Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In an eye-catching turn of events, the popular meme-inspired cryptocurrency Shiba Inu (SHIB) has experienced an epic surge in a crucial on-chain metric within the span of just 24 hours.

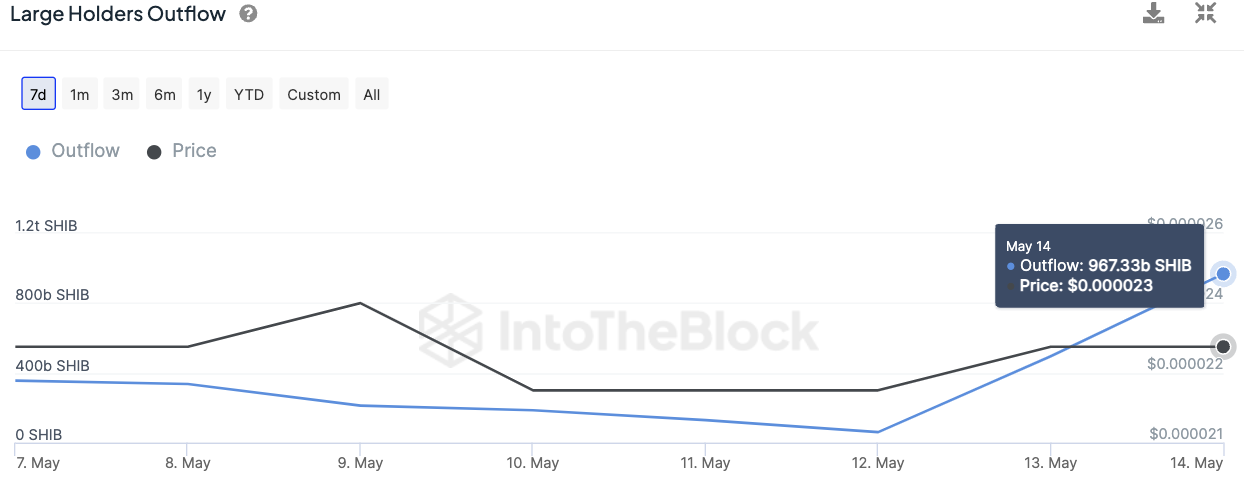

According to data sourced by IntoTheBlock, the Large Holders Outflow metric skyrocketed from 60.44 billion SHIB to a jaw-dropping 967.33 billion SHIB, marking an extraordinary 1,510% surge.

The Large Holders Outflow metric is instrumental in tracking the movement of funds exiting addresses held by whales or investors, each owning over 0.1% of the cryptocurrency’s circulating supply. Such monumental increases in outflows typically raise red flags, hinting at potential panic-induced selling.

On the other hand, however, it can mean significant withdrawals from exchanges, which is traditionally a bullish signal.

What does it mean for Shiba Inu (SHIB) price?

This surge in outflows can be interpreted in multiple ways. On one hand, it may indicate large holders offloading assets amid heightened market volatility to manage positions and dodge liquidations.

Conversely, the exodus of funds from exchanges, which often hold substantial amounts of cryptocurrency, suggests a different narrative, possibly indicating a shift in trading strategies or investor sentiment.

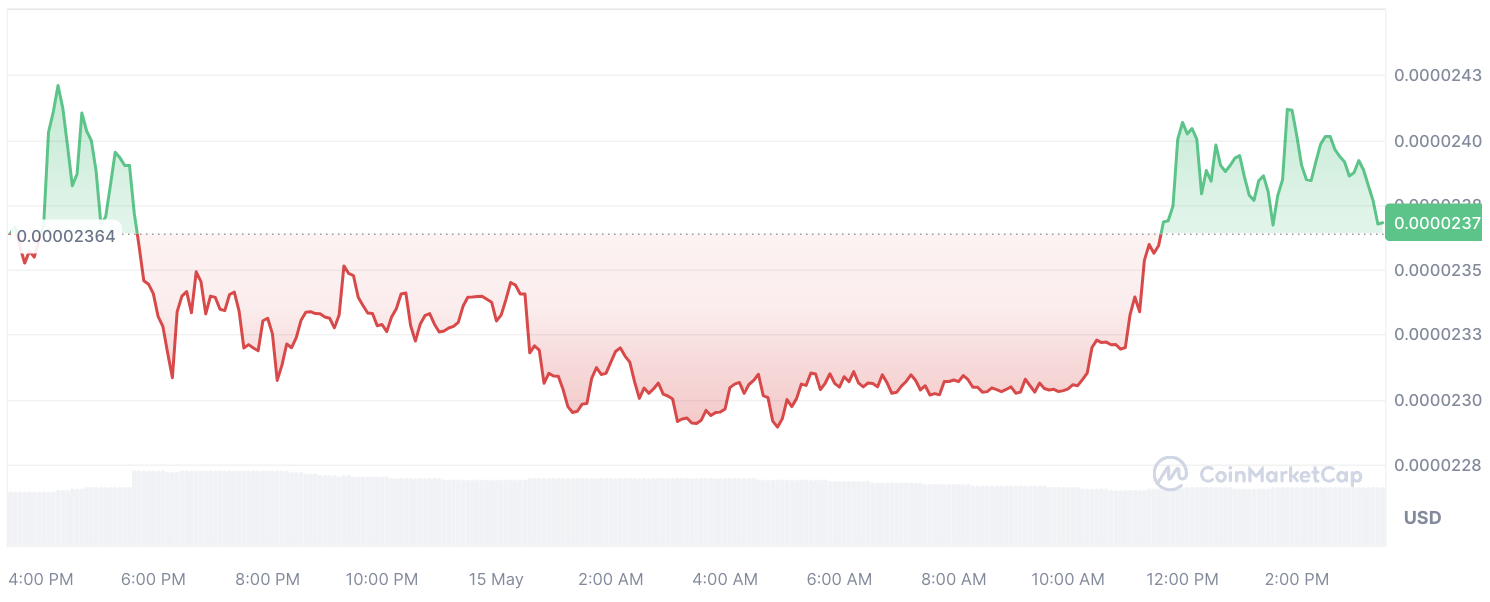

Despite this monumental surge in the outflow metric, Shiba Inu’s price experienced a marginal setback over the same period, witnessing a modest 1.63% decline. However, this dip seems inconsequential, particularly in light of the cryptocurrency’s resilience as it swiftly rebounded, surging by an impressive 3% within a day.