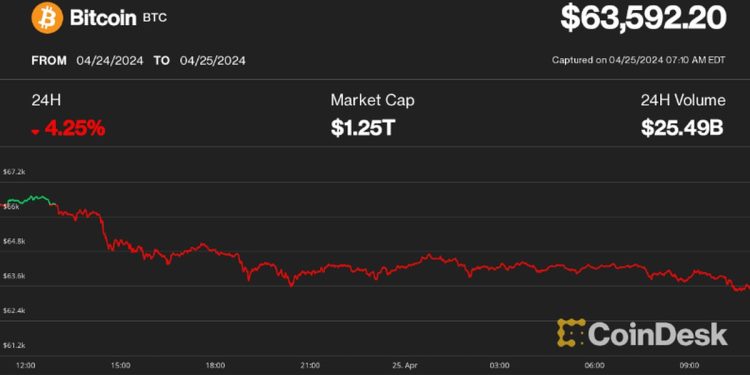

BlackRock’s spot bitcoin exchange-traded fund (ETF), which trades under the ticker IBIT on Nasdaq, fell out of favor on Wednesday, preliminary data published by Farside Investors showed. For the first time since going live on Jan. 11, the fund did not draw any investor money, snapping a 71-day inflows streak. Seven of the other 10 funds followed IBIT’s lead. Fidelity’s FBTC and the ARK 21Shares Bitcoin ETF (ARKB) registered inflows of $5.6 million and $4.2 million, respectively, while Grayscale’s GBTC bled $130.4 million, leading to a net cumulative outflow of $120.6 million, the highest since April 17.

Why machine-to-machine payments are the new electricity for the digital age

We are moving toward an economic system in which software and devices transact with one another without human involvement.Instead of...