Non-fungible tokens (NFT) have become a fast-spreading phenomenon since their introduction in early 2021. These digital assets sell like exotic paintings from the 17th century, from art to music, sports, tacos to chimp faces. The craze has gone so wild that even people outside the crypto and blockchain space have flocked to their nearest search engines to understand how to buy NFT. The result is the wobbling trend, as shown in the picture below.

The So-called NFT Mania

Consequently, the NFT market is now on fire. Lebron James, a famous basketball player, sold his dunking video for $200,000 as a digitized asset. Grimes, the artist who has a kid with Elon Musk, sold her digital art for over $6 million in just one day.

And remember the popular neon cat meme? Yes, that got sold as NFT for $590,000—so as the super popular Disaster Girl meme that got sold for $500,000 by the same woman who got featured in it as a young girl.

But one of the most interesting things about NFTs is that none of these assets have anything physically attached to them. It is just a JPEG, or PNG, or any other digital format on the screen. For instance, Twitter CEO Jack Dorsey sold his first tweet for a whopping $2.9 million. That is the power of collectibles—they might not make sense to everyday Joes, but enthusiasts are willing to pay millions for them for their uniqueness.

As a result, NFTs does sound like pure hype. Boomers compare it with the notorious Tulip Mania. GenX calls them beanie babies. Meanwhile, millennials believe it is the repeat of the 2017 initial coin offering crash.

But is there more to NFTs that meets the eye? Maybe it is a new paradigm or a new investment class altogether. That is what CoinStats want to find out. And by the end of this article, we’ll be one step closer to find out the real truth and understanding whether it’s worth it for people to know how to buy NFT tokens or consider investing in NFTs.

So let’s start with the basics.

What Is NFT

People use popular blockchain tokens to issue their own. For example, they will use something like Ethereum’s ETH, Cardano’s ADA, Polkadot’s DOT, and many different cryptocurrencies to put them into a smart contract. Then, they will issue their digital asset from the smart contract, which they will call something unique and special—like CoinStats coins, etc.

So, in the end, the issued asset still takes its valuation from ETH, ADA, DOT, etc. Later, people attach artworks and similar perks to their tokens and put them in a marketplace for trade. As a result, interested collectors can purchase digital assets because they are backed by valuable cryptocurrencies—which are liquid enough to be converted back to the US dollar, Euro, etc.

That is the simplified way of explaining how NFTs work. But the reason why these tokens have value is the same as any other artwork: Because they are rare and people want to own them.

Counterfeiting Risks

But one must ask, couldn’t NFT creators create more of the same artwork since they are digital. There is two way of answering that question. First, it would not be a problem because the creator will not be able to step in and duplicate the same artwork—for the very same reason Bitcoin has a maximum supply cap of 21 million tokens; no one can step in and create more of them because its on blockchain.

And even if the creator wants to launch the same NFT all over again, they would risk making it less scarce which would reduce their value in the long run. Meanwhile, there will always be a slight variation that separates the duplicated NFT from the original one, whether that’s the ticker symbol that would change or the launch date. It would be provable and verifiable over the blockchain, even though the artwork itself could be 100% identifiable.

That sounds silly but digital collectors do care about little things. For example, the digital edition of a Pokemon card called Charizard, with a FIRST EDITION stamp, was released in 1999. It now sells for several hundred thousand dollars even though an exact identical version of the card exists but sells for way, way less.

That is why NFTs have value. One can create a similar artwork with 99% of the traits of the original asset, but it will never be exactly the same. That explains why NFTs are valuable because creators attach a special physical asset or experience to them. Or, they sell them at special events.

Is It Worth Knowing How to Buy NFT Tokens

Before people even decide to look for how or where to buy NFTs, they must question whether it is even worth putting hundreds and millions of dollars into a digital collectible. For instance, does buying an NFT token merely make creators rich and bring no value to the buyer? Let’s understand.

The most important thing to understand is: It depends on what people buy. CoinStats have created a list of criteria that would hopefully help its users out to understand which NFTs are valuable and which of them are worthless.

The First Criteria: Popularity

Funny but apprehensively true. An NFT creator needs to be popular enough, someone/something that is famous, and practically a brand in themselves. The bigger they are, the safer one’s NFT investment would turn.

For example, if you buy an NFT associated with, say, Harry Potter, then it would always have some long-term value in the eyes of millions and billions of Harry Potter fans around the world.

The Second Criteria: First

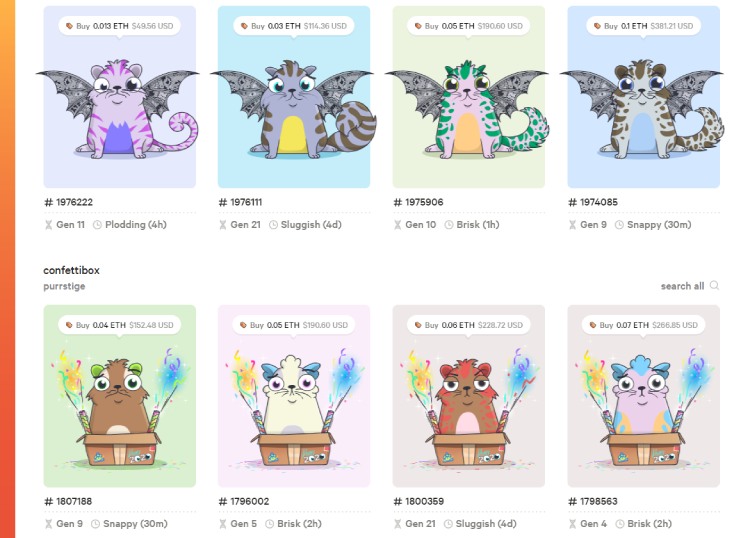

The ‘First’ factor means any NFT that is the first from the popular creator or from the industry they represent. That is why CryptoKitties became so valuable because they are one of the first NFTs ever created.

And from the look of it, CryptoKitties will always have some significant value attached to it, the same reason why the Pokemon card is selling for hundreds of thousands of dollars. Because these artworks are historical—the first of their kinds.

As a result, the ‘first’ factor always creates the right balance of excitement and buzz. And if one can get in on that hype, they can consider treating their NFT as an investment asset that they can sell to someone else later.

The Third Criteria: Touchable

Having an NFT that is attached to a real, tangible physical asset tends to increase its prospects of becoming an investment, in addition to collectible. For example, a Pokemon NFT that one can use to claim the ownership of a physical, deliverable Pokemon card adds another layer of attraction to the digital collectible industry.

Having an NFT that is attached to a real, tangible physical asset tends to increase its prospects of becoming an investment, in addition to collectible. For example, a Pokemon NFT that one can use to claim the ownership of a physical, deliverable Pokemon card adds another layer of attraction to the digital collectible industry.

Or maybe, buying an NFT that has an experience attached to it—like an opportunity to meet or collaborate with the creator—appears important. For example, digital rights are tangible that people value.

The Fourth/Last Criteria: Scarcity

Obviously, a collectible has to be rare enough to have value in the first place. If it is not, then there is no point buying it because everyone has it, like the Bluray edition of the first Jurassic Park movie. But to have Steven Speilberg’s marvelous film on a VHS tape is rare and darn scarce (kindly contact the author if you have one).

Obviously, a collectible has to be rare enough to have value in the first place. If it is not, then there is no point buying it because everyone has it, like the Bluray edition of the first Jurassic Park movie. But to have Steven Speilberg’s marvelous film on a VHS tape is rare and darn scarce (kindly contact the author if you have one).

Now the above four criteria are not bullet points on how to buy NFTs. More so, they are the brainchild of the author who collects dinosaur toys. But nonetheless, they could assist NFT maniacs to determine what art is worth their hard-earned buck.

Where to buy NFT: A Curated List

People now have more than one option when it comes to buying NFTs. Like any other product, NFTs also have specific marketplaces, where the artists list them for sale and collectors buy them for whatever reason. CoinStats have listed them below:

OpenSea

OpenSea has emerged as the most popular and visited NFT marketplaces. Founded in 2017 by Devin Finzer and Alex Atallah’s software development team, the portal recently hit a record $1 billion in weekly sales, with total value submitted to its smart contract above 450,000 Ethereum, or $1.4 billion as per the currency exchange rates.

Yahoo Finance reported that “for the entire month of August, the platform generated $2.93 billion in trading volume driven by over 2 million transactions from close to 190,000 users.”

The OpenSea marketplace features filterable price and sales status, listing everything from virtual real estate to digital pets to sound loops from The Weeknd. It also has a dedicated stats tab—almost like a stock ticker—that ranks sellers by volume, average sale price, and the number of assets sold.

Buyers need to load their wallets with Ethereum, USD Coin (USDC), or Dai (DAI), and over 150 other crypto tokens. By doing so, they can buy NFTs directly from sellers or bid on NFTs in auctions.

Location: New York

Categories: Digital art, music, games, domain names, virtual worlds, sports, collectibles

Mintable

Many call Mintable eBay of NFTs. The marketplace received backing from Marc Benioff-owned Time Ventures and billionaire investor Mark Cuban and enables people to buy and sell NFT tokens.

Ethereum and Zilliqa blockchains back the Mintable marketplace, with in-house MetaMask integration enabling buyers to set up crypto wallets. Meanwhile, creators can create free “gasless” NFTs, short-run printable series, or traditional transaction-based items.

On the other hand, buyers can purchase listed NFT items or bid on their auctions. Winners get notified by email.

Location: Singapore

Categories: Digital art, photography, videos, games, templates, domain names

NBA Top Shot

DapperLabs launched NBA Top Shot, an NBA-licensed game that enables fans to collect and trade digital “moments” from the basketball matches, in early 2020. In detail, the limited-edition sets sell for as low as $9 and for as high as $230 via an open, broader marketplace.

These moments feature video highlights, player stats, and box scores. After buying them, fans can display their curated collections while following their favorite teams. NBA Top Shot also enables users to trade assets secured on their private blockchain.

Location: Vancouver, Canada

Category: Sports collectibles

Axie Infinity

Vietnamese startup Sky Mavis launched Axie Infinity, a Pokemon-inspired video game that allows players to collect, breed, and trade digital pets while building farming kingdoms. They became one of the fastest emerging marketplaces after its launch in 2020, beating volumes of top blockchains like Bitcoin and Ethereum, single-handedly.

Axie Infinity’s daily active users surged from 30,000 in April to more than a million in August. The Ethereum-based project has recorded more than $30 million worth of Ether transfers every day over the past month. The popularity went too far that the Philippines’ Department of Finance and the Bureau of Internal Revenue had to remind players that their Axie Infinity incomes are subject to income tax.

Axie encrypts characters and land plots as NFTs. As a result, collectors and gamers can buy them via its online marketplace, with pets selling for hundreds of dollars and virtual land plots earning more than $20,000.

Location: Ho Chi Minh City, Vietnam

Category: Video game

Foundation

Launched in February 2021, Foundation is known for hosting NFT sales of the viral internet meme Nyan Cat and Pak’s Finite Records. It has also enabled Pussy Riot’s NadyaTolokonnikova, Edward Snowden, and Aphex Twins to sell their works via auction,

Foundation arranges creators’ work in a grid of cards. The marketplace lists the trending auctions at the top of the page, alongside featured artists. Meanwhile, it lists the works alongside their reserve prices, using which buyers can place their bids for 24 hours, with a 15-minute extension.

Location: Los Angeles

Category: Digital art

Other marketplaces to look for: Rarible, Decentraland, Zora, Nifty Gateway, Venly, Valuables, Zeptagram, GROW.HOUSE, MakersPlace, The Sandbox, etc.

Conclusion

So that’s it, folks. NFTs make sense to those who are already into collectibles. Investors who do not find a digital item worthy enough to attract capital should steer away from the craze. But those who do believe in the long-term valuation of rare, scarce assets, can dip their toes in the emerging NFT sector.