JPMorgan says $100k Is A “Reasonable” Bitcoin Price Target For 2022, But Won’t Recommend It As An Alternative Asset

While forecasting digital assets to outpace real estate’s gains and doubling the expected return for hedge funds, the banking giant says crypto’s wild swings diminish their appeal.

JPMorgan Chase strategists advise investors to put their cash in hedge funds and real estate because traditional assets like bonds, stocks, and cryptocurrencies will underperform next year.

Alternative assets, including digital currencies, private debt, and private equity, “should continue to outperform into 2022,” the strategists, including Nikolaos Panigirtzoglou, wrote.

They predict these assets will return 11% next year, doubling the 5% gain from fixed income and stocks. As for crypto, it may advance, but they could be too bumpy to recommend it as a core holding, they said.

So basically secular deflation ppl dumped their stocks + crypto after realizing inflation is real, only to realize that inflation is bullish for stocks + crypto anyway?

— Zhu Su 🔺 (@zhusu) November 3, 2021

These recommendations were part of the bank’s inaugural outlook focused on alternative investments. The bank estimates this category of assets to be worth $25 trillion, double the 2014 level.

While many of these vehicles aren’t easily accessible and can be hard to exit due to liquidity constraints, JPMorgan sees them as an opportunity to boost its performance.

“Unlike traditional asset classes, establishing positions and exiting them in size is less straightforward.”

“It is thus more suited to those institutional investors wishing to allocate new cash flows into alternatives, rather than institutional investors thinking about their strategic/long-term allocations to alternatives.”

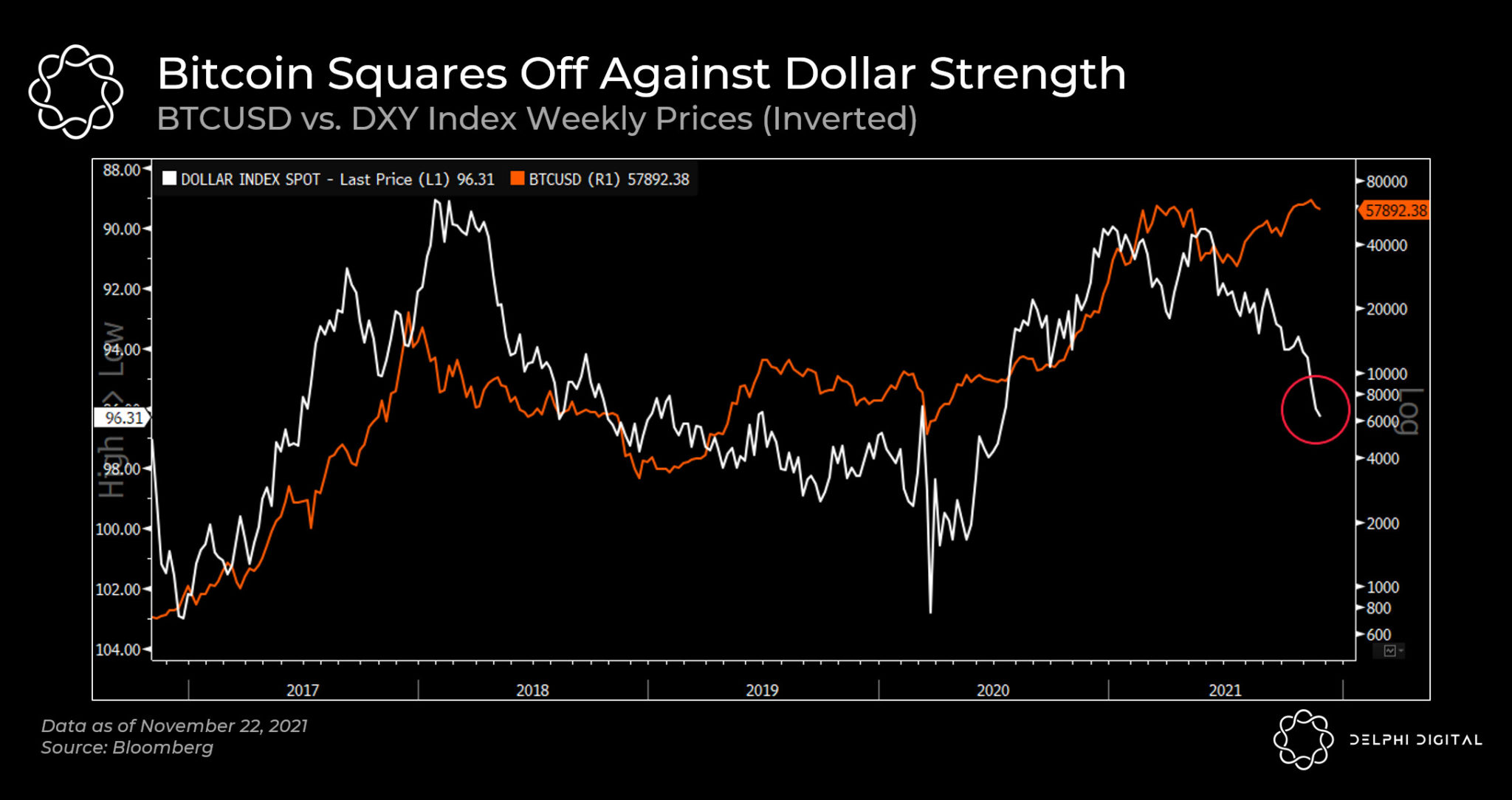

While JPMorgan is not recommending cryptocurrencies, the market cap of crypto has surged 2,211% from March 2020 low and more than 270% this year, so far, now targeting $3 trillion. According to the banking giant, digital currencies and real estate surged this year due to investors seeking shelter from inflation.

Treasuries are currently heading for their first annual loss since 2013. This week, US Treasury yields fell slightly ahead of the Federal Reserve’s two-day meeting concluding on Wednesday. Today, the FOMC meeting will be followed by a press conference, in which Chairman Jerome Powell will be giving details on their monetary policy.

As market watchers expect equity to slow down in 2022 after the S&P 500’s 20% rally this year and once the central bank announces tapering and raises interest rates, JPMorgan sees hedge funds shining during this time.

Industrial and residential properties are also expected to gain from the economy’s expansion at an above-trend pace.

Large investors, those who have held at least 1,000 #bitcoin, now hold more bitcoin than they ever have done in 2021.

h/t @chainalysis pic.twitter.com/eaZVaNNjhG

— unfolded. (@cryptounfolded) November 2, 2021

The bank forecasts digital assets to climb 15% next year, outpacing 12.5% gain from real estate and doubling the expected return for hedge funds, but JPMorgan’s outlook says crypto’s wild swings diminish their appeal.

Pointing to Bitcoin, the strategist put its fair value at around $35,000, and should the relative volatility get halved next year, then a price target of $73,000 “seems reasonable.”

“This challenges the idea that a price target of $100k or above, which appears to be the current consensus for 2022, is a sustainable bitcoin target in the absence of a significant decline in bitcoin volatility.”

“Digital assets are on a multiyear structural ascent, but the current entry point looks unattractive.”