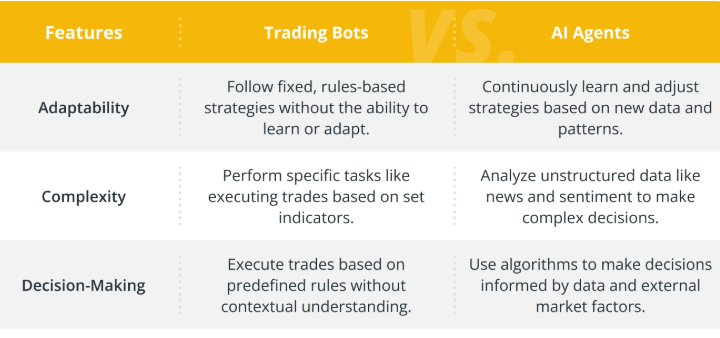

Until now, trading bots were the best tool for making money while you sleep. Recently, AI agents are entering the game, promising smarter trades, better predictions, and more profits.

So, do you need to ditch trading bots and go all-in on AI? Not so fast. Both tools can make you money, but they work in very different ways. This guide breaks it all down: how they work, what they’re good for, and how to use them to maximize your profits.

In 2025, memecoins are still booming. The market hit $100 billion, and new tokens pop up daily. But trading them is tricky. Prices move fast, hype disappears overnight, and rug pulls happen all the time. That’s why automation is key.

- Trading bots help you enter and exit trades at the right time, no emotions, no hesitation.

- AI agents scan social media, news, and on-chain data to predict which coins will pump.

If you’re trading memecoins, using the right automation tool can mean the difference between cashing out early or holding a bag of worthless tokens.

How They Work

A trading bot uses predefined rules to decide when to buy or sell. You might set up conditions like:

- “Buy if the price drops 5% within 30 minutes.”

- “Sell if the coin pumps 20% in one hour.”

- “Use a trailing stop-loss if the price rises above a certain threshold.”

The bot just follows the script. It doesn’t care about FUD (fear, uncertainty, and doubt), FOMO (fear of missing out), or random tweets from crypto influencers.

My Bot Setup Strategy

When I use trading bots for memecoins, I usually keep the rules pretty simple. If you overcomplicate things, you risk missing opportunities because the conditions might never be “perfect.” I also like to:

Diversify: Don’t put all your funds into one memecoin strategy. Use multiple bots on different coins.

Start Small: Always test a new bot strategy with a small amount of capital.

Tweak Gradually: Adjust the parameters after you see how the bot behaves in live conditions.

Pros & Cons of Trading Bots

✅ Fast execution — No delays, no hesitation. They enter and exit trades instantly.

✅ 24/7 trading — Crypto never sleeps, and neither do bots.

✅ No emotions — Unlike humans, bots don’t panic-sell or FOMO in.

❌ No adaptability — They follow fixed rules and can’t adjust to market surprises.

❌ Risk of bad settings — If a bot is poorly configured, it can lose money.

All these bots can execute trades way faster than a human, giving you an edge in volatile markets.

How They Work

Unlike bots that operate on fixed rules, AI agents adapt. They analyze tons of data — historical price charts, social media chatter, news events, and on-chain activity. Think of it like this:

- Sentiment Analysis: Scouring Twitter, Reddit, or Telegram to see if a memecoin is getting hype.

- On-Chain Detection: Spotting whale movements or unusual wallet transfers.

- Adaptive Rules: Tweaking risk levels and stop-losses based on real-time volatility.

When I first switched to using AI agents, I was shocked by how many different data points they consider. It’s not foolproof, but it definitely gives you deeper insights than a simple bot strategy.

Data Is Everything

For AI agents, data quality is critical. If the data sources are wrong or delayed, your AI’s predictions are useless. That’s why I always check the reliability of the feeds and social media analytics I use. Some AI trading platforms have direct partnerships with big data providers, which can give you an edge.

Pros & Cons of AI Agents

✅ Adapts to market changes — Learns from new data and adjusts strategies.

✅ Predicts trends — Uses sentiment analysis and historical data.

✅ Better risk management — Can adjust stop-loss and position sizes dynamically.

❌ Needs quality data — If the data is bad, predictions are bad.

3Commas — A powerful AI-driven trading platform offering automated bots, portfolio management, and smart trading tools. Ideal for advanced traders seeking AI-enhanced strategies and risk management.

Cryptohopper — A cloud-based automated trading bot with AI-powered analysis, customizable strategies, and marketplace signals. Great for traders looking for an all-in-one automated solution.

TradeSanta — A user-friendly crypto trading bot with AI-assisted tools, grid and DCA strategies, and quick setup. Best for beginners and traders who prefer simple automation.

AI agents are great for traders who want more than just automation — they want intelligent decision-making.

When to Use Trading Bots

- If you need speed (sniping memecoins, executing scalps).

- If you trade simple strategies (like arbitrage or market-making).

- If you don’t want to analyze data– just set the bot and let it trade.

When to Use AI Agents

- If you want advanced strategy and adaptive risk management.

- If you trade volatile assets and need better prediction tools.

- If you want AI to analyze social media sentiment before making moves.

- If you trade short-term and need fast execution, go with a trading bot.

- If you focus on long-term trends and market predictions, an AI agent is better.

- If you trade both ways, you might benefit from combining both.

The right tool depends on how you trade:

Pro Tip: Many traders set up AI agents to scan the market and identify trade opportunities, then use bots to execute the trades instantly. This way, you get speed + intelligence, making your strategy more profitable.

LAUNCH AI AGENTS

START TRADING BOTS

Trojan On Solana

Ton Trading Bot

Sui Sniper Bot

XRP Sniper Bot

Unibot

You get the best results when you use the right tool for the right job. Sometimes, a simple trading bot is enough. Other times, you need AI agents to make smarter moves. Here are three real-life strategies that show when to use each one.

1. Sniping New Memecoins — Speed Wins

🔹 The Setup: You see a new memecoin launching in 10 minutes. You know that the first buyers often get the best prices before hype kicks in.

🔹 The Strategy: Use a sniper trading bot like Trojan On Solana or Sui Sniper Bot to place a buy order instantly when liquidity is added. These bots execute way faster than human hands.

🔹 Why Bots Work Here: AI agents don’t help much in a launch scenario because there’s no historical data to analyze. But a bot can execute your buy order in milliseconds. After a quick pump, set a sell order to take profits before the hype dies down.

📌 Tip: Some bots have anti-rug features that auto-detect shady contracts before buying. Always use them to avoid getting scammed.

2. Riding the Hype Wave — AI Detects Trends Early

🔹 The Setup: A celebrity just tweeted about a memecoin, and the price is starting to move. You want to catch the uptrend early before everyone FOMOs in.

🔹 The Strategy: Use an AI agent like 3Commas or Cryptohopper to scan social media and on-chain data. The AI will track how much engagement the tweet is getting, whether whales are buying, and if liquidity is increasing.

🔹 Why AI Works Here: A bot alone can’t tell if a tweet is just noise or a real pump signal. AI agents analyze sentiment and trading volume in real-time and give you a more informed decision. If everything lines up, you can then use a bot to execute the buy instantly.

📌 Tip: AI doesn’t always get it right, so don’t blindly trust its predictions. But when an AI agent and bot work together, you get both intelligence and execution speed.

3. Avoiding Market Crashes — AI for Risk Management

🔹 The Setup: You’re holding multiple altcoins, and the market suddenly turns red. You need to decide whether to sell or hold.

🔹 The Strategy: Instead of panic-selling, use an AI agent with adaptive stop-loss rules. Platforms like TradeSanta adjust your stop-loss based on real-time volatility. If it detects a flash crash, it exits the trade early to minimize losses.

🔹 Why AI Works Here: A bot with a fixed stop-loss might not react fast enough to save your profits. AI, on the other hand, can detect news events, whale sell-offs, and liquidity drops to adjust your position dynamically.

📌 Tip: If you don’t want AI making automatic decisions, you can set alerts instead. When AI spots danger, you get a notification and decide if you want to sell.

1. Are AI agents replacing trading bots in crypto?

No. They do different tasks. AI agents are about predictions and adapting to new data, while trading bots follow fixed rules and execute them quickly. Often, you can use both together.

2. Can a beginner trader use AI-powered trading strategies?

Yes, but it might be complicated. AI trading needs good data sets and correct settings. If you just started, it might be easier with a simple bot first, then move to AI later.

3. Do AI crypto trading agents guarantee bigger profits than bots?

No tool can guarantee you profits. AI agents help with advanced analysis, but results still depend on market conditions and your setups.

4. What is the best trading bot for automated crypto trading in 2025?

It depends on what you want to do. If you want multi-chain coverage, Unibot is good. If you want Solana sniping, Trojan On Solana might be better. They all have different strengths.

- If you need quick, simple trades, use a bot.

- If you want to adapt to changing market conditions, AI might be better.

- Many people use both for extra advantage.

5. How do I decide to use a trading bot or AI agent?

Look at your strategy:

6. Are AI-powered crypto bots better for long-term investing?

They can be good because AI can track big-picture trends. But it is not always perfect. Make sure to check results and adjust if market changes.

7. Can AI crypto trading bots react to market news and social media trends?

Yes, that’s one of their main benefits. They can scan social media, read news feeds, and detect big changes in sentiment or hype about a coin.

8. What’s the safest way to start using automated crypto-trading tools?

Try them with a small amount. Test different strategies. Check reviews to make sure you’re not using a scam. And always do your own research.

9. Is AI trading legal, and do I need a license to use AI bots?

In most places, it is legal. You usually don’t need a special license, but be aware of local regulations. If you handle large amounts or do advanced stuff, always check local laws.

10. Do I need to keep my computer running 24/7 to use these tools?

Not all the time. Many bots and AI agents run on cloud servers, so they keep trading even if your computer is off. Just make sure you set everything up properly.