Cryptocurrencies are an integral part of blockchain technology, powering all its use cases. These digital coins and tokens, when transacted, not only enable the transfer of value but also the execution of smart contracts, driving a whole host of blockchain-based applications.

Like any other currency, they are stored in wallets called crypto wallets. Coupled with asset storage functionalities, these wallets also allow individuals to transact their digital assets with others on the blockchain network. Acting as blockchain accounts, they help individuals connect and interact with the decentralized world.

Unlike regular wallets, crypto wallets do not store currency the traditional way. Instead, they securely store the digital keys associated with the crypto assets on the blockchain. These keys link your wallet to your assets on the blockchain, proving your ownership. The wallet-associated digital keys exist in pairs consisting of the private and public keys.

Private keys digitally sign transactions providing unique cryptographic hashes. These hashes finalize the transfer of the assets on the blockchain. Since the private keys are solely responsible for transaction signing, it goes without saying that they need to be handled very safely. Private key mismanagement could lead to the wrong people running away with stored funds.

While private keys act as passwords securing wallet-related funds, public keys act as wallet addresses. Using public keys, users can determine the destination of their transaction. Public keys are generated from wallet-related private keys making them unique to a single crypto wallet. Together, these wallet keys help getting transactions going from the wallet. Moreover, they are also used to verify transactions on the blockchain.

Kicking off transactions from a wallet is quite straightforward. By using the wallet interface, users can specify the destination address they wish to send funds to. Once the destination is chosen, they sign the transaction with their private keys. However, depending on how the private keys are stored, the signing process varies across different wallets.

Some wallets are designed to provide the highest possible security while storing private keys, invariably adding extra steps to signing transactions. Wallets aiming for transaction convenience store private keys in an easily accessible fashion. This allows for quick transaction signing. However, the pay-off for convenience is sacrificing private key security. Private key management is often a criterion that differentiates wallets from one another.

Let’s look at the different kinds of crypto wallets —

Software wallets, as the name suggests, store their private keys within software applications. They usually reside on devices like computers and mobile phones. These wallets can be downloaded easily from respective app stores, and setting them up is quite simple. Similarly, the entire process of accessing private keys for signing transactions is also simple making them desirable to new crypto investors. However, these keys are exposed to the same networks the devices they sit on are connected to. This makes them highly susceptible to cyber attacks that could lead to loss of funds. For the most part, such wallets are also referred to as hot wallets due to their presence within network-connected devices.

For convenience’s sake, software hot wallets are often implemented within crypto exchange and enterprise infrastructure. Referred to as custodial wallets, they are often centralized. The funds in these wallets are under the custody of the enterprise. Not only do ‘your’ funds technically belong to the enterprise, but any successful attack launched on them could result in the possible loss of all your funds. Albeit an easy way to access and transfer crypto assets, these wallets are highly risky for storage purposes.

While software wallets house private keys in network-connected devices, hardware wallets store private keys in secure offline environments. Often referred to as cold wallets, they range from anything like air-gapped laptops to highly robust storage devices called HSMs (Hardware Security Modules) made specifically for crypto assets. Storing assets away from networks makes it impossible for cybercriminals to steal the funds. They can only be stolen in instances where a bad actor finds the device in person and manages to obtain the private keys.

However, the hardware wallets of today are equipped with security features such as password protection and multi-factor authentication. These measures prevent anyone but the owner from accessing their contents. The funds in such wallets are more likely to be lost due to device mismanagement than to cyberattacks. Therefore, the owners are required to store their wallets in safe environments that they always remember.

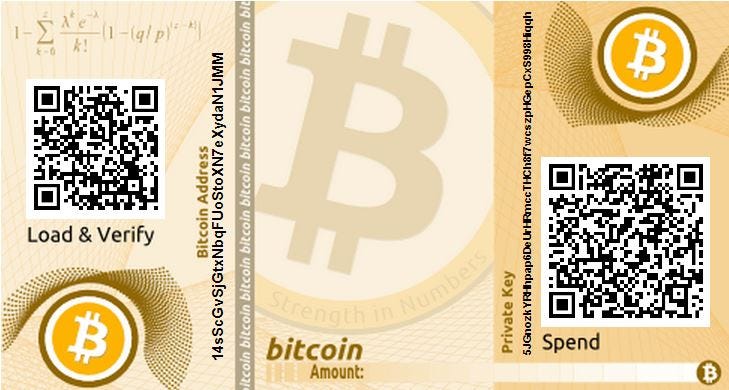

Paper wallets are considered the rawest form of cold wallets because of their inability to connect to any network. These wallets originally required users to write down wallet-associated keys whose alphanumeric values would span to great numbers. However, they have evolved to contain shorter representations of the cryptographic digital keys along with their QR representations. This has made it slightly easier to access the funds they store with the help of devices that contain transaction signing software.

Like hardware wallets, the storage of these wallets is very important. In fact, the need for cautious storage is more so with paper wallets. They are susceptible to the elements of weather and natural disasters that can cause users to lose all their wallet-associated funds.

The presence of different kinds of crypto wallets might make it hard to choose for an investor taking their first steps into the world of blockchain. Singling out a wallet requires careful consideration of your needs. For example, software wallets present on mobile devices would be the best bet for users who regularly transact with crypto assets. On the flip side, hardware wallets are best suited for cold storage. They can securely store larger quantities of cryptocurrencies for long periods. And, of course, the old-school investor could always go the paper wallet route for nostalgia’s sake.

However, most users on the blockchain interact with a variety of the technology’s offerings and use cases. Therefore, they would benefit from mixing and matching all kinds of wallets according to their specific requirements. Regardless of what kind is used, crypto wallets are a bare necessity to interact with the blockchain. Thorough research is needed before you opt for one.