Key Takeaways:

- Billionaire Peter Thiel has acquired a 9.1% stake in BitMine Immersion Technologies, a major Ethereum treasury player.

- BitMine now holds over 163,000 ETH, worth more than $500 million, surpassing the value of its recent private fundraising.

- Thiel’s involvement signals a rising institutional push toward Ethereum-centric strategies beyond traditional Bitcoin accumulation.

A quiet yet significant shift is unfolding in the crypto landscape. Peter Thiel, tech billionaire and co-founder of PayPal, is making a bold entrance into the Ethereum space through a strategic investment in BitMine Immersion Technologies. This move not only echoes the corporate crypto strategies of past cycles, it also underscores a growing appetite for ETH-based treasury management among elite investors.

Thiel’s Stake in BitMine: A Strategic Ethereum Bet

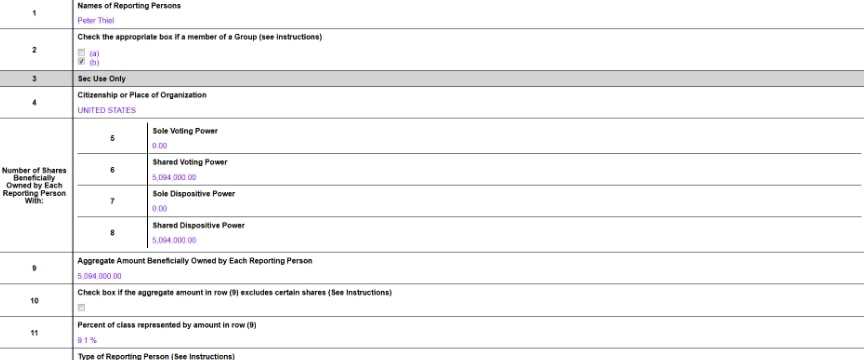

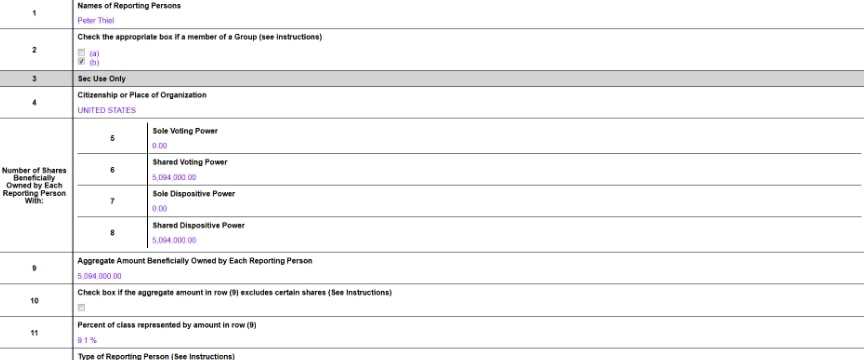

Recent filings with the U.S. Securities and Exchange Commission (SEC) revealed that Peter Thiel has taken a 9.1% stake in BitMine Immersion Technologies, a publicly traded crypto infrastructure firm. The acquisition, totaling 5,094,000 common shares, grants Thiel both shared voting and dispositive power, positioning him as one of the most influential backers of BitMine.

While the deal’s precise financial terms remain undisclosed, its signal is clear: Thiel, the contrarian investor, is making a big bet on Ethereum, not through DeFi or NFTs, but through infrastructure plays and a corporate balance sheet strategy.

Thiel’s decision is striking in part because of his more general interest in building alternative financial infrastructures. His new efforts, including the rumored launch of Erebor Bank (which is in response to the meltdown at Silicon Valley Bank), shows where he’s putting his focus on rebuilding the essential services vital to future-facing sectors like AI, defense tech, and crypto.

BitMine’s Ethereum Treasury Model: The New Playbook

BitMine isn’t a mining firm in the traditional sense. Instead, it has embraced a treasury-focused model, managing ETH reserves in a way that echoes Michael Saylor’s Bitcoin-heavy approach at MicroStrategy (now rebranded as Strategy).

As of July 14, BitMine reported Ethereum holdings exceeding 163,000 ETH, valued at over $500 million. That’s more than double the $250 million the company raised in a private placement just five days prior.

The pace of accumulation indicates a shift in how public companies perceive digital assets, not just as speculative plays, but as core treasury reserves. Ethereum, rationally a sort of “tech stock” of crypto assets for its smart contract capabilities, is now seeing it treated to the same type of strategic focus Bitcoin had in 2020–2021 cycle.

Read More: GameSquare Greenlights $100M Ethereum Strategy, Eyes Up to 14% Yield via DeFi Alliance

Ethereum’s Institutional Moment

It’s been Bitcoin, not Ethereum, that has been the focus of institutional interest the past few weeks. The approval of spot Ethereum ETFs in large markets and PoS led ETH to become an investable asset that offered both yield while also being usefu.

The treasury model used by BitMine looks like it may be taking advantage of this movement. Through holding ample ETH, the company can participate in Ethereum’s staking rewards and simultaneously the long term upside of the network as the base layer for decentralized finance and Web3 infrastructure.

Thiel’s investment, as such is not about equity; it’s about alignment with Ethereum’s future position in the financial system.

BitMine’s Role in Shaping ETH Treasury Norms

BitMine is rapidly turning into one of the largest holder of ETH, but it is not only opportunistic, it is strategic. With over $500 million in ETH reserves, the firm now ranks among the top corporate holders of Ethereum, alongside Grayscale’s ETH trust and a handful of blockchain-native companies.

Its strategy is designed to:

- Serve as an Ethereum-native asset manager

- Offer custodial and staking services to institutions

- Leverage ETH holdings as collateral for future crypto-backed financial products

Its management, led by the “crypto bull” Tom Lee, is another point in favor of their long-term thesis, not withstanding Lee’s macro outlook that has historically been bullish on cryptos. Lee, the former JPMorgan strategist who is the founder of research firm Fundstrat Global Advisors, has long argued that Ethereum will outpace Bitcoin in future boom-and-bust cycles because of its bigger utility and more complex economy.

Read More: Bitcoin Crashes Below $80k But Top Traders Eye Dip Buys Before Run to $150k

What Thiel’s Move Means for Crypto in 2025

Thiel’s investment could be indicative of a second phase of corporate acceptance, one that may revolve around Ethereum. In previous cycles, the attention revolved around Bitcoin as the “digital gold” safe haven. Now, Ethereum is assuming the role as the “digital oil” powering decentralized infrastructure.

As Ethereum’s ecosystem grows to encompass real-world assets, institutional DeFi, and even government-backed stablecoin pilots, the asset class becomes perceived as being systemically important within the crypto economy.

The Ethereum-first nature of BitMine could serve as a model for future treasury plays.

![Best BitMEX Referral Code in 2025: [KvNvfN]](https://mtrushmorecrypto.com/wp-content/uploads/2025/08/best-bitmex-referral-code.webp-75x75.webp)