TLDR

- Solana hits resistance at $175 as bulls struggle.

- DEX volume soars but bots are inflating the figures.

- $10B drained in hidden fees hurting liquidity providers.

- Liquidity leaks raise concerns over Solana’s future.

- Glyde launches with zero fees and bold promises.

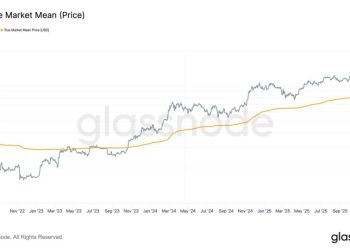

Solana is testing a significant resistance level at $175 following a period of record-breaking decentralized exchange activity. The network’s daily DEX volume has exceeded $2.8 billion while its total value locked (TVL) remains near $9.4 billion. This sharp increase in trading velocity has raised concerns about sustainability as value continues leaking from the ecosystem.

Solana Hits Resistance as Price Hovers Near $175

Solana is trading at 173.92, just below a significant resistance zone that has triggered pullbacks in previous rallies. Historically, the $175 level has acted as a ceiling and floor, showing strong market memory across different cycles. A clean break above this level would need sustained volume and demand to confirm a new leg upward.

#Solana $SOL has reached a critical resistance area at $175! pic.twitter.com/hP66opUPKD

— Ali (@ali_charts) May 12, 2025

Price action leading to this point has been supported by strong momentum across DEX platforms on the Solana network. However, the rally now faces pressure from technical resistance, as shown in recent trading patterns. Any failure to hold above $175 due to profit-taking may trigger a short-term correction.

Analysts show repeated rejections at the $175 range in past rallies making this level highly critical. The Solana price touched this resistance earlier but failed to break through cleanly and has since hovered beneath it. Consequently, traders are now observing whether volume can push through the supply at this zone.

DEX Volume on Solana Breaks Records but Raises Concerns

Solana’s decentralized trading activity has grown rapidly in 2025, with year-to-date DEX volume surpassing $806.8 billion. This reflects nearly 400% growth compared to last year’s period, showing significant onchain interest. However, much of this volume appears artificial due to MEV bots, front-running, and wash trading.

Solana is breaking records and breaking itself.

Daily DEX volume: $2.8B+

TVL: ~$9.4B

SOL price: ~$172.88Over 29% of TVL turns over daily. No other chain comes close.

But here’s the problem:

This velocity isn’t healthy. It’s hemorrhaging value.

Solana’s 2025 DEX volume has…

— Sweep (@0xSweep) May 12, 2025

Several new platforms, such as BullX, Photon, and Pump.fun, have contributed to this rapid volume increase. Since the start of the year, these platforms have reportedly extracted over $10 billion in hidden fees from liquidity providers. As a result, real liquidity continues to exit the ecosystem, reducing its long-term health.

Although Solana maintains high activity levels, the trading ecosystem lacks safeguards to retain value within the chain. Fees collected through predatory mechanisms are not returned to the community or supporting protocols. Without structural reform, this extraction model may limit Solana’s growth and weaken user confidence.

New Protocol Glyde Aims to Retain Value in Solana

A new protocol called Glyde has entered the Solana ecosystem with a zero-fee model designed to retain all value onchain. Unlike traditional DEXs, Glyde replaces fees with licenses and returns protocol value to users through epoch-based redemption. This structure locks value as TVL instead of allowing it to leak out as revenue.

Glyde claims it does not rely on token emissions or incentives, making the protocol equity for its users. It introduces features like an artificial order book, AI-powered alerts, and slippage-free orders. By eliminating fees and front-running, Glyde aims to make Solana trading fairer and more sustainable.

This platform highlights a shift toward long-term alignment between user activity and protocol ownership in the Solana network. It may set a new standard for user-owned trading platforms across other chains. Whether Glyde’s approach changes the broader dynamics of value flow in Solana remains to be seen.