DAILY CONQUEST ISSUE #078

Actionable insight for today’s fast-moving crypto markets.

The crypto market is a wild, wondrous and intimidating place; don’t trek alone! Subscribe to The Crypto Conquistador, and let us be your guide.

Subscribe to this daily newsletter TO NEVER MISS AN ISSUE.

Overview

- Which protocols benefit from the Merge?

- Crypto Market rebounds after a shaky Monday.

- Frax Finance introduces Frax Lend.

- BNB blockchain looks towards zk-rollups.

- GameStop partners with FTX.US.

- Why are protocols creating their native stablecoin?

Good morning Fam,

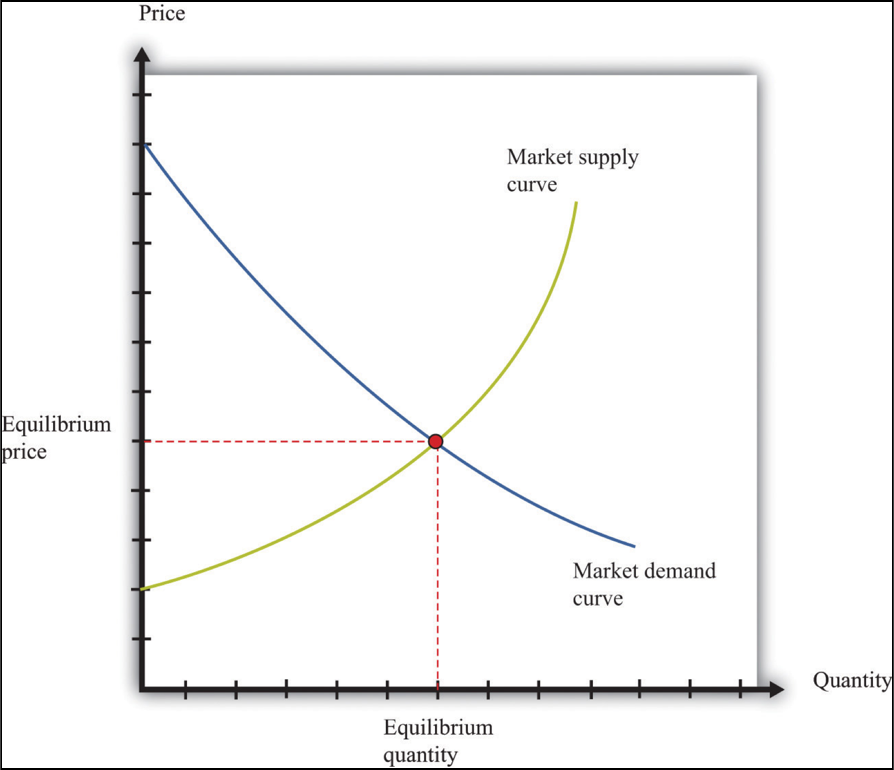

With a successful Merge, Ethereum’s upgrade will reduce supply issuance by ~90%. Economic principles state that if the demand for Ethereum remains constant and the supply facet shuts off, the ETH price is sure to increase.

Increased economic activity on-chain

will follow increased prices.

So to benefit from this possibility, I’ve correlated a list of projects that will benefit long-term from a successful Merge.

If you’re bullish on the Merge, then these are some protocols you may want to explore to stay ahead of the crowd:

Ethereum Staking services

If The Merge is successful, it will create a large demand for Ethereum staking services. With a high staking APY between 8–12%, you can bet these staking providers will benefit:

Ethereum based-DeFi

The first stop for blockchain users is typically DeFi. These OG protocols have been developing despite the bear market. However, it would be a mistake to focus on token price only. Increased total-value-locked (TVL) and increased user metrics will confirm if the thesis is correct.

Layer-two (L2) Protocols

When activity on Ethereum increases, so will its native gas price. High gas prices will force many users into L2 ecosystems in search of cheaper transactions.

Want to transact cheaply on Ethereum? Layer-twos are your answer. The subsequent iterations of Ethereum are fast, cheap, and easy-to-use L2 blockchains that encompass the security of the mother chain.

Layer-two DeFi of DeFi 2.0

When new liquidity begins to enter L2s, the first stop will be DeFi. Many of the same Ethereum protocols above are on the L2 blockchains (Uniswap, Sushiswap, Curve, Aave). Although, there are also strictly native L2 DeFi protocols. Below are some of the more popular ones:

Now, the effects of the Merge could take months to transpire, similar to Bitcoin’s halvings. So don’t expect prices to skyrocket on Sept 15. Some people have predicted that the ETH price might experience a “buy the rumor, sell the news” event immediately after the Merge. The point is no one truly knows in the short term.

But long term, if bitcoin halvings are an indication of price movements after large supply shocks, the Ethereum Merge will allegedly be one of the most fundamentally bullish events in crypto history.

BTC/USDT

After experiencing the lowest daily candle close of the year on Monday, Bitcoin recovered some of its lost ground. The bulls and bears are battling at the $19k support level showcased by high volume. The next couple of days will determine if BTC reaches new lows or if the bulls prevail to hold this crucial support. BTC completed the daily candle up +2.67% to $19,292.

High-resolution chart

NDAQ/USD 1D

The Nasdaq ignored bearish sentiment surrounding the Fed’s Brainard’s hawkish comments to climb +2.47% yesterday, the highest rally since Jul 28. Nasdaq, which follows the tech sector in US equalities, continues to be closely correlated with crypto. Today was no exception. NDAQ closed the day at 62.42.

High-resolution chart

Light Crude Oil Futures 1D

Oil futures broke below $85, a significant support level yesterday. One of the major contributing factors to inflation was high oil prices which appear to be in a downtrend. Could the lower oil price forecast a lower inflation CPI print this month? A lower CPI would be bullish for equities and crypto alike.

High-resolution chart

If you’re enjoying this report and think it’s worth 20 sats (.01 cent), please press the clap button below to help support my writing. (Up to 50 times!) THANKS!

Voyager’s liquidation auction. The crypto exchange/lender Voyager plans to liquidate assets via an auction on Sept 13 while it proceeds through its chapter 11 bankruptcy. FTX and Binance, who showed interest in acquiring Voyager assets, are speculated to be part of the auction process. The courts finalized the bidders on Sept 6. According to Voyager’s tweet, the firm will update after the Sept 13 auction.

BNB embraces zero-knowledge (ZK) rollups. Binance announces plans to upgrade its BNB blockchain through the use of ZK-rollups. The upgrade, planned for early next year, increases the throughput of the BNB to allow for 5,000–10,000 transactions per second. Additionally, the update will advance scalability, finality speed, and increase security.

Nexo Pro. Cryptocurrency exchange Nexo introduces an upgraded trading platform, Nexo Pro, with spot, futures, and margin trading for retail clients.

Curve’s stablecoin. Developers for Curve Protocol have uploaded code for an overcollateralized stablecoin onto its Github account. Following a recent announcement, many speculate the protocol will introduce the crvUSD stablecoin soon.

Frax Finance enables borrowing and lending. Stablecoin project Frax Finance introduces its native borrowing and lending network, Fraxlend, which grants users the ability to mint the FRAX stablecoin through borrowing and lending. Users can then earn interest with FRAX.

News Tidbits:

- Binance introduces 6% high-yield Ethereum staking ahead of the Merge.

- Crypto Miner Bitdeer delays $4B SPAC deal again.

- Swan Bitcoin introduces Swan Advisor services, a bitcoin purchasing platform for financial advisors.

Gamestop partners with FTX. Meme-stock and video game firm GameStop is partnering with crypto exchange FTX.US to introduce more customers to crypto and collaborate in marketing promotions. Additionally, Gamestop will begin carrying FTX gift cards.

NBA and Sorare developing fantasy games. Sorare and the National Basketball Association (NBA) have teamed up to create an NFT-based fantasy basketball game. Customers can sign up early for the chance to win NBA tickets.

The stablecoin race.

Two of the most prominent DeFi protocols, Aave (GHO) and Curve (crvUSD), have announced a move into creating native stablecoins. In addition, Binance announced two days ago it would stop using USDC on its exchange and opted for its native BUSD.

So what gives? Why do protocols and exchanges want a native stablecoin?

The simple answer is liquidity. It’s one of the most important aspects of any financial service. There must be a pool of money to help facilitate transactions. Low liquidity issues lead to a myriad of financial problems.

The efficiency of minting a native stablecoin allows improved control of liquidity across their network and comes with the additional benefit of being another source of revenue.

Simply put, everything becomes more efficient, and that’s half the battle in finance.

Gabriel M.

Follow me on Twitter for daily updates!

Subscribe to this daily newsletter TO NEVER MISS AN ISSUE.