Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

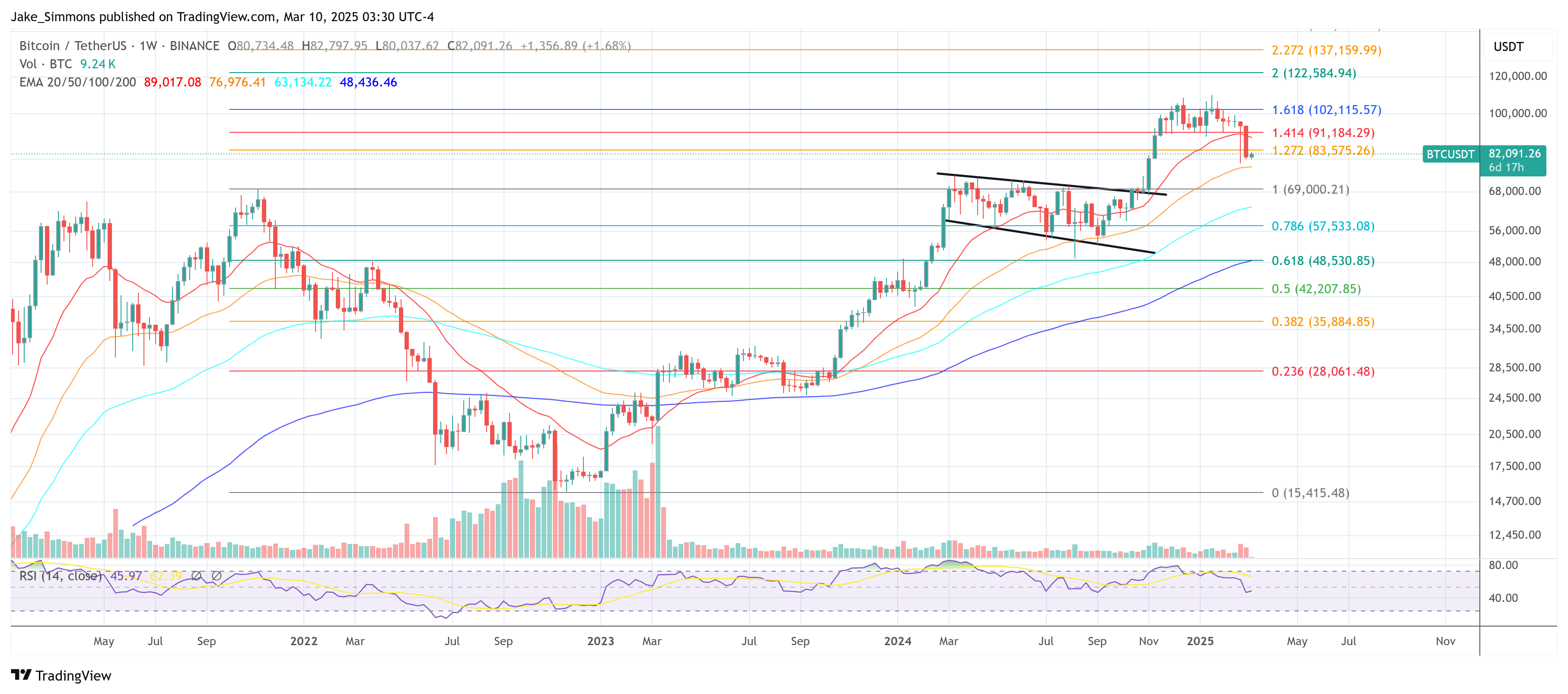

Bitcoin’s price endured another bout of volatility over the weekend, shedding 5% on Sunday to dip below the $80,000 mark, before settling near $82,000. This latest decline places the cryptocurrency roughly 25% below its all-time high of $109,900. Analysts attribute the downturn to ongoing trade tensions—linked to President Donald Trump’s latest tariff measures—and the fears of a looming recession.

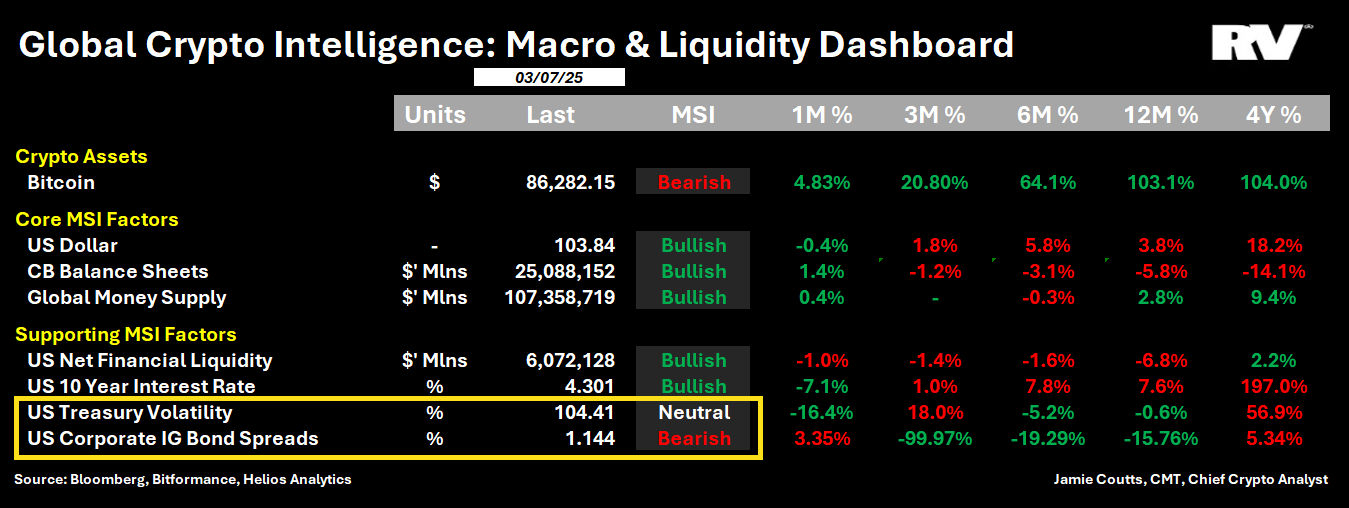

Meanwhile, a weakening US Dollar Index (DXY), which has fallen from 110 to 103 since mid-January, coinciding with Trump’s second term in office and could be a potential bullish catalyst for the Bitcoin price. In a series of posts on X, Jamie Coutts, Chief Crypto Analyst at Realvision, offers a look at the current market environment, highlighting two key metrics that could shape central bank policy—and, by extension, Bitcoin’s trajectory. “Bitcoin is like playing a game of Chicken with central banks,” Coutts writes.

Related Reading

He explained that while the dollar’s recent decline supports a bullish framework for Bitcoin, rising Treasury bond volatility (tracked by the MOVE Index) and widening corporate bond spreads are causing concern: Coutts emphasized the role of US Treasuries as the global collateral asset. Any spike in their volatility, he argued, forces lenders to impose larger haircuts on collateral, tightening liquidity. “Rising volatility forces lenders to apply haircuts on collateral, thereby tightening liquidity. […] Above 110 [on the MOVE Index] and I suspect there will be a few concerns at the central planner levels.”

Over the past three weeks, US investment-grade corporate bond spreads have been widening, a shift Coutts views as a signal that risk assets—including Bitcoin—could face pressure: “This suggests that the demand keeping yields compressed relative to Treasuries is fading—and further widening could be negative for risk assets.”

Despite these cautionary flags, Coutts remains optimistic about Bitcoin’s medium-term prospects, primarily due to the dollar’s “rapid decline.” He noted that the dollar’s drop in March—one of the most significant monthly dips in 12 years—historically has coincided with bullish inflection points in Bitcoin’s price. According to his research, “They have all occurred at Bitcoin bear market troughs (inflection points) or mid-cycle bull markets (trend continuations).”

Related Reading

While acknowledging the limited historical dataset for Bitcoin, Coutts also cited key catalysts he believes could propel the digital asset higher:

- Nation-State Adoption: “A global nation-state race is underway,” Coutts wrote, describing a scenario in which countries either include Bitcoin in their strategic reserves or ramp up mining efforts.

- Corporate Accumulation: He points to the possibility of companies—particularly Strategy (MSTR)—adding 100,000 to 200,000 BTC this year.

- ETF Positions: Exchange-traded funds may “double their positions,” further driving institutional inflows.

- Liquidity Dynamics: In Coutts’s words, “The Spice Must Flow.”

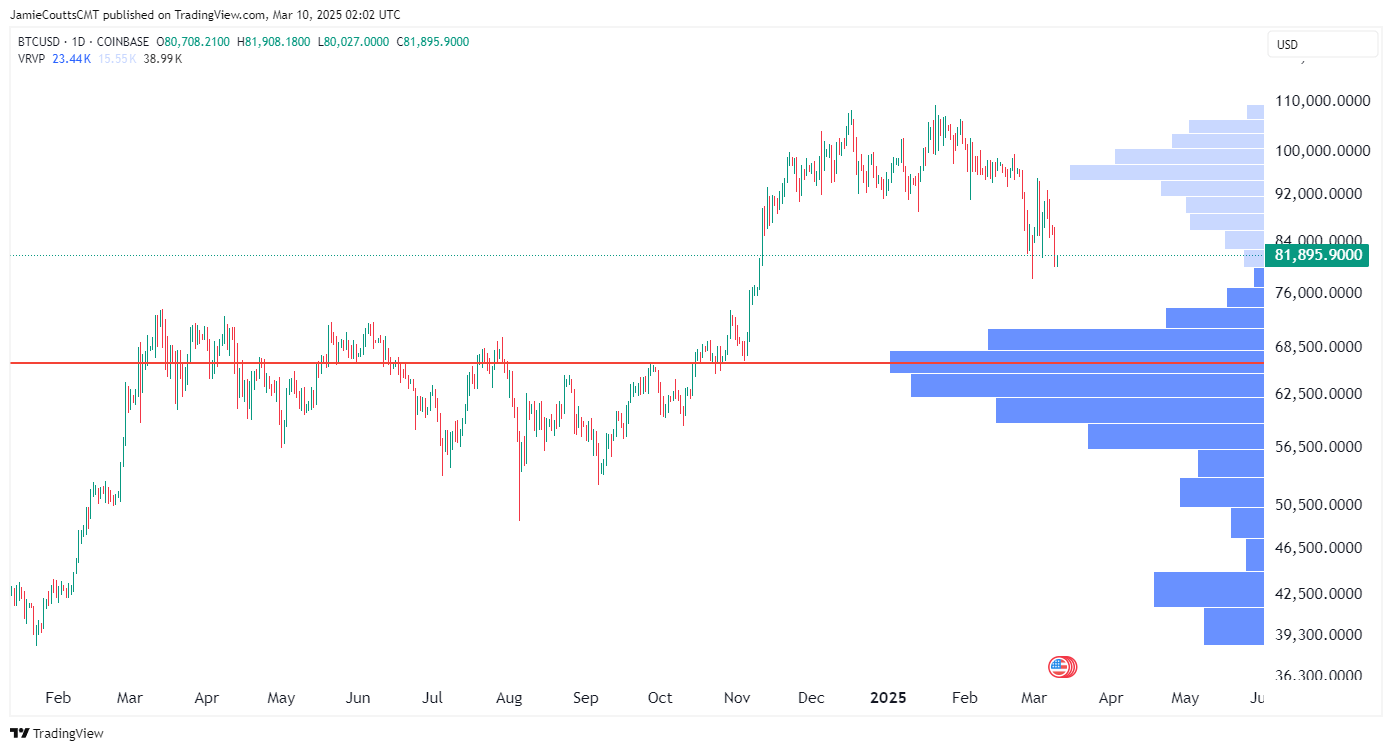

Coutts also mentioned that Bitcoin appears to be “filling a big gap” and reiterated his view that a slide below the high-$70,000 range would signal a fundamental market shift. Meanwhile, he sees central bankers edging closer to possible intervention as Treasury volatility and credit spreads climb: “If Treasury volatility and bond spreads keep rising, asset prices will continue their decline. Meanwhile, this will likely push the central planners to act.”

In closing, Coutts offered a concise summary of why he believes Bitcoin is effectively locked in a showdown with central banks: “Think of Bitcoin as a high-stakes game of chicken with the central planners. With their options dwindling—and assuming HODLers remain unleveraged—the odds are increasingly in the Bitcoin owner’s favor.”

For now, the world’s largest cryptocurrency appears to be treading a line between macroeconomic headwinds—highlighted by a volatile bond market—and the tailwinds of a weakening dollar. Whether Bitcoin continues to retreat or resumes its long-term ascent will likely depend on how global policymakers respond to mounting bond market pressures—and whether holders are prepared to keep playing “chicken” with the central planners.

At press time, BTC traded at $82,091.

Featured image created with DALL.E, chart from TradingView.com