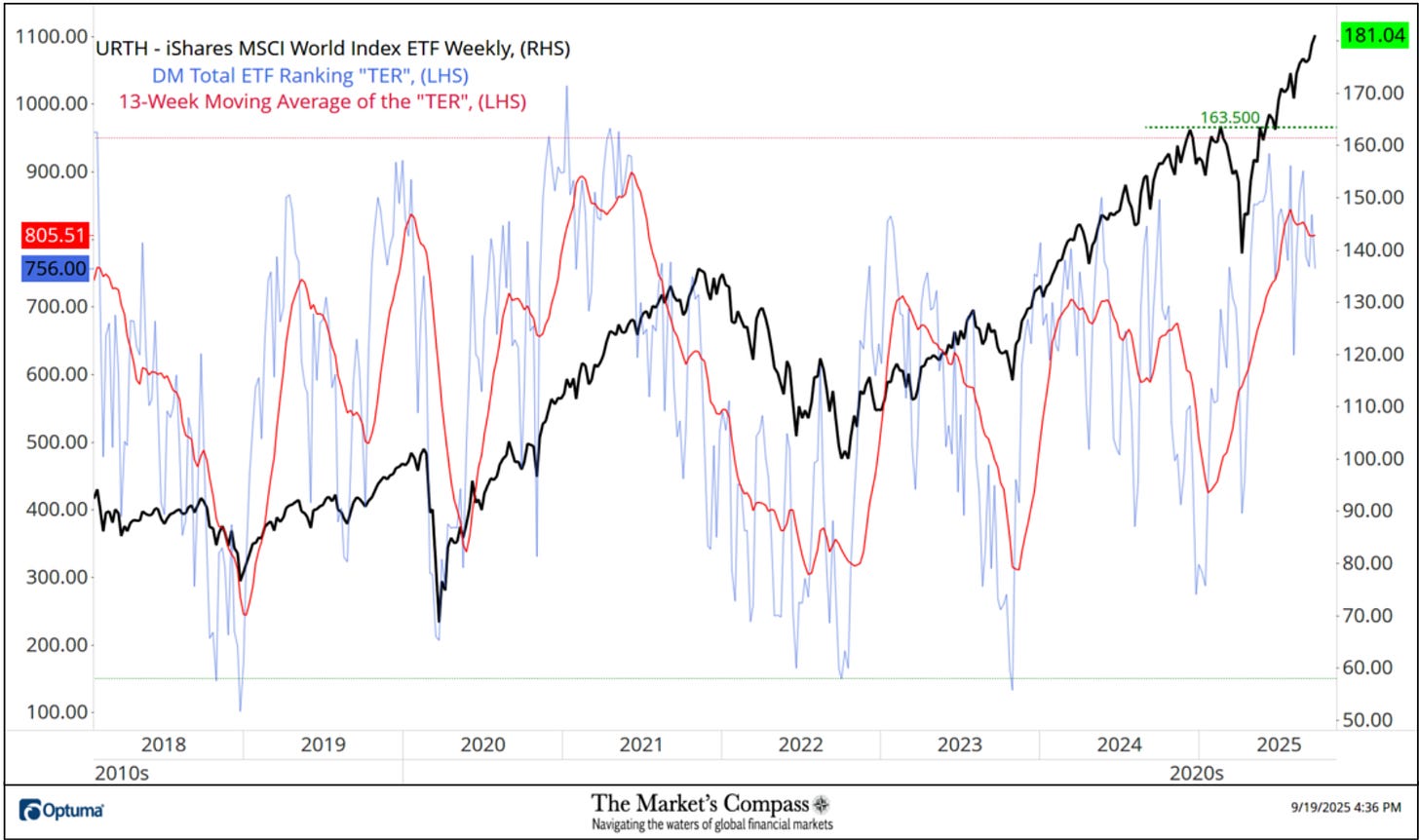

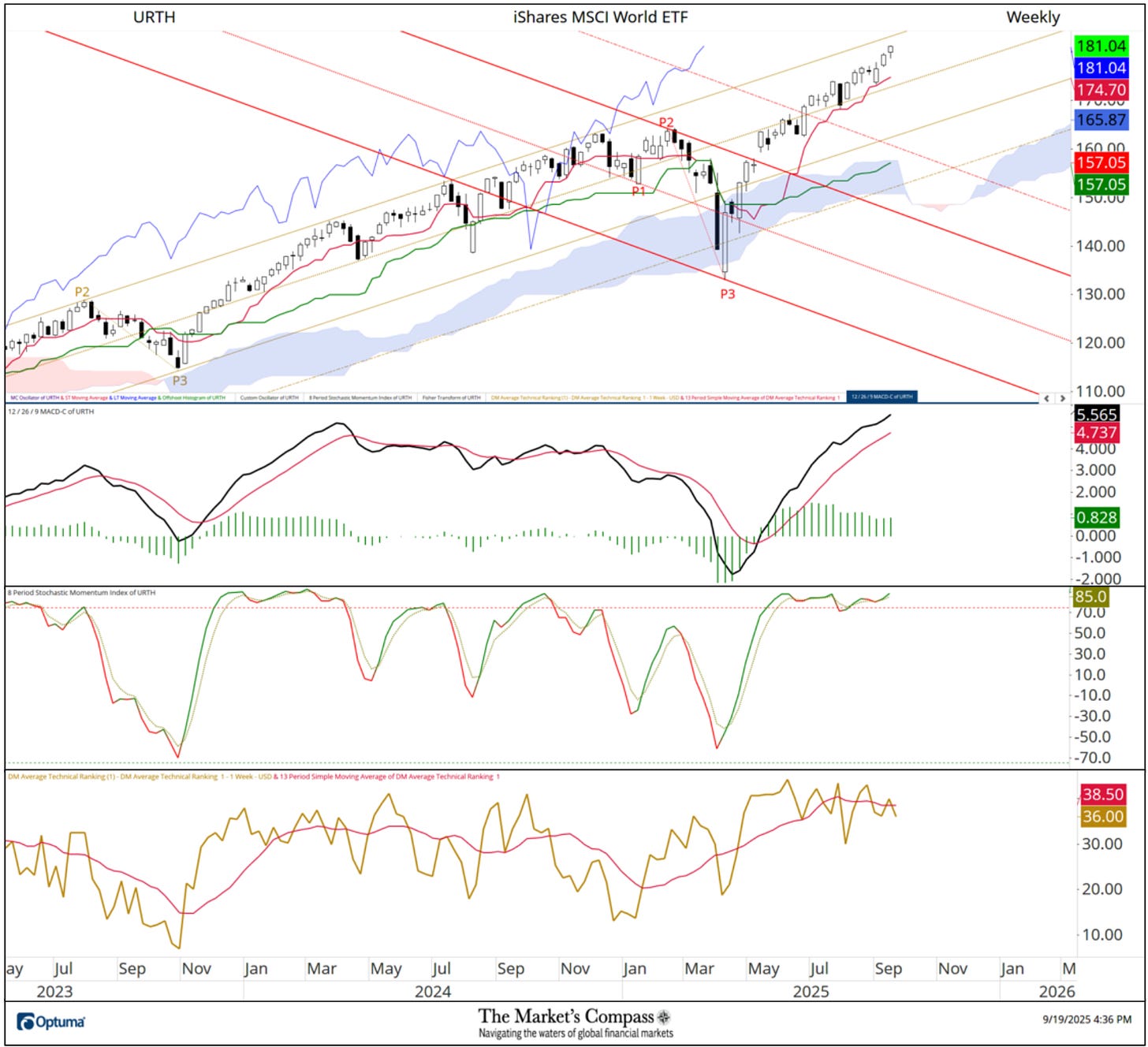

The iShares MSCI World Index ETF closed at yet another record weekly closing high at 181.04 but there continues to be a non-confirmation of the new price highs by The DM Total ETF Ranking (blue line) or “TER” as it prints lower highs and with it the 13-Week Moving Average of the “TER” (red line) is stumbling slightly lower. Oversold “TER” readings (150 or lower) and non-confirmations are normally more reliable for marking immediate price reversals at lows than extended periods of overbought at “TER” highs or non-confirmations at price highs. That said, it remains an indicator worth monitoring and as will be seen further into today’s Study there are currently other indicator signals that the URTH is over extended.

The Weekly Average DM Technical Ranking (“ATR”) is the average of the individual Technical Rankings of the 21 Developed Markets Country ETFs I track. Like the TER, it is a confirmation/divergence or overbought/oversold indicator.

As i wrote in the last DM ETF Study “there is nary a signal in both MACD and the Stochastic Momentum Index that an immanent decline is about to unfold in the URTH” and the condition of those indicators still do not offer a signal, but the DM Average Technical Ranking still suggests that there could be a problem (bottom indictor panel). The ATR has fallen below the 13-week moving average from another lower high but price action supersedes secondary indicators. Price has for a second time have found support at the Tenkan Plot (red line) and continues to rise in the confines of the Standard Pitchfork (gold P1 through P3). Thus, it is folly to fight the rally and the psitive price action. More on the short-term technical condition but first…

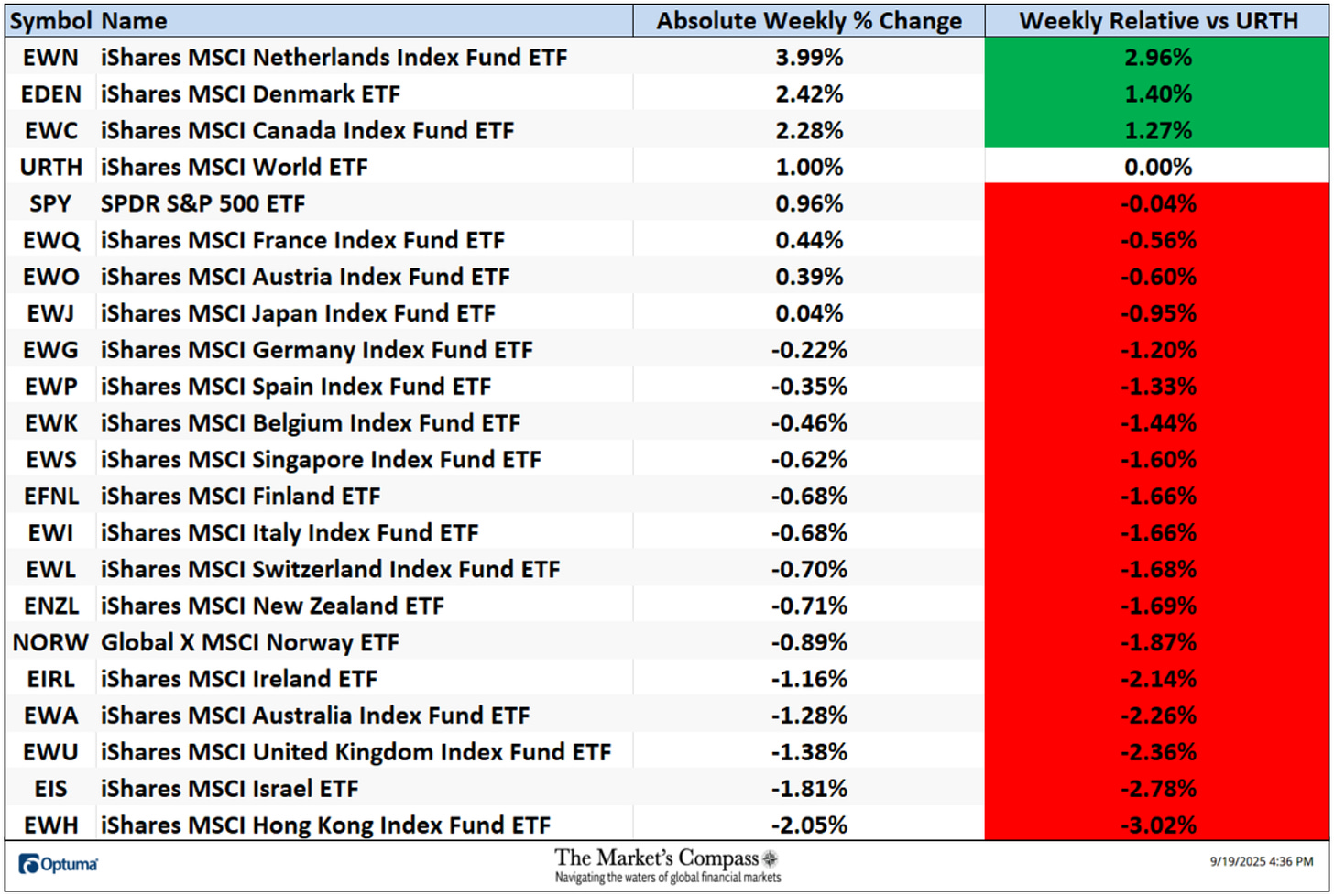

Seven of the 21 Developed Markets ETFs I track in these pages were up on an absolute basis and 14 fell (five more than 1.00%) in what was not a broad endorsement of the rally in the URTH. Only three of the ETFs outpaced the +1.00% gain in the iShares World ETF or URTH last week.

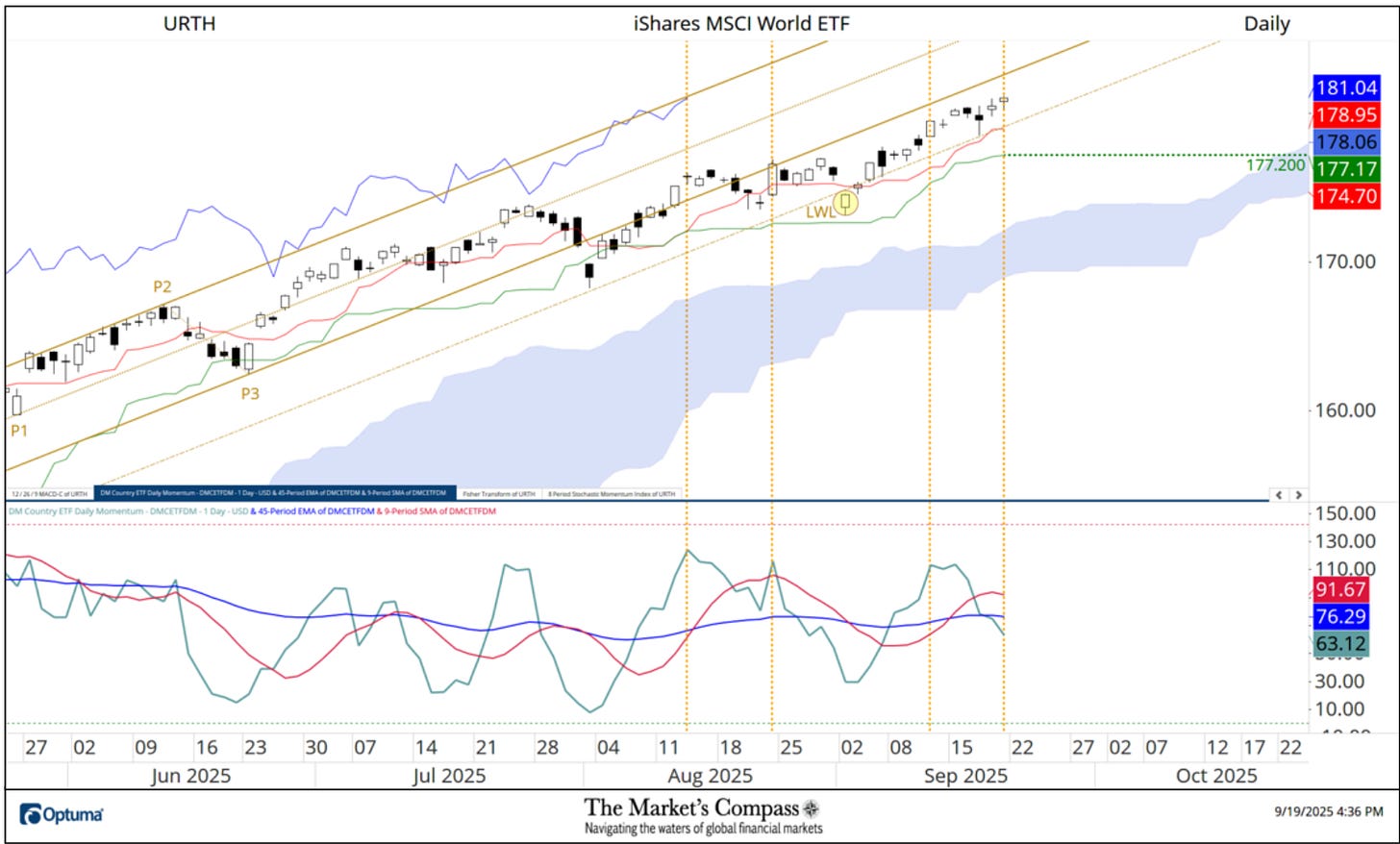

On the day of my last published DM Country ETF Study on September 2nd the URTH fell below the Lower Warning Line (gold dashed line) of the Standard Pitchfork (gold P1 through P3) that I have highlighted with a yellow circle. It recovered back above the Lower Warning Line the following Wednesday but there been two subsequent tests of that support but both times support held but prices have failed to reenter the confines of the Pitchfork. Since the start of the month there have been two more failures of the DM Country ETF Daily Momentum / Breadth Oscillator to confirm two new closing highs (vertical dashed lines). The indictor has now fallen below both moving averages.

I have bought attention to more than one indication that the Developed Markets I follow have not endorsed the move in the URTH. But it remains to be seen whether these indications will like chickens will come home to roost and produce a correction of a larger degree. in price. I think that the odds suggest that they will.

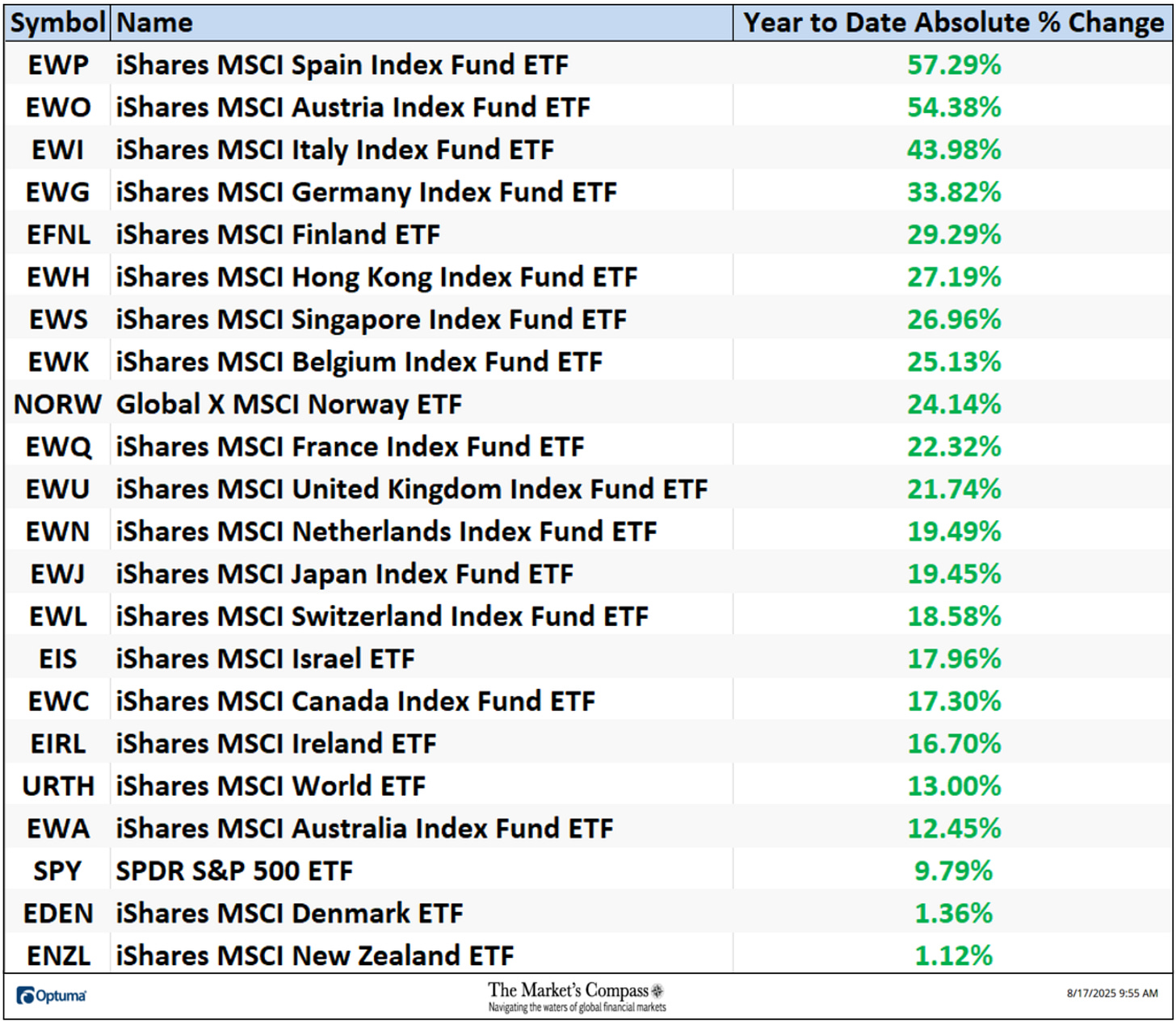

The YTD Average Absolute % price change of the twenty one Developed Markets County ETFs was +25.48% at the end of last week.

Charts and price data are courtesy of Optuma. Any time series data including my ETF Technical Rankings can be imported, charted, and back tested in Optuma.

The following links are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…