Key Takeaways:

- Bitcoin hits a historic all-time high (ATH) of $122,604, driven by institutional demand and ETF inflows.

- Former Binance CEO CZ warns the current ATH may soon look minor, recalling BTC’s rise from $1,000 in 2017.

- Spot Bitcoin ETFs and rising global adoption have pushed BTC’s price up over 215% since early 2024.

Bitcoin’s price surge has reignited bullish sentiment across the crypto world. On July 14, 2025, Bitcoin broke through $122,000, hitting an all-time high that few could have imagined just a few years ago. But while retail traders celebrate, Binance founder Changpeng “CZ” Zhao offers a sobering reminder: today’s ATH could be tomorrow’s footnote.

Read More: CZ Warns Bitcoin Sellers: “Regret at $77K Is Real” — Why Long-Term Charts Matter

Bitcoin Surpasses $122K: A New Era of ATHs

Bitcoin soared past the $120,000 mark and climbed as high as $122,604 on Monday, according to TradingView data. The shift represented a 3.5 percent rise within 24 hours supported by the booming volumes with a blow of institutional interest.

Historic Growth and Milestone Metrics

The recent ascent has placed the BTC as the fifth-largest asset in the world market cap only after Apple, Microsoft, NVIDIA, and gold. Its market cap now exceeds $2.43 trillion, pushing it past Amazon.

Daily volume also increased significantly, rising 94.2% from the previous day to more than $44 billion on exchanges like Binance, KCEX and CoinW.

This latest break out follows a trend observed since the SEC gave its stamp of approval to spot Bitcoin ETFs in early 2024. In that time, bitcoin has surged more than 215%, and confirming the notion that traditional finance is embracing crypto.

CZ Reflects: “This Is Just the Beginning”

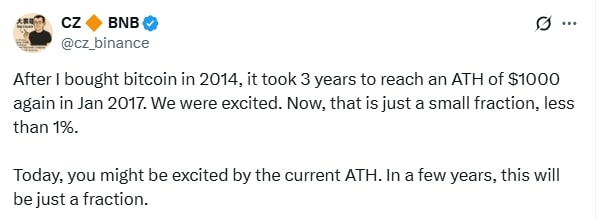

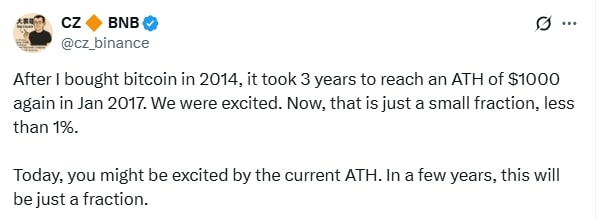

Amid the excitement, former Binance CEO CZ reminded his 8.6 million followers on X (formerly Twitter) to keep the big picture in mind. Recalling his personal history with Bitcoin, CZ wrote:

“After I bought Bitcoin in 2014, it took 3 years to reach an ATH of $1,000 again in Jan 2017. We were excited. Now, that is just a small fraction, less than 1%. Today, you might be excited by the current ATH. In a few years, this will be just a fraction.”

CZ’s post frames today’s highs not so much as an all-time high, but as another plateau that ALCM has risen to. His belief in the long-term prospects of BTC has remained intact even following his rise to the ranks of the CEO of the Binance at the end of the year 2024 when it faced certain conflicts with the regulations.

Those who have lived to see BTC develop out of obscurity into a worldwide financial player will read the message with an overwhelming feeling of connection to it. According to CZ, the excitement around $122K may soon pale in comparison to future valuations.

Institutional Demand and Spot ETFs Fuel the Rally

The recent run-up in the price of Bitcoin is not merely “speculation.” A large part of the momentum is driven by the increasing acceptance of Bitcoin as an institutional-grade asset.

Large funds and asset managers have added funds continuously since the first wave of U.S. spot Bitcoin ETFs received the go-ahead from the SEC in January 2024. These ETFs offer exposure to BTC to classical investors who have eschewed the crypto asset, partly on risk, and partly on regulatory unease.

This has opened up BTC to retirement portfolios, endowments, and pension funds, all of whom have historically shied away from the crypto scene. And as a new class of long-term holder has grown, overall volatility has waned, helping Bitcoin attract its first dollars from mainstream portfolios.

The proportion of BTC held by long-term holders presently stands at an all-time high of 69% — a development that coincides with CZ’s sentiments as that humungous figure proves that valuations at spot rates are still early in Bitcoin’s global monetization journey.

Market Sentiment and Concerns of a Pullback

Analysts are warning that the rally has generated excessive enthusiasm.

The Crypto Fear and Greed Index is currently at 74, showing strong “Greed.” Readings like this have typically been followed by modest corrections, as it is in the nature of overly eager markets to overshoot before reining themselves back in.

Still, long-term believers, in the mold of CZ, remain unfazed. To them, BTC’s limited supply, decentralized structure, and increasing recognition throughout the world means momentary volatility doesn’t matter. As CZ’s post suggests, the price might pull back, but the overall trajectory is up.

Bitcoin’s Place Among Global Assets

The rest of Bitcoin’s price performance makes it a completely different ball game. It has since debounced as a macro asset, likened to gold, and a hedge against cash devaluation and inflation.

Since 2024, a few central banks in countries such as Nigeria, Turkey, Argentina, have even started experimenting with BTC and stablecoins as alternatives to their ailing local currencies. These big picture shifts still provide fertile ground for Bitcoin over the long run.

Additionally, sovereign adoption is potentially on the horizon as well. With El Salvador and the Central African Republic having already embarked on testing Bitcoin as legal tender, there is increasing speculation that a G20 nation will add BTC as a reserve asset before 2030.