TLDR

- Zeta Network’s $230M SolvBTC deal sparks wild stock swings on Nasdaq

- ZNB dives 6% after Bitcoin-linked private placement announcement

- Zeta Network unveils $230M SolvBTC-backed raise amid stock volatility

- Bitcoin-tied funding sends Zeta Network stock surging then sliding fast

- ZNB’s crypto-financing move fuels sharp price swings and market debate

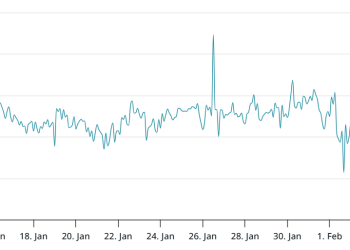

Zeta Network Group (Nasdaq: ZNB) stock experienced a sharp price spike early this morning, followed by a fast and steep drop. The stock surged near $2.78 just before 7:00 AM EDT but declined quickly, trending downward through mid-morning. By 11:54 AM EDT, ZNB had fallen to $1.8910, marking a single-day loss of 5.91%.

Zeta Network Group (Nasdaq: ZNB)

Private Placement Backed by Bitcoin-Linked Token SolvBTC

Zeta Network Group today confirmed a private placement agreement involving Class A shares and warrants totaling $230,837,060.2. The company will offer each Class A share bundled with a warrant at a combined price of $1.70. Each warrant enables the purchase of one Class A share at $2.55.

The proceeds will be paid in Bitcoin or SolvBTC, a 1:1 wrapped Bitcoin token issued by Solv Protocol. SolvBTC is held under regulated custody and verified through on-chain proof-of-reserves. This setup aims to provide both transparency and a yield-generating mechanism for corporate treasuries.

ZNB expects the transaction to close on October 16, 2025, pending standard closing conditions. The agreement is part of ZNB’s long-term strategy to enhance its digital asset treasury model. The firm sees SolvBTC as a tool to strengthen its balance sheet and ensure liquidity.

Stock Movement Highlights Market Reaction

Market participants responded to the announcement with volatility, triggering a sharp intraday swing in ZNB stock. After peaking early, the stock lost momentum rapidly and declined throughout the morning session. The steep drop suggests skepticism around the offering’s pricing and structure.

The private placement’s offering price of $1.70 sits significantly below early spike of $2.78. This discount may have contributed to the fast decline in price as the market digested the news. The immediate downturn reflects concerns about dilution and the unconventional use of wrapped crypto assets.

Trading volumes also surged, reflecting high activity in reaction to the announcement and its implications for equity value. Some traders may have exited positions following the early spike, accelerating the decline. ZNB’s sharp movement underlines the impact of non-traditional financing strategies on market behavior.

Strategic Shift Toward Tokenized Bitcoin Treasuries

Zeta Network Group’s use of SolvBTC marks a shift toward integrating tokenized Bitcoin into traditional financial operations. The company joins other Nasdaq-listed firms experimenting with yield-generating digital instruments for treasury diversification. Solv Protocol positions SolvBTC as a compliant, productive tool for institutional Bitcoin exposure.

ZNB aims to align with entities adopting structured instruments over passive crypto holdings. The strategy targets long-term financial resilience while adhering to regulatory frameworks. The move also signals confidence in Bitcoin’s fundamentals during broader market turbulence.