Coinbase believes it “can bring billions of users to DeFi by making it easy to use” while Valkyrie launches a $100 million “On-Chain DeFi Fund.”

On Monday, San Francisco-based investment firm Paradigm announced that it is starting a $2.5 billion venture capital fund aimed at the “next generation of crypto companies and protocols.”

Coinbase co-founder Fred Ersham co-founded Paradigm with former Sequoia Capital partner Matt Huang which would be the largest new VC fund aimed at the industry, according to the Finance Times.

Launched during the bear market of 2018, the firm’s fundraising outruns VC giant Andreessen Horowitz’s (a16z) $2.2 billion fund earlier in 2021.

There has been a record-breaking venture capital raising activity this year, highlighting a continuing boom in the crypto industry.

“This new fund and its size are reflective of crypto being the most exciting frontier in technology. Over the past decade, crypto has come a long way,” Ersham and Huang wrote in a blog post on Monday.

The crypto investment of Paradigm involves both big and small, as much as $100 million-plus or as little as $1 million, and intends to continue to invest in startups with “just a glimmer of an idea” as well as later-stage companies.

Zeroing in on DeFi

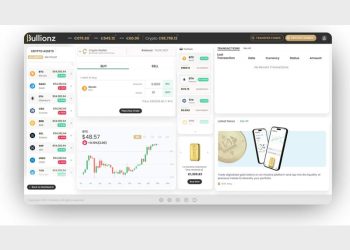

Crypto asset manager Valkyrie Investments is also launching a $100 million decentralized finance (DeFi) fund next week. The fund is designed to give investors easy and safe exposure to the rapidly growing industry.

Last month, Valkyrie received approval from the US Securities and Exchange Commission (SEC) to launch a Bitcoin exchange-traded fund (ETF) which would start trading on Tuesday.

Now, it is launching the “On-Chain DeFi Fund,” which is going live on Nov. 22 and targets accredited investors in the US and the majority of international countries. The Fund holds its assets on-chain, unlike Galaxy Digital’s recently launched DeFi tracker fund, which is managed passively.

This Fund will allow Valkyrie to participate in the upside of DeFi while gaining additional yield from lending, liquidity pools, farming, and staking in the DeFi ecosystem.

“We get the appreciation plus the compounded yield generated from on-chain DeFi participation,” Valkyrie’s Managing Director of DeFi, Wes Cowan, said in an interview.

The Fund will invest in most of the major DeFi protocols, including Ethereum, Solana, Avalanche, Binance Smart Chain, Fantom, and Matic.

When assessing the risk associated with DeFi investing, the firm’s investment counsel works to determine what percentage of the portfolio should be in stablecoins, which are also deployed on-chain to generate yield.

Stablecoin lending yields more than twice as much as US junk bonds and almost 150 times as much as the average US savings account.

No wonder why the cryptocurrency lending industry is growing at such a staggering rate.

From our weekly market report: https://t.co/tj905wIDuo pic.twitter.com/ScDzIAFdVj

— Arcane Research (@ArcaneResearch) November 13, 2021

Cryptocurrency exchange Coinbase is also interested in DeFi and has divided its overall strategy into three “pillars” where the third one is about “crypto as an app platform” focusing on allowing users access to applications.

“We plan eventually to service third-party apps inside our main product and so that we’re going to be agnostic between a customer choosing a Coinbase product or a third-party DeFi product. We want to introduce and find the best product for our customers,” said CFO Alesia Haas while speaking at the fintech-focused event hosted by Citi.

As an app platform, the company will help DeFi in two ways — building tools to accelerate the builders in the ecosystem through Coinbase Cloud, an opportunity it expects to be large in the future as more companies want to offer crypto services to their customers, and helping with the distribution where it acts as a “bridge to DeFi.”

Coinbase believes it “can bring billions of users to DeFi by making it easy to use,” and both the exchange and DeFi “can and will successfully grow and coexist,” Hass said.