In traditional markets or TraFi (Traditional Finance i.e. stock exchange), a 20% drop in prices of an equity indicates a bear market. This is then followed by a negative investor sentiment and declining economic prospects. They are also considered cyclical, meaning that when market sentiment reverses, the prices can go up again. Based on those observations, should we consider the cryptocurrency market led by Bitcoin (BTC) to be in a bear market in early 2022?

Bitcoin has fallen nearly 45% from its all-time high of $68,789.63 back on November 10, 2021. The cryptocurrency market as a whole has also fallen below $2 Trillion at the start of 2022, with Bitcoin market dominance at 41%. Since it has fallen by more than 20% of its ATH price, TraFi would view this as a bear market. Another bearish sign is that Bitcoin Fear and Greed Index has fallen below 20 (extreme fear) at the start of 2022. This occurred after FUD (Fear, Uncertainty, Doubt) of full cryptocurrency ban in China, ETF application rejection by the SEC (US), and the US Federal Reserves plan for hiking interest rates.

Despite the news, Bitcoin is actually still a good investment. If you had invested early on, when Bitcoin was first listed on exchanges, you would have an ROI of 28,377.27% (BTC price at $38,417.83). The volatility is what makes BTC unstable to traditional investors, but that is also where plenty of the gains are coming from. Despite volatile swings that can be more than 40% to the downside, Bitcoin can just as quickly increase in a small amount of time. Sometimes it is 5% or 10% increase in a single day. From October 28 to November 10 in 2021, BTC jumped in price from $58,206.92 to $68,789.63. That would be an 18.18% increase in a span of 2 weeks.

While some would analyze falling demand for Bitcoin during the downside, it is not entirely the case since Bitcoin tends to rebound and surge even further higher. Looking back in time from the last 13 years since its inception, Bitcoin is trending with higher highs and higher lows after each 4-year halving cycle. At the end of 2017 Bitcoin was valued at just under $19K. On a recent episode of Anthony Pompliano Best Business Show (Feb. 2, 2022), the CAGR of Bitcoin in the past 10 years was 140.80%. That is far better than other assets like gold (0.39%) and the S&P 500 (12.93%).

Looking at current prices still shows how far Bitcoin has gone, and everyone who got in when Bitcoin was $7K+ in early 2020 would be in profit. Bitcoin’s volatility is dictated by market forces, despite manipulation by whales or emotional trading during FUD. As Bitcoin reaches a market valuation of hard assets like gold (est. $10–12 Trillion), it is expected to become less volatile. This makes it an even more attractive choice for a store of value or hedge against inflation.

What you are really investing in when it comes to Bitcoin is the technology to store, transfer and secure money. As a digital asset, it has a multi-purpose utility that makes it more than just currency for payments. It can be used directly like a messaging app with another user, without an intermediary to process a transaction. This provides more financial freedom without requiring a trusted third party.

Further signs of bullishness can be seen more from on-chain analytics rather than from traditional TA (Technical Analysis). TA can be a good indicator for short-term price analysis, but for long-term projections, the on-chain analysis presents a different story (from the blockchain perspective). On-chain indicators like the number of Bitcoins in custody outside of exchanges give an idea of how illiquid Bitcoin’s supply is becoming. In 2021, analysts like Willy Woo and Will Clemente have noticed the increasing amount of Bitcoins moving out of exchanges and into personal wallets. This creates a supply crunch as less BTC are available for selling. Many miners have also held onto new BTC, keeping them as reserves rather than immediately selling them.

Another telling sign is that the Bitcoin hash rate has continued to go up, even after the China ban on Bitcoin mining. That shows that the Bitcoin network is stronger than ever. The network effect is increasing the value of Bitcoin to its users, as a higher hash rate means more activity. Bitcoin has even surpassed PayPal in transaction volume in 2021, $489 Billion per quarter on average versus $302 Billion. The number of Bitcoin wallet addresses has also increased to 200 million, with at least 106 million addresses owning BTC. A growing community can continue the growth of Bitcoin on a logarithmic scale in the long term, and provide support from falling to lower price levels.

Another bullish sign, from a macro perspective is the upcoming transfer of wealth from boomers to millennials and GenZ. This has been valued at $68 Trillion to the next generation, perhaps what will be the greatest wealth transfer in history. The significance here is that millennials and GenZ are more likely to invest their money in cryptocurrency rather than the stock market or hard assets like gold. According to a CNBC millennial millionaires survey, out of 750 investors, close to half (47% of respondents) have invested in cryptocurrencies like Bitcoin.

Continued onramps to onboard users to Bitcoin are growing. NYDIG is working with banks to allow Bitcoin purchase or custody. Even banks like JP Morgan and Morgan Stanley have allowed customers exposure to Bitcoin via certain investment funds. Fintechs like Robinhood, Block (formerly Square), PayPal, EToro, Coinbase and Binance are providing retail users access to purchase, sell and trade Bitcoin. The apps simplify how users can get access to Bitcoin, to build a digital asset portfolio.

There is also growing institutional investment in Bitcoin. Following ARK Invest, Fidelity and Grayscale are MicroStrategy and Tesla. Institutions bring more liquidity and capital into the market for long term holdings, rather than for speculative trading. With more institutions comes more capital to sustain growth and liquidity of Bitcoin, making it a more viable investment. Institutions are also continuing efforts to push for Bitcoin spot ETFs for SEC approval in the US, while Canada and Brazil have already passed spot ETFs.

While China has continued its strict banning policies on cryptocurrency, other countries have opened up. One of the biggest news of 2021 was El Salvador’s adoption of Bitcoin as legal tender. India has also decided on regulating cryptocurrency rather than a total ban. Thailand has decided to not apply a 15% tax on Bitcoin use. Russia’s Ministry of Finance has proposed not to ban Bitcoin (and crypto) despite recommendations by their Central Bank and instead explore regulation and mining. More regulatory clarity can bring Bitcoin to the mainstream fold of traditional finance allowing for more users to enter the market..

Bitcoin adoption continues to grow. Certain athletes and even politicians now accept Bitcoin as payment for salary or endorsements. A town in Arkansas is offering $10,000 dollars in BTC to anyone who wants to move there. A Missouri town mayor wants to give $1,000 in BTC to all its residents. Payment processor Strike has integrated Bitcoin payments to their app using the LN (Lightning Network). Strike allows Bitcoin payments in countries like El Salvador and Argentina, where there is a large remittance market from overseas residents. Finally, in adoption news, the growth in Bitcoin ATMs is also providing a new onramp to users. This helps to serve the unbanked and those who cannot participate in the current financial system.

There is perhaps one reason to remain bullish on Bitcoin, and that has to do with the fundamentals. Remember that it has a finite supply of 21 million coins.

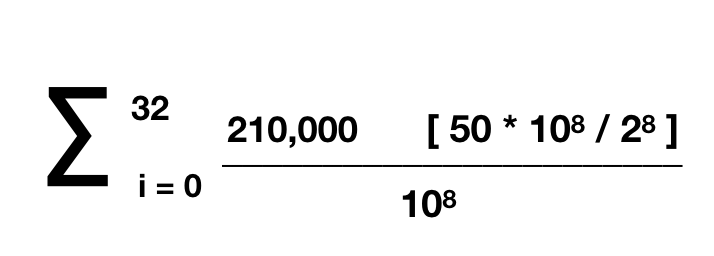

As expressed by the formula:

A currency that has a finite supply that has been hardcoded, and cannot be changed or modified, unless with the consensus of the community. As a disinflationary measure, the supply of BTC decreases geometrically with a 50% block subsidy reduction every 210,000 blocks (approximately every 4 years).

According to theory, a decreasing-supply algorithm was chosen for approximating the rate at which gold is mined. Over 90% of the supply has been circulated to date. It is the digital scarcity that Bitcoin creates that gives it a long-term bullish prospect. It is even more scarce than gold since you can never fix gold’s supply if you can find a new place to mine it.

For Bitcoin to remain on a bullish trend in 2022, the positive outlook would suggest that it will follow an extended cycle. Perhaps Bitcoin will no longer have a 4-year cycle, but instead a “supercycle,” which means that the price will continue moving upwards, so long as it is relevant. Skeptics would call this a bubble that is ready to burst and bring Bitcoin down to zero. The addressable market of Bitcoin is around $100 Trillion, so this, in theory, is a long stretch for a bubble.

Looking at TA, Bitcoin MACD has crossed below zero toward the end of January 2022, indicating a bullish-to-bearish trend. This can invalidate the bullish indication of a Bitcoin supercycle or any further bull runs in the short term. This can further break support since it is a sell signal among traders, if not investors. A good level to hold would be at above $30K, and for the 50 MA to cross back above the 200 MA to a level above $40K to indicate in TA terms that the bulls are still in charge.

On the other hand, on-chain analytics data shows that Bitcoin is stronger than ever before. Higher hash rates, illiquid supply, and accumulation by miners can lead to higher demand. The amount of BTC in circulation can never exceed its finite supply, so this makes it more valuable. Other than on-chain analytics, the growing community of BItcoin users and projects that add value to the network can keep the bullish momentum moving forward. There are also the strong fundamentals of Bitcoin in theory, which remain consistent, but it has to meet the price value.

With the US Federal Reserves planning on tapering (beginning in March 2022) or raising interest rates to counter inflation, the outlook for the traditional markets is not so good. Investors are selling off crypto like they were tech stocks, which are risk assets to higher interest rates. The question is if Bitcoin and the cryptocurrency market will follow in correlation to the Nasdaq and S&P 500, etc. Regulatory announcements may also play a part, as the US government prepares executive orders on cryptocurrency. Bitcoin was already tested back in 2020 during the market crash at the start of the COVID pandemic. At least we know that Bitcoin did not crash to zero but instead rallied to take its price value above $30K by 2021.

Disclaimer: This is not financial advice. The information provided is for reference and educational purposes only. DYOR always to verify any information.