Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Renowned trader Peter Brandt recently published an insightful analysis titled “Does history make a case that Bitcoin has topped?”

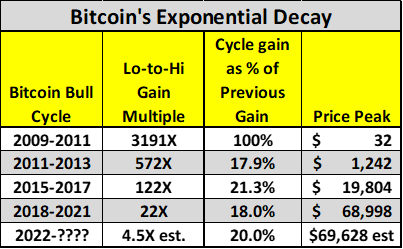

In his new essay, the veteran trader delves into the concept of exponential decay, suggesting that Bitcoin’s bull market cycles have gradually lost momentum over time.

Brandt highlights four significant bull cycles in the history of Bitcoin, with the current surge marking the fifth. He notes a concerning trend: Each successive cycle has seen a diminishing exponential advance, indicating a loss of about 80% of the momentum from previous cycles.

Applying this trend to the current cycle, the expert projects a potential peak of around $72,723, a figure already reached in recent trading. While acknowledging the historical impact of halving events on the Bitcoin price, Brandt emphasizes the sobering reality of exponential decay, suggesting a 25% chance that BTC may have already reached its peak for this cycle.

In the event of a market top, he speculates on potential price retracements, foreseeing a decline to the middle of $30,000 per BTC or even revisiting lows from 2021. Despite the bearish implications, he views such a correction as potentially bullish in the long term, drawing parallels to similar chart patterns observed in the gold market.

Brandt concludes his analysis by acknowledging the weight of the data, stating, “Do I believe the analysis just presented? I don’t want to, but the data speak for itself.”