TLDR:

- Bitwise 10 Crypto Fund secures SEC approval for NYSE Arca listing.

- Bitwise’s fund expands to NYSE Arca, offering institutional crypto access.

- Bitwise moves to regulated NYSE Arca, boosting crypto market credibility.

- Bitwise Crypto Fund’s transition to NYSE Arca opens new investment paths.

- Crypto ETP market grows with Bitwise 10 Crypto Fund’s NYSE Arca debut.

The Bitwise 10 Crypto Index Fund has received approval from the U.S. Securities and Exchange Commission (SEC) to begin trading on NYSE Arca. The $1.25 billion fund will now be a regulated exchange-traded product (ETP), offering investors exposure to top cryptocurrencies. This development marks a significant step for the cryptocurrency market, positioning the fund as the second U.S.-listed multi-asset crypto index ETP.

Expansion from OTC Trading to NYSE Arca

Since its launch in 2020, the Bitwise 10 Crypto Fund operated as an over-the-counter product. With the SEC’s approval, it has transitioned to a regulated structure on NYSE Arca. This move broadens its access to financial advisors, retirement platforms, and institutional investors. These groups can now invest in the fund with the security of a regulated exchange.

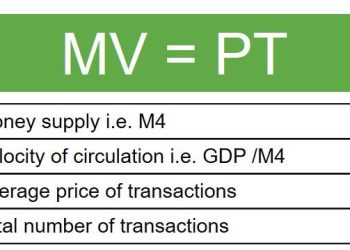

The fund tracks the 10 largest cryptocurrencies by market capitalization, including Bitcoin, Ethereum, and Solana. It uses a rules-based index methodology that incorporates liquidity and market capitalization filters. Monthly rebalancing ensures the fund remains aligned with the market’s current trends.

A New Milestone for Crypto Assets

Bitwise’s move to a regulated exchange-traded product is seen as a major milestone for the cryptocurrency asset class. “This is a watershed moment for crypto,” said Hunter Horsley, CEO of Bitwise. The approval by the SEC allows the Bitwise 10 Crypto Fund to operate under the same framework as commodity and equity-linked exchange-traded products.

The transition to NYSE Arca also brings added regulatory oversight, addressing custody, tax, and compliance concerns. This structure could increase institutional interest in crypto assets, especially for those wary of direct token exposure. The approval follows a delayed review process earlier in 2024, with the final sign-off coming on December 4, 2024.

A Growing Crypto ETP Market

The approval of the Bitwise 10 Crypto Fund follows a similar move by Grayscale earlier in 2024. Grayscale’s fund, also a multi-asset crypto ETP, was the first to receive such approval. The market for crypto ETPs is expanding rapidly, with Bitwise now offering another diversified index-based product.

The Bitwise 10 Crypto Fund provides a streamlined way for institutions and individual investors to gain exposure to the crypto market. By holding a basket of top cryptocurrencies, the fund offers a diversified approach without the need to select individual assets. This strategy is ideal for investors looking to capitalize on the crypto market’s growth without predicting future winners.

Bitwise’s uplisting to NYSE Arca signals the continued maturation of cryptocurrency as an asset class, offering regulated products that can appeal to a broader range of financial players.