TLDR

- Leverage in derivatives markets is driving Bitcoin’s price movements, not spot buys.

- Binance data reveals that perpetual futures volumes dominate Bitcoin’s price discovery.

- Bitcoin’s scarcity doesn’t prevent price declines when derivatives and leverage lead.

- Leveraged liquidations in Bitcoin futures are causing price drops despite growing spot bids.

The recent decline in Bitcoin prices, despite significant spot market buying activity, has sparked confusion. New Binance trading data sheds light on why Bitcoin’s value continues to slide. The analysis focuses on the impact of leveraged trading, which has become the dominant force in setting Bitcoin’s price, overshadowing the influence of spot buyers.

The Role of Leverage and Derivatives in Bitcoin’s Price Movement

Bitcoin has a fixed supply of 21 million coins, making it a scarce asset. However, the actual market for Bitcoin often trades more than 21 million coins in terms of exposure. This exposure is primarily driven by derivatives like perpetual futures, which allow traders to gain large positions with minimal capital. These markets can be much larger and more liquid than the spot market, where actual Bitcoin is traded.

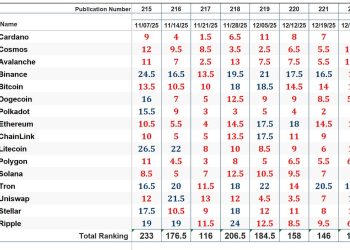

According to data from Binance, the perpetual-to-spot volume ratio has been consistently high. On February 3, this ratio reached 7.87, with perpetual futures volume hitting $23.51 billion, compared to just $2.99 billion in spot trades.

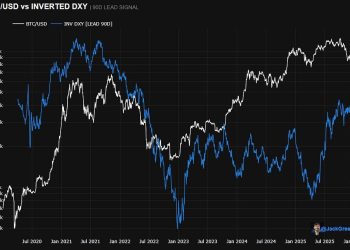

Even as Bitcoin price dropped from $75,770 to $69,700, these derivatives markets drove much of the trading action. This scenario reveals a paradox where Bitcoin, despite its limited supply, behaves like an asset with effectively unlimited exposure in the market.

The key factor in these price fluctuations is the speed and flexibility of derivatives trading. Unlike the slower spot market, where Bitcoin physically changes hands, derivatives allow for quick changes in exposure without requiring an actual transfer of Bitcoin. Leveraged positions can be easily created or closed, causing significant price swings that impact both traders and long-term holders.

Spot Buyers vs. Leveraged Traders: Who Controls Bitcoin’s Price?

Spot buyers play a crucial role in the overall demand for Bitcoin. However, data shows that the spot market’s influence on Bitcoin prices is often weaker when compared to leveraged trading in the derivatives markets. For instance, on January 31, the futures market saw a massive increase in liquidity of $297.75 million at a time when the spot market’s liquidity delta was much smaller.

Even when spot bids increase, as seen in the February 5 data with a $36.66 million spot liquidity delta, the price of Bitcoin still slid. This suggests that the marginal trade—the one that sets the next price—was determined more by the futures market than by the spot market.

The growth in perpetual futures trading, where traders can go long or short and use leverage, has meant that the actual purchase of Bitcoin in the spot market is no longer the main factor driving price movements. Instead, it is the rapid rebalancing of leveraged positions, whether through liquidations or hedging, that dictates Bitcoin’s day-to-day price changes.

The Influence of Bitcoin ETFs on Market Movements

Bitcoin Exchange-Traded Funds (ETFs) have also had an impact on the price dynamics, though not as directly as some might think. According to the data, while Bitcoin ETFs showed both inflows and outflows over the past few weeks, these movements did not always correlate directly with Bitcoin’s price. For example, on February 2, Bitcoin ETFs saw a positive flow of $561.8 million, but the price of Bitcoin still fell after this.

It’s important to understand that ETF flows are processed through authorized participants and do not always directly result in Bitcoin being bought or sold in the spot market. The process of creating and redeeming ETF shares is often done in cash, which doesn’t always translate into actual Bitcoin transactions.

Moreover, the SEC-approved in-kind creation and redemption of crypto ETFs does allow authorized participants to directly handle Bitcoin, but even then, ETF activity sits alongside the more dominant derivative markets when it comes to short-term price movements.

The Effect of Exchange Reserves on Bitcoin Liquidity

Another important factor in understanding Bitcoin’s price dynamics is the amount of Bitcoin held in exchange reserves. From January 15 to February 5, the amount of Bitcoin on exchanges increased by 29,048 BTC, or about 1.07%. While this might suggest a higher supply of Bitcoin ready to be sold, it is crucial to note that not all of this Bitcoin is immediately available for trading.

Exchange reserves serve as a proxy for the tradable float of Bitcoin. However, even if the available supply of Bitcoin rises, leveraged positions in derivatives can still dominate price movement. As Binance’s data shows, the growth in reserves does not necessarily lead to a price increase in the spot market.

This data reflects the complexity of Bitcoin’s market structure, where the concept of scarcity doesn’t guarantee price stability. The speed of derivatives trading and leveraged positions often outweigh the effects of spot market buying, leading to continued price declines despite seemingly strong demand.