In this article, Fin-telligence.com reviews how traders, particularly from Belgium, can spot crypto trading scams and safeguard their investments. The crypto market can be a lucrative space, but it is also rife with scams that prey on uninformed traders.

Recognizing the signs of a scam is crucial to ensure that your trading experience is both profitable and safe.

Fin-telligence.com Reviews: Understanding Crypto Trading Scams

Crypto trading scams are deceptive schemes that trick people into losing their hard-earned money. These scams often promise high returns, quick profits, and easy trading. They often lure traders with the promise of lucrative investments in the booming crypto market.

Fin-telligence.com reviews the most common types of scams, which include Ponzi schemes, fake ICOs, pump-and-dump schemes, and phishing attacks. By understanding these scams, traders from Belgium can be more vigilant and avoid falling victim to them.

One key aspect of these scams is their similarity to legitimate trading opportunities. Scammers often use high-pressure tactics, making it hard to distinguish between a scam and a genuine trading platform.

That’s why Fin-telligence.com emphasizes the importance of conducting thorough research before committing to any investment in the crypto space.

Fin-telligence.com Reviews: Red Flags to Watch Out For

Fin-telligence.com reviews several red flags that traders should watch out for when engaging with a crypto trading platform. These signs can help traders from Belgium identify potentially fraudulent schemes:

- Unrealistic Promises of High Returns: If an offer sounds too good to be true, it likely is. Scammers often promise guaranteed returns, especially in volatile markets like crypto. No legitimate platform or trader can guarantee profits, so this is a major red flag.

- Lack of Transparency: Transparency is essential when evaluating a trading platform. If a platform refuses to disclose its location, team members, or the company behind it, it’s a warning sign. Fin-telligence.com recommends traders look for platforms that offer clear information about their operations and regulations.

- Unclear or Hidden Fees: Another common tactic of scammers is to hide their fees. Legitimate crypto platforms are transparent about the fees they charge, while scammers may not make their fees clear or may have hidden costs that are revealed only after you make an initial deposit.

- Unlicensed or Unregulated Platforms: Regulatory compliance is crucial for ensuring the safety of your funds. Legitimate trading platforms are regulated by financial authorities, such as the Financial Conduct Authority (FCA) in the UK. Fin-telligence.com suggests checking if a platform is regulated before using it.

- Pushy Marketing Tactics: Scammers often use aggressive marketing tactics to persuade traders to deposit money quickly. These tactics include limited-time offers, pressure to act now, or threats of missing out on a great opportunity. Traders should be cautious of such high-pressure strategies.

Fin-telligence.com Reviews: How to Conduct Research

When it comes to avoiding scams, research is key. Fin-telligence.com reviews the best practices for conducting due diligence before committing to any platform. Here’s how traders from Belgium can ensure they’re making informed decisions:

- Check for Regulation: As previously mentioned, regulation is a key indicator of a trustworthy platform. If a platform is regulated by a reputable body like the FCA, it’s more likely to be legitimate. Traders should always check the platform’s regulatory status before engaging in any transactions.

- Read Reviews and Testimonials: Traders should look for independent reviews and testimonials from other users. Platforms like Fin-telligence.com can provide an overview of a platform’s reputation. By reading user experiences, traders can gauge whether a platform has a history of fraudulent activity.

- Visit the Website and Check Contact Details: A legitimate platform will have a well-established website with contact details, customer support, and clear information about its services. If the website looks unprofessional or lacks proper contact information, it may be a scam.

- Test the Platform: Before investing large amounts, Fin-telligence.com recommends testing the platform with a small deposit. This allows traders to get a feel for the platform’s functionality and withdrawal processes. If a platform has trouble processing withdrawals, it’s a clear sign of a scam.

- Consult Trusted Sources: Fin-telligence.com reviews and suggests consulting trusted financial sources and forums where experienced traders share their insights and warnings about scams. These can be invaluable resources for identifying red flags before making any investment decisions.

Fin-telligence.com Reviews: The Role of Regulation in Protecting Traders

Regulation plays a crucial role in protecting traders from fraud and scams. Fin-telligence.com emphasizes the importance of using regulated platforms to ensure the security of your funds and trading activities.

Platforms that are authorized and regulated by financial authorities must comply with strict guidelines to protect investors.

For example, in the UK, the Financial Conduct Authority (FCA) oversees all financial platforms and ensures they operate within legal boundaries. This includes regular audits, transparent operations, and adherence to strict security protocols.

By choosing regulated platforms, traders from Belgium can reduce their risk of falling victim to scams.

Fin-telligence.com Reviews: Avoiding Common Pitfalls

While scams are common in the crypto trading world, avoiding them is possible with the right precautions. Fin-telligence.com reviews common pitfalls that traders should be aware of:

- Not Understanding the Risks: Crypto trading can be volatile, and while it offers high potential returns, it also carries significant risks. Traders should be prepared for the possibility of losses and not rely on platforms that promise easy wins.

- Falling for Fake Promises: Scammers often use enticing offers, such as “100% risk-free” or “guaranteed returns,” to lure in traders. Fin-telligence.com suggests that traders ignore these promises and look for platforms that focus on realistic goals and responsible trading.

- Failing to Verify Information: Another common mistake traders make is not verifying the information provided by a platform. It’s important to double-check the legitimacy of the platform’s claims and make sure everything aligns with known regulatory standards.

Conclusion: Protecting Yourself from Crypto Trading Scams

Fin-telligence.com reviews the importance of vigilance and research when engaging in crypto trading.

By understanding the common signs of scams, conducting thorough research, and choosing regulated platforms, traders from Belgium can protect themselves from losing money to fraudulent schemes.

While the crypto market offers exciting opportunities, it is essential to approach it with caution and ensure that every platform you interact with is trustworthy and transparent.

About Fin-telligence.com

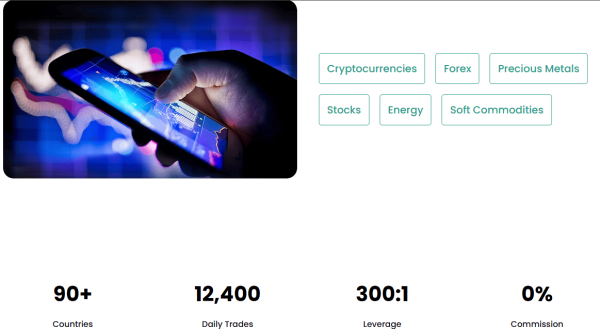

Fin-telligence.com is operated by TUNSTALL TRADING LIMITED, a British investment company regulated by the Financial Conduct Authority (FCA) under license reference number 798614. The platform provides access to a wide range of trading options, including cryptocurrencies, stocks, soft commodities, energy, forex, and precious metals. TUNSTALL TRADING LIMITED is authorized and regulated by the UK government, ensuring that traders can engage in a safe and compliant environment.

The post Fin-telligence.com Scam or Not? How to Spot Crypto Scams appeared first on Visionary Financial.

![Best Hyperliquid Referral Code in 2026: [HYPERLIQUIDREVIEW]](https://mtrushmorecrypto.com/wp-content/uploads/2026/02/hyperliquid-referral-code-75x75.jpg)

![Best Hyperliquid Referral Code in 2026: [HYPERLIQUIDREVIEW]](https://mtrushmorecrypto.com/wp-content/uploads/2026/02/hyperliquid-referral-code-120x86.jpg)

![Best Hyperliquid Referral Code in 2026: [HYPERLIQUIDREVIEW]](https://mtrushmorecrypto.com/wp-content/uploads/2026/02/hyperliquid-referral-code-350x250.jpg)