Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The price of Bitcoin (ETH), the largest cryptocurrency, briefly fell below the do-or-die $60,000 earlier today on the Bitstamp exchange.

At 16:07 UTC, the top cryptocurrency plunged to an intraday low of $59,672 on the Bitstamp exchange.

It has since recovered to $61,764, but the largest cryptocurrency is far from reclaiming its intraday high of $64,636.

This is the first time in more than a month that the price of the crypto king has dipped below $60,000. Bitcoin crashed to $59,313 on March 5 before recovering the following day and eventually hitting its current all-time high of $73,679 on the Bitstamp exchange on March 13.

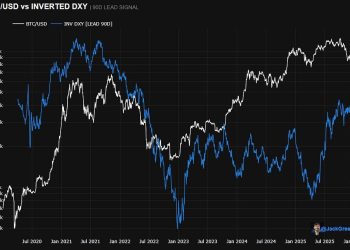

The largest cryptocurrency is suffering from the double-whammy of diminishing exchange-traded fund (ETF) inflows and increasingly hawkish rhetoric from Federal Reserve Chair Jerome Powell. On Tuesday, Bitcoin recorded another $59.3 million worth of outflows. Meanwhile, JPMorgan has predicted that the Fed will have to make a hawkish pivot due to “above-trend” GDP growth.

DonAlt, a pseudonymous cryptocurrency trader with more than half a million followers on the X social media, recently said that a “washout” below the aforementioned $60,000 level appears to be “much more attractive” as of now.

The price of Ethereum (ETH), the leading altcoin, has also dropped below the key $3,000 level before paring some losses. Dogecoin (DOGE) is the biggest laggard in the top 10, dropping roughly 2.5%, according to CoinGecko data.

Almost $214 million worth of crypto has been liquidated over the past 24 hours, according to data provided by CoinGlass.