TL;DR

- Warren asks agencies to confirm no taxpayer funds will support Bitcoin.

- Bitcoin has fallen about 50 percent since its October peak.

- World Liberty Financial sold wrapped Bitcoin to avoid liquidation.

- Warren warns bailouts could benefit wealthy investors and insiders.

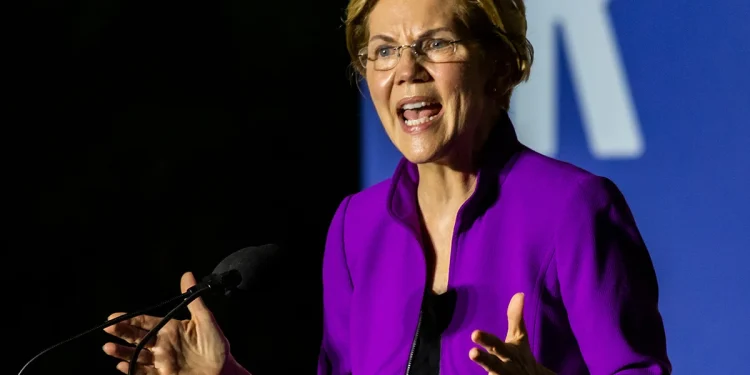

U.S. Senator Elizabeth Warren has asked the Treasury Department and the Federal Reserve to confirm that taxpayer funds will not be used to support Bitcoin or assist cryptocurrency firms during the ongoing market downturn. Her letter was sent as Bitcoin continues to fall from last year’s high, prompting renewed debate over the government’s role in digital asset markets.

Warren said sharp declines and heavy liquidations have raised new questions about the federal government’s authority to intervene. She wrote that both agencies must rule out any action that could transfer losses from crypto investors to the public. Bitcoin has lost around half its value since October, and leveraged positions have added pressure to the market.

The request comes during a period of expanding crypto activity in the United States. Since President Donald Trump returned to office, some states have considered building strategic Bitcoin reserves and Congress has debated new digital asset rules. Federal agencies have also advanced several crypto-related programs designed to integrate digital assets into the broader financial system.

Warren Warns Against Use of Public Funds

Elizabeth Warren said government intervention during the current decline would favor wealthy investors and major holders. She wrote that a bailout “would be deeply unpopular” and said it could benefit individuals with large Bitcoin exposure. She also said it could enrich President Trump and his family due to their involvement in the crypto firm World Liberty Financial.

The senator cited recent activity by World Liberty Financial. The company sold roughly 173 wrapped Bitcoin to repay $11.75 million in USDC debt. Warren said the firm took the step to avoid liquidation when Bitcoin fell below $63,000. She added that several large Bitcoin holders have also faced losses during the downturn.

Warren said it is unclear whether any federal agency has plans to intervene in the market. Her letter referenced testimony by Treasury Secretary Scott Bessent, who was asked whether taxpayer money could be deployed into digital assets. Warren said his response did not offer a clear rejection of the idea.

Market Conditions and Investor Losses

Bitcoin is trading just under $67,000, according to market data. Prediction markets show a strong expectation of further downward movement toward $55,000. The decline has affected corporate holders and individual investors who added exposure during the market’s rise.

Elizabeth Warren named several prominent figures who have reported losses. She pointed to Strategy Inc., the firm associated with Michael Saylor, which has seen its share price decline. She also referred to losses reported for Binance founder Changpeng Zhao and Coinbase CEO Brian Armstrong. Warren said the sell-off shows why stronger consumer protections are needed.

She noted that in 2025, a record amount of crypto fraud was reported, with $17 billion lost or stolen. Warren said that without clear rules, small investors could bear losses while large firms protect themselves from risk.

Federal Responses and Regulatory Positions

Federal officials have addressed questions about government authority in recent weeks. During a House Financial Services Committee hearing, Bessent said the Treasury retains seized Bitcoin. He also said the government has no authority to support the Bitcoin market with public funds. He added that there is no mechanism that allows agencies to direct banks to buy Bitcoin.

A spokesperson for the Federal Reserve said the agency received Warren’s letter and plans to respond. The Treasury Department did not issue an immediate statement.

The letter was sent on the same day World Liberty Financial held a business forum at Trump’s Mar-a-Lago club. The event drew attention due to the company’s role in the digital asset sector and its links to the president.

Elizabeth Warren said federal agencies should strengthen protections for retail investors and monitor leveraged crypto positions more closely. She added that regulators must ensure the market does not shift risk to households or retirement funds.