If you’ve ever wondered where wealthy investors quietly earn double-digit yields while the rest of the world fights over low-return assets, the answer is simple: private credit.

Private credit — once a niche corner of institutional finance — has exploded into a $40 trillion global private market, reshaping how capital flows, how businesses borrow, and how wealthy families generate passive income outside the public markets.

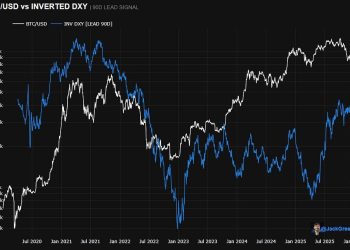

While everyday investors obsess over Bitcoin predictions, ETF chatter, meme stocks, and the Nasdaq, ultra-wealthy family offices are quietly repositioning billions into yield-generating private credit structures with far less volatility and far more control.

And here’s the shocking part:

Private credit has outperformed private equity for nearly a decade

Private credit has outperformed the S&P 500 on a risk-adjusted basis

And private credit yields are often 2–4× higher than traditional fixed income

This is why private credit has become the new power center of global finance — and why high-net-worth investors are accelerating their exposure to this growing market.

In this deep-dive, you’ll learn:

- Why private credit is suddenly the most in-demand asset class

- How a $40T private market emerged almost overnight

- Why wealthy investors prefer private credit to stocks, bonds, and even real estate

- How private credit helps with wealth creation, income generation, and even debt relief

- And most importantly: How everyday investors can finally access opportunities once locked behind institutional walls

Let’s break down the biggest shift happening in the world of modern wealth.

What Exactly Is Private Credit — And Why Is It Exploding Now?

Private credit, put simply, is non-bank lending. Instead of businesses borrowing from banks, they borrow from:

- Private lenders

- Investment funds

- Asset managers

- Family offices

- Wealthy investors pooling capital

- Non-bank financing platforms

Think of it as the private version of bonds — or the private version of real estate lending — in which investors receive:

- Yield (interest income)

- Collateral

- Priority repayment

- Negotiated terms

- Contractual protections

Unlike public markets, private credit is not traded on exchanges.

Deals are negotiated directly, allowing lenders to secure:

- Higher yields

- Better covenants

- More downside protection

- Customized structures

So why is it booming in 2025?

Two reasons changed the global financial landscape:

1. Banks pulled back from lending after 2008 and again post-COVID

Tighter regulations meant banks were forced to reduce risk. They stopped lending to many mid-market businesses, real-estate developers, and startups.

Who filled the gap?

Private lenders.

2. Higher interest rates made private credit insanely profitable

In a high-rate environment, floating-rate private loans generate yields of:

- 10%

- 12%

- 15%+

Institutional investors noticed first.

Now wealthy families are following.

This combination — high demand from borrowers and high yields for lenders — created a perfect storm.

Private credit didn’t just grow.

It exploded into a $40 trillion market that quietly fuels everything from buyouts to infrastructure to venture capital.

Why Wealthy Investors Are Suddenly Loading Up on Private Credit

The ultra-wealthy don’t chase hype — they chase risk-adjusted returns, predictable income, and asymmetric opportunities.

Private credit offers all three.

A. High, Contractual Income Streams

In a world where:

- Bonds pay weak yields

- Cash loses value to inflation

- Stocks remain volatile

- Real estate faces tightening liquidity

Private credit stands out.

Typical yields in private credit today:

- Senior secured loans: 8–12%

- Asset-backed credit: 10–14%

- Specialty finance: 12–18%

- Distressed credit: 15–25%

For wealthy investors seeking stable monthly or quarterly income, private credit has become a go-to solution.

B. Lower Volatility vs. Public Markets

The rich care more about capital preservation than moonshots.

Private credit:

- Has low correlation to public equities

- Avoids day-to-day market volatility

- Provides downside protection via collateral

- Offers predictable repayment schedules

Where stocks fluctuate hourly, private credit yields remain stable and contractual.

C. Better Control and Transparency

Unlike public bonds, private credit investors can negotiate:

- Interest rates

- Covenants

- Collateral packages

- Maturity terms

- Protective rights

This flexibility is a luxury public market investors will never have.

D. Recession-Resistant Yield

During market downturns:

- Companies still need capital

- Banks lend even less

- Private lenders gain more pricing power

This makes private credit one of the few asset classes that strengthens during economic stress.

E. Floating Rates = Inflation Protection

Most private credit loans are floating-rate, meaning yields adjust upward when interest rates rise.

Even wealthy investors holding billions in treasuries or bonds are shifting capital because:

“Why hold 4% fixed income when you can earn 12% floating?”

Private credit, in other words, is the new fixed income for the rich.

The $40 Trillion Private Market: What’s Actually Inside It?

The private market includes assets that don’t trade publicly:

- Private credit

- Private equity

- Private real estate

- Infrastructure

- Private debt

- Specialty finance

- Venture debt

- Asset-backed lending

- Hard money loans

- Litigation finance

- Revenue-based financing

But private credit has become the engine behind all of it.

Where Private Credit Capital Goes

Private lenders finance:

- Business acquisitions

- Management buyouts

- Real estate development

- SaaS companies

- Manufacturing

- Transportation fleets

- Healthcare expansion

- Clean energy infrastructure

- Hard-asset projects

- Venture-backed startups

- E-commerce companies

- Franchise operators

Private credit is now bigger than:

- The entire global crypto market

- Global commercial real estate lending

- The entire high-yield bond market

And yet, everyday investors barely know it exists.

Why Family Offices Are Exiting Venture Equity and Moving Into Private Credit

From 2010 to 2020, venture equity was the hot trend among wealthy families.

But by 2023–2025, everything changed:

1. Lower VC returns

The venture boom cooled, valuations collapsed, and exits slowed.

2. Liquidity dried up

Venture investments can be locked up for 7–12 years.

Private credit offers income immediately.

3. Higher risk, lower reward

Private credit offers higher yields with lower volatility than most venture equity.

4. Family offices prefer control

Private credit offers governance rights many venture investors never get.

5. Predictable income vs. unpredictable exits

Yield beats hope.

And family offices know that.

This is why reports show private credit allocations rising 200–300% among wealthy families since 2020.

Read More: How Investors Gain Premium Access to Private Credit Investments In A Few Steps

How Private Credit Helps with Wealth Building, Income, and Debt Relief

Here’s where private credit becomes fascinating:

It isn’t just for the rich.

It offers strategies that can help:

- Wealth builders

- Passive income seekers

- Entrepreneurs

- Individuals needing debt relief

- Retirees

- High-income earners needing diversification

A. Wealth Creation Through Yield Compounding

Private credit yields of 10–15% compounded annually can double capital in as little as 5–7 years, far faster than traditional fixed income.

B. Passive Income Generation

Contractual monthly or quarterly interest payments are ideal for:

- Retirees

- High-income professionals

- Digital entrepreneurs

- Anyone seeking passive, uncorrelated returns

C. Portfolio Diversification

Private credit reduces exposure to:

- Market noise

- Stock volatility

- Bond underperformance

- Real estate cycles

A balanced private credit position stabilizes overall portfolio returns.

D. Debt Relief and Personal Finance Advantages

Private credit is even reshaping the debt relief and personal finance landscape:

- Individuals can refinance at better rates

- Small business owners gain access to non-bank capital

- Borrowers avoid predatory lending

- Debt consolidation lenders increasingly rely on private credit funds

This creates a more efficient ecosystem for those seeking healthier financial stability.

The Risks: What Investors Need to Understand Before Entering Private Credit

Private credit is powerful — but not risk-free.

Key risks include:

1. Liquidity risk

Loans are not easily tradable. Investors may be locked in for months or years.

2. Credit risk

Borrowers can fail or default, though collateral mitigates this.

3. Interest-rate cycles

While floating rates help, rate declines can reduce yields.

4. Market concentration

Some funds are overly concentrated in specific industries.

5. Complex structures

Not all private credit funds are transparent.

Sophisticated investors perform:

- Collateral analysis

- Underwriting review

- Cash-flow modeling

- Scenario stress testing

But for most retail investors, professionally managed funds are safer than direct lending.

How Everyday Investors Can Access Private Credit (In 2025 and Beyond)

A decade ago, private credit was nearly impossible for non-institutional investors.

Today?

It’s increasingly accessible.

Here are the main entry points:

1. Private Credit Funds (Most Popular)

Offered by:

- Blackstone

- Apollo

- Ares

- KKR

- Oaktree

- Brookfield

These funds provide diversified exposure with institutional-quality underwriting.

2. Interval Funds & BDCs (Retail Friendly)

Publicly accessible with:

- Lower minimums

- Monthly or quarterly income

- Regulated structures

3. Tokenized Private Credit (New & Fast-Growing)

On-chain credit platforms provide:

- Lower fees

- Instant settlement

- Global participation

- Real-time transparency

4. Real Estate Private Credit

Hard money loans

Bridge loans

Construction financing

Fix-and-flip credit

These remain popular among accredited investors.

5. Specialty Finance Platforms

Revenue-based financing

Litigation finance

Equipment financing

Invoice factoring

These niche opportunities offer higher yields but higher complexity.

Why 2025–2030 Will Likely Be the Golden Age of Private Credit

Several macro forces are pushing private credit into a super-cycle:

1. Banks are permanently reducing lending exposure

Regulation, risk, and capital constraints limit their role.

2. Middle-market businesses are growing rapidly

They need capital — and private lenders supply it.

3. Private equity relies on private credit more than ever

Buyouts and expansions require non-bank capital.

4. Global wealth is moving into alternatives

Institutional and family office demand is accelerating.

5. Infrastructure and energy transitions require massive financing

Solar, EV, battery storage, and clean energy all rely on private debt.

6. Tokenization is unlocking global participation

Blockchain rails enable new distribution channels for private credit.

Combine these forces, and we’re witnessing one of the largest capital shifts in modern financial history.

The Future: What Investors Should Do Next

Whether you’re:

- Building wealth

- Increasing income

- Seeking portfolio diversification

- Managing risk

- Recovering from debt

- Preparing for retirement

- Or looking for stable, predictable returns

Private credit deserves a serious look.

Here’s what wealthy investors are doing in 2025

Step 1: Allocating 10–30% of portfolios to private credit

A foundational allocation for income + stability.

Step 2: Choosing senior secured, floating-rate structures

These offer the best balance of yield and safety.

Step 3: Diversifying across industries and borrowers

Mitigates risk while maintaining returns.

Step 4: Mixing institutional-grade funds with niche opportunities

Broad exposure + high-yield satellite investments.

Step 5: Preparing for long-term, compounding returns

Private credit rewards patient capital. We are early in the cycle. Not late.

The wealthy know this. Institutional capital knows this. Family offices know this. Now you know it too.

Final Thoughts: The Wealth Shift No One Is Talking About

The $40 trillion private market is no longer a hidden corner of global finance — it’s becoming the backbone of modern capital markets.

And private credit is its beating heart.

For investors seeking:

- Higher income

- Lower volatility

- Better returns

- Wealth protection

- Portfolio diversification

- Debt relief

- Recession protection

- Long-term compounding

There is no asset class more aligned with the future than private credit.

The rich are rushing in for a reason.

And now — for the first time in history — you can too.

The $40T Private Market EXPLAINED: Why the Rich Are Rushing Into Private Credit was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.