Welcome to this week’s publication of the Market’s Compass Crypto Sweet Sixteen Study #169*. The Study tracks the technical condition of sixteen of the larger market cap cryptocurrencies. Every week* the Studies will highlight the technical changes of the 16 cryptocurrencies that I track as well as highlights on noteworthy moves in individual Cryptocurrencies and Indexes. Paid subscribers will receive this week’s unabridged Market’s Compass Crypto Sweet Sixteen Study sent to their registered email. Past publications can be accessed by paid subscribers via The Market’s Compass Substack Blog.

*In observence of Christmas, Hanukkah, and New Years holiday this week’s complete Market’s Compass Crypto Sweet Sixteen Study will be the final Study for 2024. Many thanks to all subscribers, paid and free, for your attention and feedback to my technical observations on the cryptocurrency markets through out 2024. Today’s study will be sent to all subscribers, Happy Holidays!

*An explanation of my objective Individual Technical Rankings go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select “crypto sweet 16”.

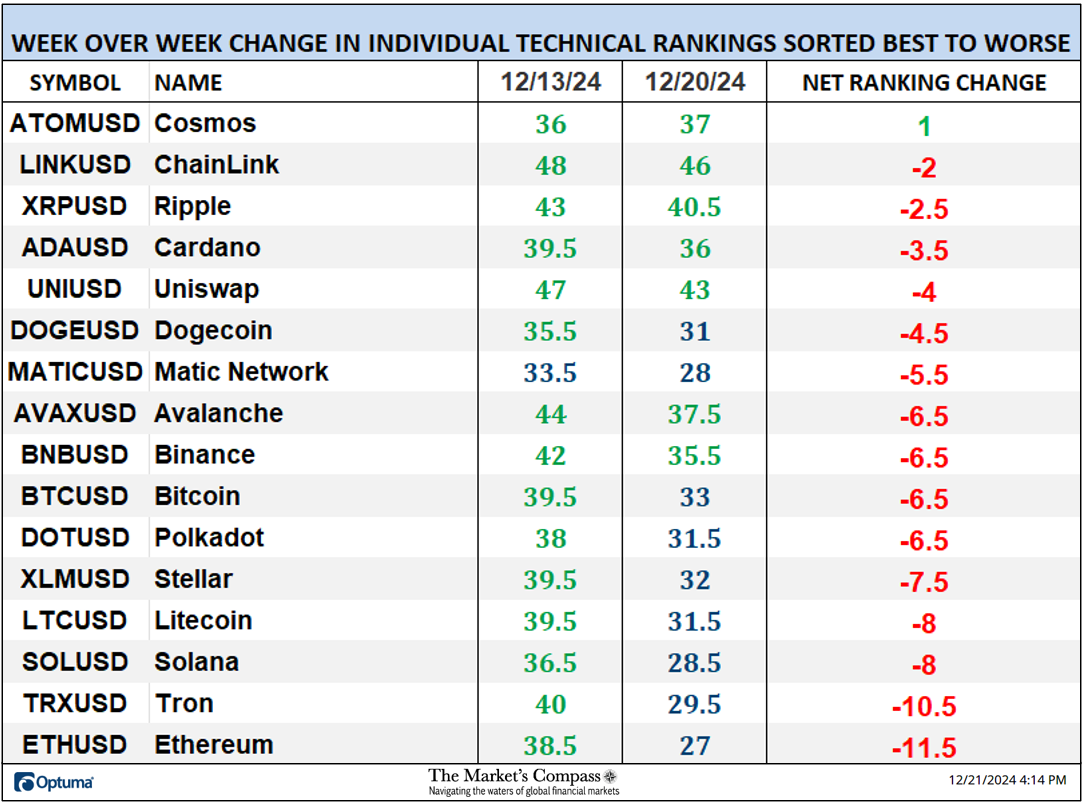

The Excel spreadsheet below indicates the weekly change in the objective Technical Ranking (“TR”) of each individual Cryptocurrency and the Sweet Sixteen Total Technical Ranking (“SSTTR”)*.

*Rankings are calculated up to the week ending Friday Dember 20th

After rising for nine weeks in a row, the Sweet Sixteen Total Technical Ranking or “SSTTR” fell for the second week in a row, by falling -14.45% to 547.5 from the previous week’s reading of 640, which had dropped -8.11% from the previous week’s SSTTR reading of 696.5 (December 6th). That reading marked the highest overbought reading since I began tabulating the Individual Sweet Sixteen Technical Rankings and the SSTTR in October of 2021.

Last week only one of the Sweet Sixteen Crypto TRs rose and fifteen fell. That was vs. the week before when two of the Sweet Sixteen Crypto TRs rose, one was unchanged and thirteen crypto TRs fell. The average Crypto TR loss last week was -5.78 vs. the previous week’s average loss of -3.53. Seven ETF TRs ended the week in the “green zone” (TRs between 35 and 50) and nine were in the “blue zone” (TRs between 15.5 and 34.5) vs. the previous week when fifteen were in the “green zone” and one was in the “blue zone”. Last week’s and the previous week’s TR contractions in the Sweet Sixteen confirmed the price pullback in the broader market.

*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

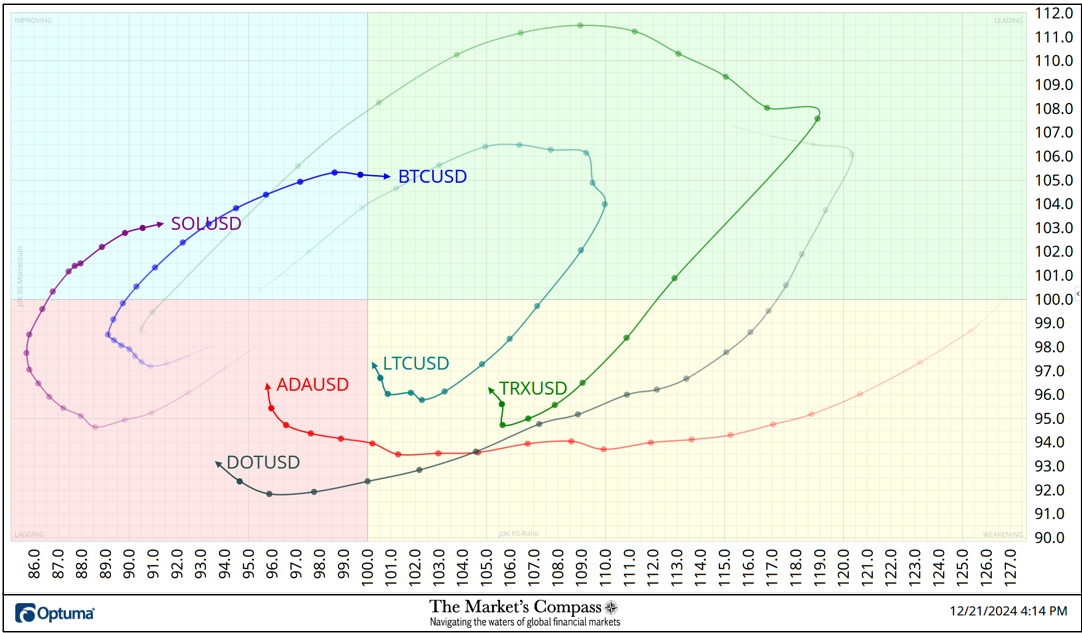

A brief explanation of how to interpret RRG charts can be found at The Market’s Compass website www.themarketscompass.com Then go to MC’s Technical Indicators and select Crypto Sweet 16. To learn more detailed interpretations, see the postscripts and links at the end of this Blog.

The chart below includes three weeks or 21 days of data points deliniated by the dots or nodes.

Both Tron (TRX) and Litecoin (LTC) bean to roll over in the Leading Quadrant two week’s ago. A week ago last Friday, TRX, accelerated to the downside exhibiting downside Relative Strength Momentum (note the distance between nodes) as it moved into the Weakening Quadrant. To a lesser degree, LTC, also fell into the Weakening Quadrant losing Relative Strength Momentum. Polkadot (DOT) has made a three quadrant move by falling out of the Leading Quadrant into the Weakening Quadrant and last week it entered the Lagging Quadrant although along with Cardano (ADA) it has started to hook higher. Bitcoin left the Lagging Quadrant two weeks ago and has been gaining Upside Relative Strength Momentum and last Friday it entered the Leading Quadrant although upside momentum is slowing. Solana (SOL) began “chugging” higher in the Lagging Quadrant three weeks ago and last week it entered the Improving Quadrant.

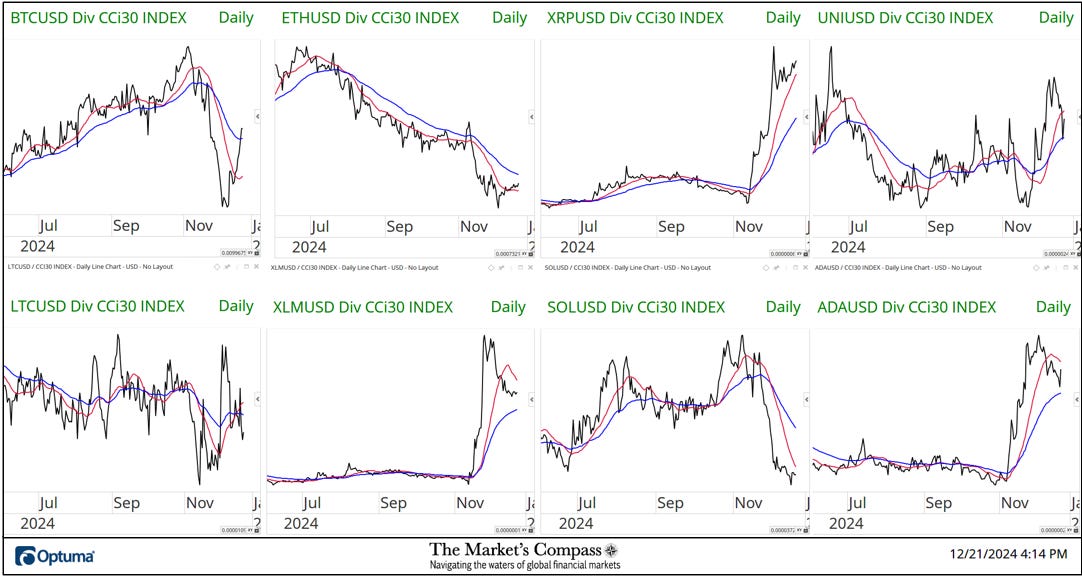

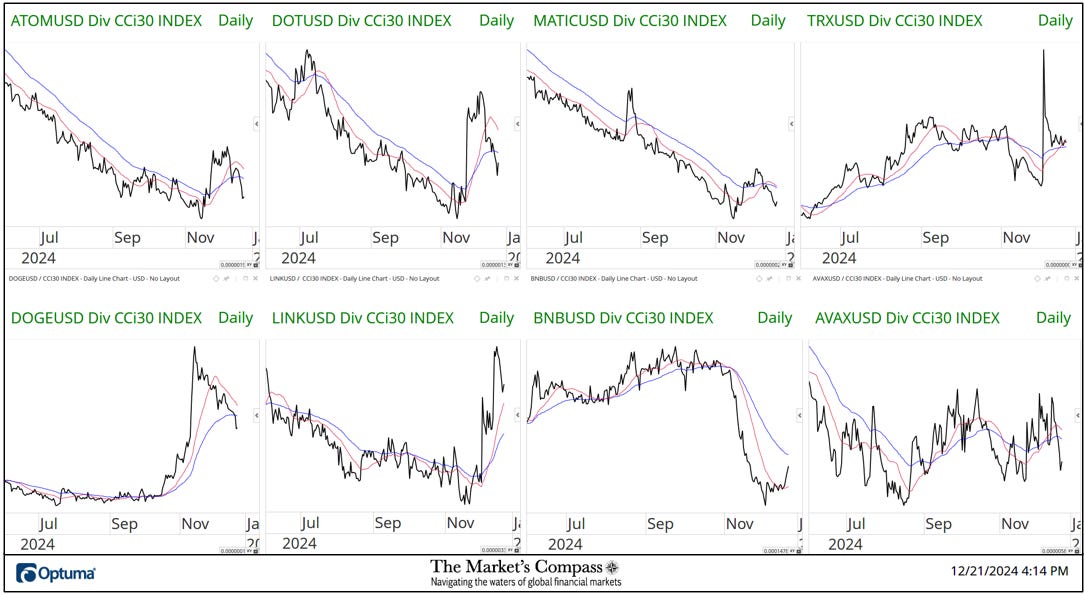

The two charts below are longer term line charts of the Relative Strength or Weakness of the Sweet Sixteen Crypto Currencies vs. the CCi30 Index that are charted with a 55-Day Exponential Moving Average in blue and a 21-Day Simple Moving Average in red. Trend direction and crossovers, above or below the longer-term moving average, reveal potential continuation of trend or reversals in Relative Strength or Weakness.

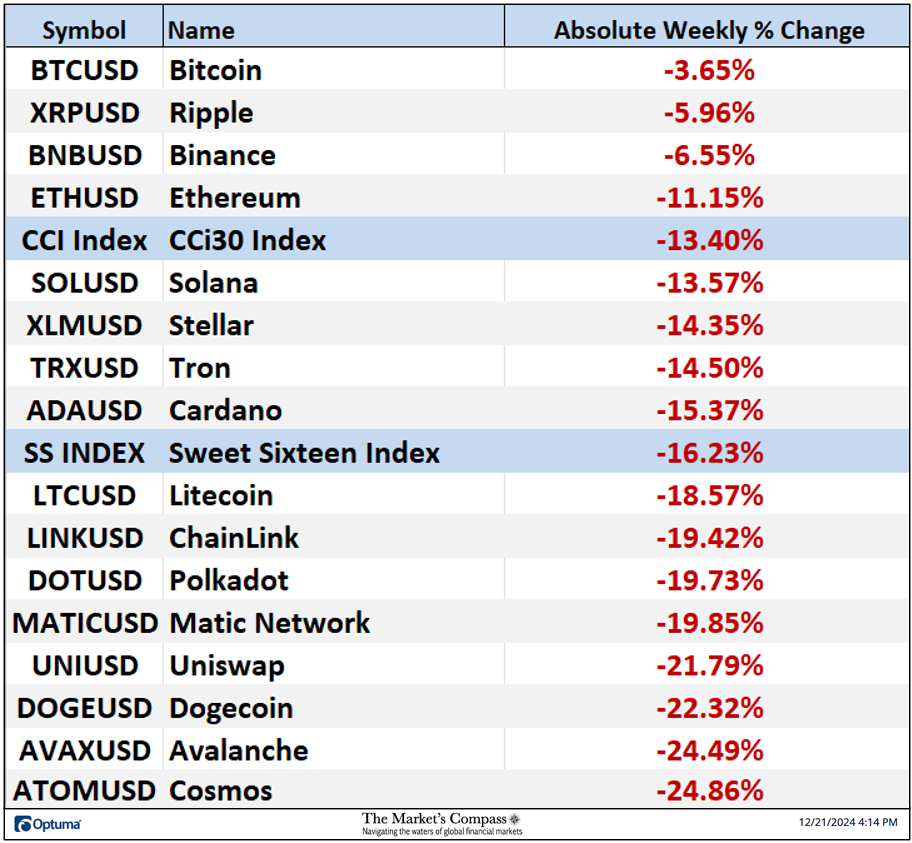

*Friday December 13th to Friday December 20th.

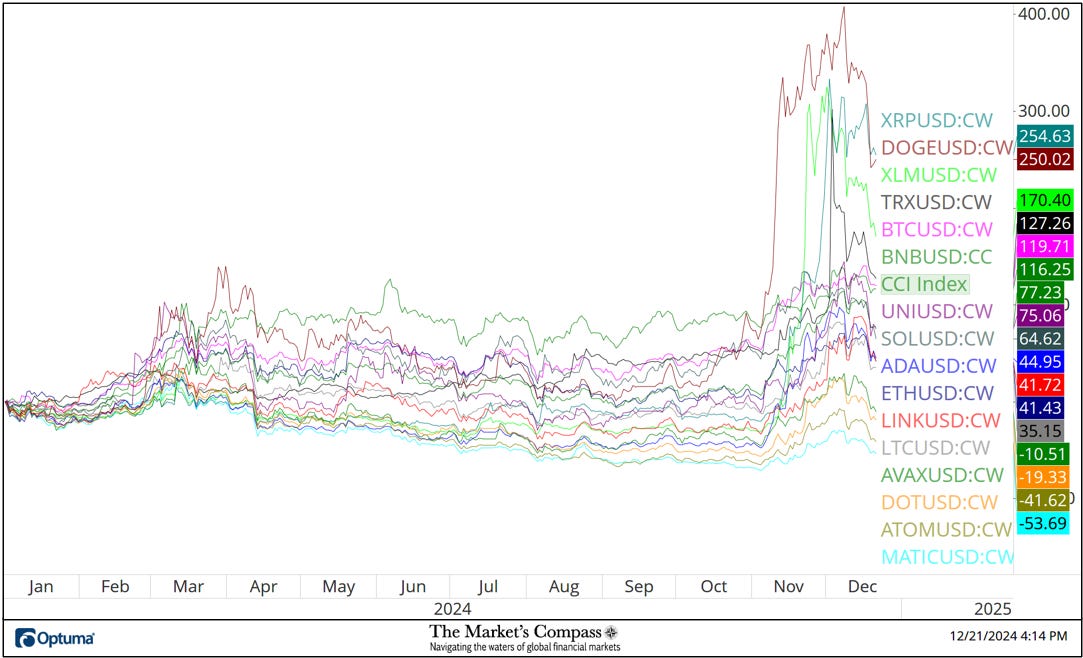

All the Crypto Sweet Sixteen registered absolute losses last week (thirteen marked double digit absolute losses) vs. the previous week when three registered absolute gains and thirteen traded lower. This followed the absolute price gain of the week ending December 6th of +61.07% and the preceding two weeks it gained +130.10% and +88.87% respectively (a number of the Sweet Sixteen had become stretched at that time). The seven-day average absolute price loss was -15.88% versus the previous week’s average absolute loss of -2.56%.

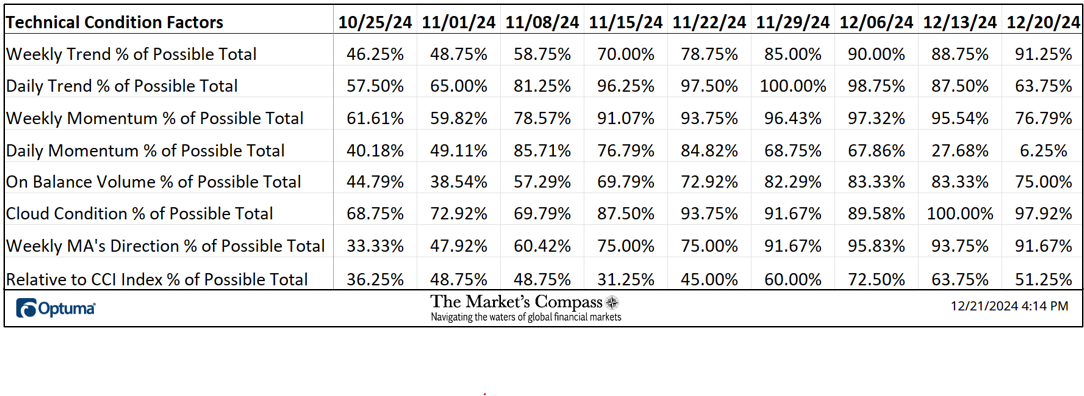

*An explanation of my The Technical Condition Factors go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select Crypto Sweet 16.

The DMTCF dropped sharply last week from a reading of 27.68 or 31 the week before to a deeply oversold reading of 6.25% or 7 out of a possible 112. Last week I noted the Daily Trend Technical Condition Factor had reached a reading of 100% four weeks ago. In the three years of tracking the Technical Condition Factors there has never been a reading that high. Last week it continued to fall to 63.75%, signaling a continued weakening of the Daily Trend in the Sweet Sixteen.

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 16 Cryptocurrencies are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the TCFs fall on a week over week basis, more of the “Cryptos” are deteriorating on a technical basis confirming the broader market move lower. Last week one of TCFs rose, and seven fell.

For a brief explanation on how to interpret the Sweet Sixteen Total Technical Ranking or “SSTTR” vs the weekly price chart of the CCi30 Index go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select Crypto Sweet 16.

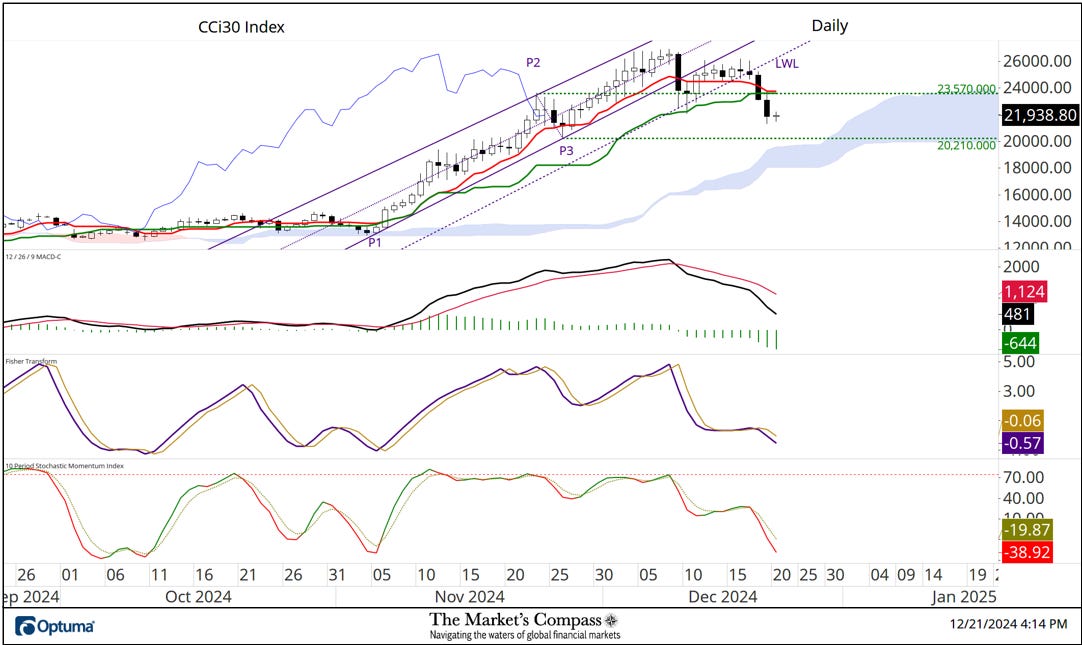

In my comments on the technical condition of the CCi30 Index three weeks ago, that referenced the Weekly Candlestick Chart, I suggested that “there was little question that the 5-week rally had become parabolic and extended over the previous five weeks and that either a pause to refresh or a price retracement should be expected. That thesis was fortified by the condition of the Sweet Sixteen Total Technical Ranking (bottom panel) which had reached an overbought extreme (red dashed line) as did the Fisher Transform which had also reached the top of its range and has now rolled over and is below its signal line in concert with the Stochastic Momentum Index which has rolled over at an extreme reading. The second Upper Warning Line (UWL2) capped the rally for three weeks running and last week prices closed near the lows of the week. Key support is at 19,861 and second is at 17,696.

Last Tuesday, support at the Lower Warning Line (violet dashed line, LWL) finally gave way and on Wednesday prices acellerated lower breaking price support and Kijun Plot support at 23,570) That level was my line in the sand a violation of which would suggest that correction of a larger degre was developing. All three secondary indicators are tracking lower and there is nary a hint that the sell off has run its course. I am now marking key support at 20,210.00 which is just above the Upper Span of the Cloud.

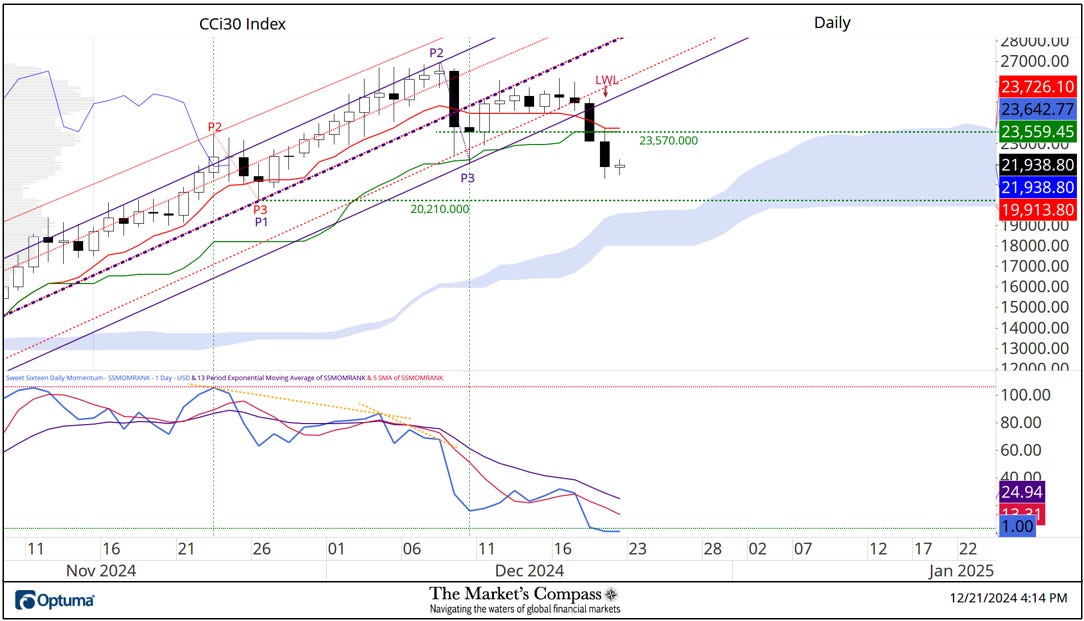

Last week I introduced the technical therory of Combination Pitchforks that help to indentify the promenate angle or vector of the rally (see last week’s Crypto Sweet Sixteen Study). Last week that anle or vector was violated. The lower panel of the chart contains my Sweet Sixteen Daily Momentum / Breadth Oscillator. The oscillator has reached an extreme oversold level leading to a pause in the sharp price downdraft in the index in the form of, in Candlestick parlance, a Doji which suggests a temporary state of equallibreum between buyers and sellers. That said, it should not be construed as a bottom or a reversal pattern but considering the current oversold condition as witnessed by the Momentum / Breadth an oversold bounce may develop.

All of the charts are courtesy of Optuma whose charting software enables users to visualize any data such as my Objective Technical Rankings. Cryptocurrency price data is courtesy of Kraken.

The following links are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…

A basic tutorial on the Tools Technical Analysis is available on my website…