The market is entering the holiday season without much strength. Unfortunately, investors are not rushing to buy into the Christmas holidays, which is understandable considering the state of Ethereum, which is barely forming a higher low, while XRP and BTC are cooling off somewhat.

Will Ethereum bring us any presents?

Ethereum is currently at a point where a bullish reversal is not only logical but statistically plausible. ETH has compressed into a structure that typically resolves with volatility expansion after months of corrective price action. Downward momentum is clearly waning.

Technically, following a steep sell-off, Ethereum is trading inside a rising, wedge-like recovery channel. The price is testing descending moving averages from below while holding above a rising trendline. Buyers are not aggressive, but sellers are no longer able to push the price meaningfully lower. In this type of broader structure, upside usually gains the advantage once that balance shifts.

The 200-day moving average, while still above the price, has flattened. That matters. When long-term averages stop accelerating downward, macro selling pressure is largely exhausted.

Momentum indicators support this view. RSI is holding in neutral territory instead of collapsing into oversold conditions. During periods of extreme bearishness, RSI typically fails to hold above 40. Ethereum is now doing so consistently, signaling that sellers are losing control. Each dip is being bought faster, and downside follow-through continues to weaken.

Bitcoin absorbed most of the systemic selling pressure, while Ethereum had already corrected significantly from its local highs. ETH’s relative underperformance during the drawdown increases the probability of relative strength in the next advance. This rotation pattern has repeated in prior cycles.

This does not imply an immediate rally. It suggests that Ethereum is transitioning from distribution to accumulation. The structure shifts decisively from defensive to constructive once ETH reclaims the $3,300-$3,400 range.

Bitcoin hiding

On the surface, Bitcoin appears weak, but structurally, it is behaving in a way that often precedes significant upside. Repeated tests of the same lows do not signal fragility. They signal absorption.

Since a steep decline from the highs, Bitcoin has returned to the same demand zone multiple times without breaking down further. Each sell-off into this region shows diminishing downside follow-through. This is how market floors form — not through clean V-shaped reversals, but through slow, ugly price action that convinces most participants that nothing bullish is happening.

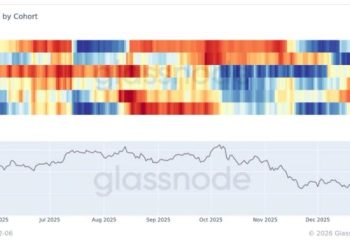

Volume behavior reinforces this view. The initial breakdown saw front-loaded selling spikes, but subsequent declines have been shorter and accompanied by lower volume. This suggests that forced selling has largely run its course. What remains is rotational churn, where short-term traders are shaken out and supply is absorbed by longer-term capital.

Markets do not bottom when everyone agrees the price is cheap. They bottom when selling pressure fades. Momentum metrics reflect this shift. While the price remains near the lows, the RSI is no longer marking new bearish extremes. This divergence signals decaying downside momentum. In prior cycles, this configuration has often preceded sharp relief rallies, especially when sentiment was overwhelmingly bearish.

Time is also a factor. After the decline, Bitcoin has already spent a significant period consolidating. Markets often turn when boredom sets in, not when fear peaks. Extended sideways action near the lows conditions participants to expect further downside, which is typically when rebounds occur.

This does not imply an immediate surge higher. It does indicate that downside asymmetry is shrinking. While most traders remain focused on prior resistance and recent losses, the risk-reward profile is quietly improving.

XRP’s bloodbath ends

After about 160 days of persistent downside pressure, XRP is finally showing us something to make us believe in a proper reversal.

Since late summer, the asset has been stuck in a clear bearish structure that is characterized by a declining channel, regular lower highs and frequent rejections from important moving averages. Any early bullish expectations have been punished by this trend.

However, the most recent price behavior indicates that the carnage may finally be slowing down. Exhaustion, rather than an explosive bounce, is the most significant change. XRP’s decline in acceleration has stopped. The price is beginning to compress close to the lower edge of its descending channel, recent sell-offs are weaker and follow-through is scarce. Extended downtrends usually end with a slow bleed that runs out of sellers, rather than a V-shaped reversal.

Momentum indicators back up this assertion. After weeks of being trapped in depressed territory, RSI is now stabilizing, as opposed to further declining. This suggests that selling pressure is being absorbed. Volume also conveys a similar message: recent candles indicate decreasing participation on the downside, and significant distribution spikes are behind us. Although they are still there, bears are no longer hostile.

However, there is currently no proof that this is a trend reversal. Until a higher high is printed, XRP continues to trade below its key moving averages, and the overall structure is still technically bearish. Instead, a base is developing.