CRV Pumps to Lead DeFi as Curve Finance Hits $100 Billion in Overall Volume

Total value locked (TVL) in Ethereum decentralized finance (DeFi) protocols has surpassed $160 billion to hit a new all-time high at $163.52 bln.

But while DeFi tokens haven’t got the memo as they continue to lag behind the rest of the market with L1s stealing all the limelight, Curve is one of the exceptions.

Curve is the dominant DeFi project on Ethereum, accounting for its 10.18% of TVL at $16.64 bln. The decentralized exchange, however, isn’t limited to Ethereum but has grown to cover Avalanche, where it has $648.8 mln of assets locked, Harmony ($13.92 mln), Polygon ($380.85 mln), Arbitrum ($321.55 mln), Fantom ($165.2 mln), and xDai ($5.86 mln).

In total, Curve Protocol’s TVL has also hit a new peak of $18.17 bln in continued growth, up from $1.4 billion at the beginning of the year.

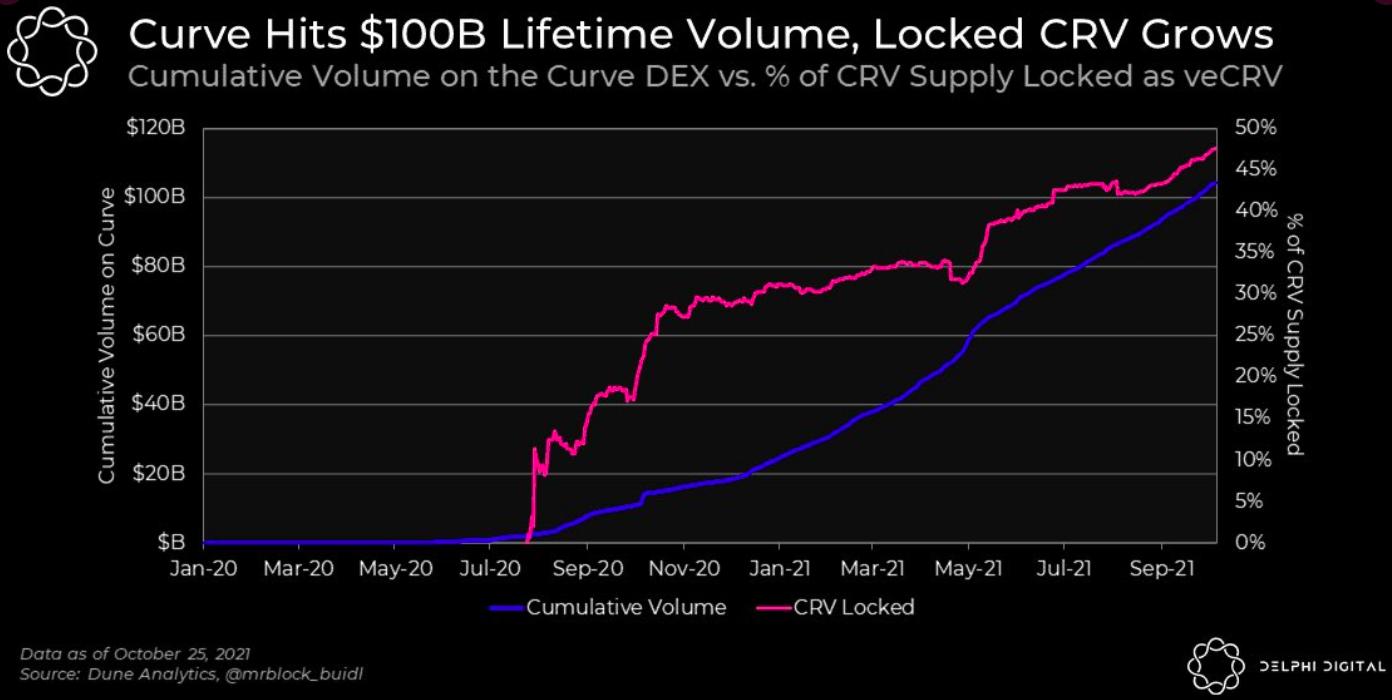

Curve has also facilitated more than $100 billion of volume since launching in January 2020.

This growth can also be seen in the price of CRV, which is up 84% in the past week to trade at $5.08, a level last seen in September 2020. CRV, however, is still down 90.5% from its all-time high of $54 in mid-August last year.

The token was launched in August 2020 with a very small float and rapid emissions, causing its price to collapse. While initially criticized, CRV’s token economics has since then proven that its token model works.

“Crv pump is a byproduct of market pricing in curve v2 / curve being deflationary the last 20d…” noted trader CryptoMessiah.

Yield farming is another factor as Liquidated Pools (LPs) on Curve get a boosted yield by locking their CRV tokens into veCRV. More than 47% of all circulating CRV tokens are currently locked in the protocol and continue to increase. In exchange for locking their CRV tokens, users receive cvxCRV — a liquid staking derivative of veCRV.

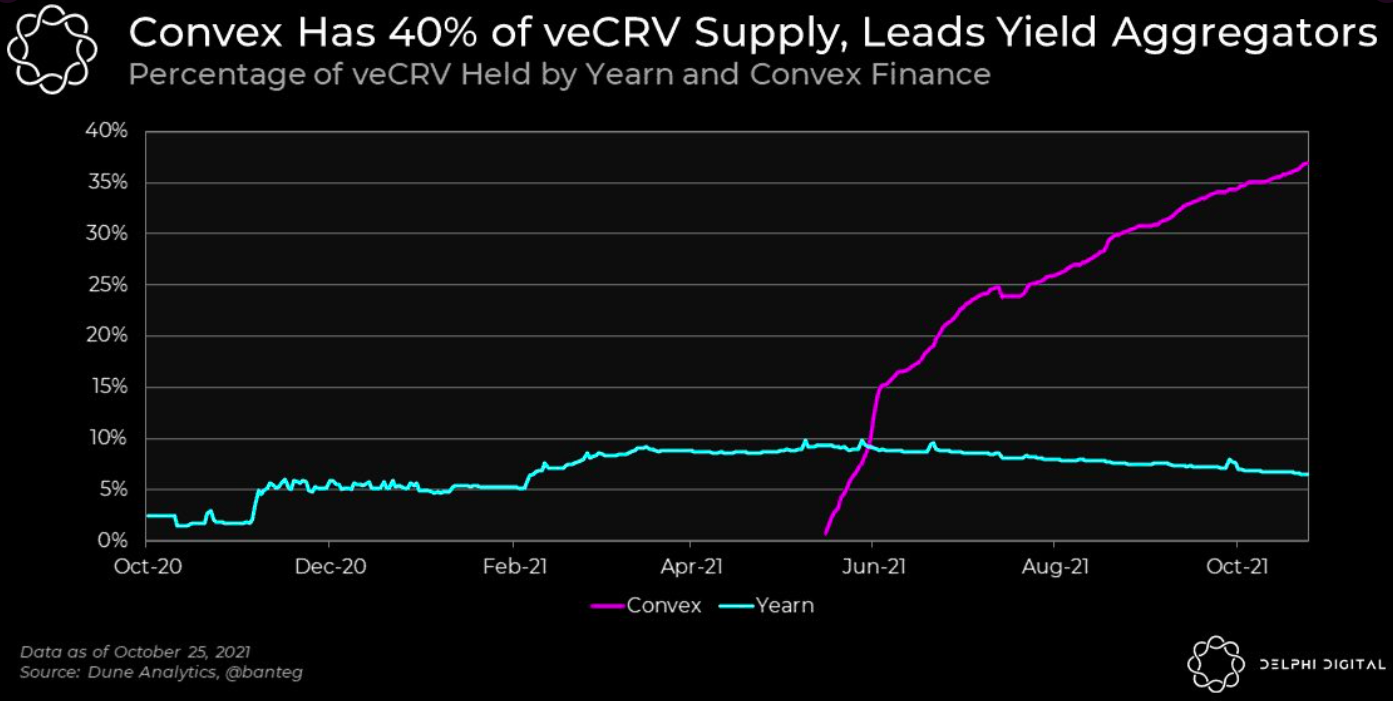

Curve’s liquidity provision and token locking model is what has led to competition amongst farming products built on top of Curve.

The majority of the newly emitted CRV is locked within Convex, which has over 35% of veCRV supply. Besides Convex, Yearn offers attractive yields to users to lock their tokens in vaults for up to four years.