bitFlyer, Inc. (Head office: Minato-ku, Tokyo; Representative Director: Yuzo Kano; hereinafter referred to as “the Company”) will begin offering a Self-Trade Prevention function on bitFlyer Exchange and bitFlyer Lightning from Friday, March 15th, 2024.

This feature has been introduced on major stock exchanges around the world to prevent transactions with the same investor on both sides, that are not for the purpose of transferring assets. By providing this function, unfair transactions that mislead others into believing that the market is active will be prevented, allowing our customers to trade with more confidence. We will continue to strive to operate a fair and secure exchange.

About Self-Trading

This is a transaction in which the same person or corporate entity places a sell order and a buy order for the same assets and executes them against their own order. This is prohibited by the Financial Instruments and Exchange Act as market manipulation transactions that intentionally mislead other investors into believing that the market is active without there being an actual purpose of transferring assets. Even if there is no intent to mislead other investors into believing that themarket is active, there is a risk that such transaction may be regarded as selftrading if one’s own orders are matched.

Special Features of the STP (Self-Trade Prevention) Function Provided by bitFlyer

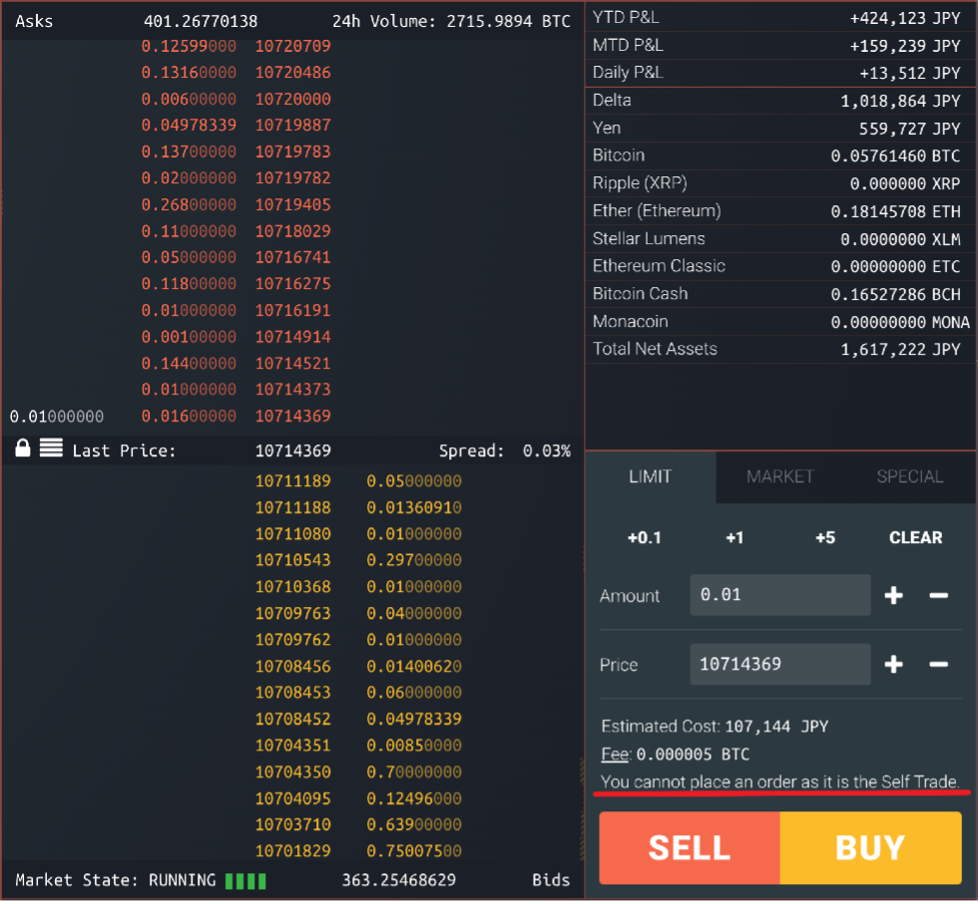

When a customer attempts to place a sell or buy order on bitFlyer Exchange or bitFlyer Lightning, while an opposite order has already been placed and has not yet been executed, our system will automatically determine if matching the orders would constitute a self-trade. If applicable, a warning will appear on the order screen and the order cannot be placed. STP functionality has been introduced by major stock exchanges around the world and offered against a fee by some. However, our service will be free of charge for all orders placed by our customers.

Benefits of Self-Trade Prevention

(1) Safe and Secure Trading Opportunities

After the feature is introduced, all orders will be targeted automatically, preventing unintended self-trades and allowing customers to trade with confidence.

(2) Prevention of Losing Trading Opportunities

Since customer orders are always matched with orders of other parties, it is possible to prevent lost trading opportunities and unnecessary commission payments due to unintentional self-trades.

(3) Increased Convenience for Corporate Customers

Corporate customers, mainly institutional investors, often hold multiple accounts and trades are conducted by multiple traders. With this feature, self-trades within the same corporate entity can also be prevented, making trading easier.

*We prohibit the creation of multiple accounts by the same individual. Please contact us if you intend to register as a corporate entity.

We will continue to strive to operate a fair and secure exchange and provide services that our customers can use with confidence.

About bitFlyer, Inc.

bitFlyer was founded in 2014 with the mission to “Simplify the World with Blockchain” and has developed its crypto asset trading business globally with its group companies bitFlyer USA, Inc. and bitFlyer EUROPE S.A. bitFlyer has achieved the highest customer satisfaction* thanks to the patronage of its customers.

As a crypto asset exchange operator and a Type I Financial Instruments business operator, bitFlyer continues to expand and improve its services and aims to provide a highly liquid crypto asset exchange that satisfies as many customers as possible.

Official website: https://bitflyer.com/en-jp

*Survey: November 2022 Market Research on Crypto Asset Exchange Services

Research Organization: Japan Marketing Research Organization

Survey period: November 11, 2022 – November 25, 2022