Bitcoin price history: 2026 as a turning point

2025 was a pivotal year for the crypto market. The early surge in risk appetite gradually gave way to a much more fragile sentiment.

Bitcoin reached an all-time high of $126,210.50 on October 6, 2025. Since then, the market has been dominated by doomscrolling, denial, suspicion, stressful liquidations, and bouts of unreasonable optimism.

After several so-called “crypto bloodbaths” in just a few months, traders are now approaching 2026 with mild caution.

Whether another bull run emerges in early 2026 will largely depend on broader macroeconomic conditions and overall financial market sentiment.

S&P 500 bubble: Will BTC save crypto market?

This question often comes up when valuing the largest U.S. tech companies. A comparison with the 2000 dot-com bubble is useful. Back then, the Nasdaq fell about 75% over two years.

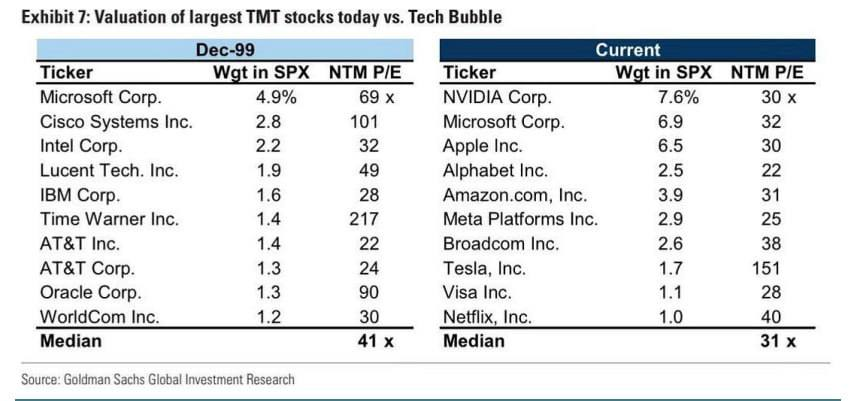

A table from Goldman Sachs compares today’s P/E ratios of the 10 largest companies in the S&P 500 with their levels at the 1999 peak, before the bear market began. It also highlights concentration: the top three companies made up 10% of the index then, versus 20% today.

More importantly, at the 1999 peak, the average P/E of the top 10 companies was 41; today it is about 31. There were outliers then (Cisco, Time Warner) and now (Tesla), but on average valuations are still roughly 30% lower than 25 years ago.

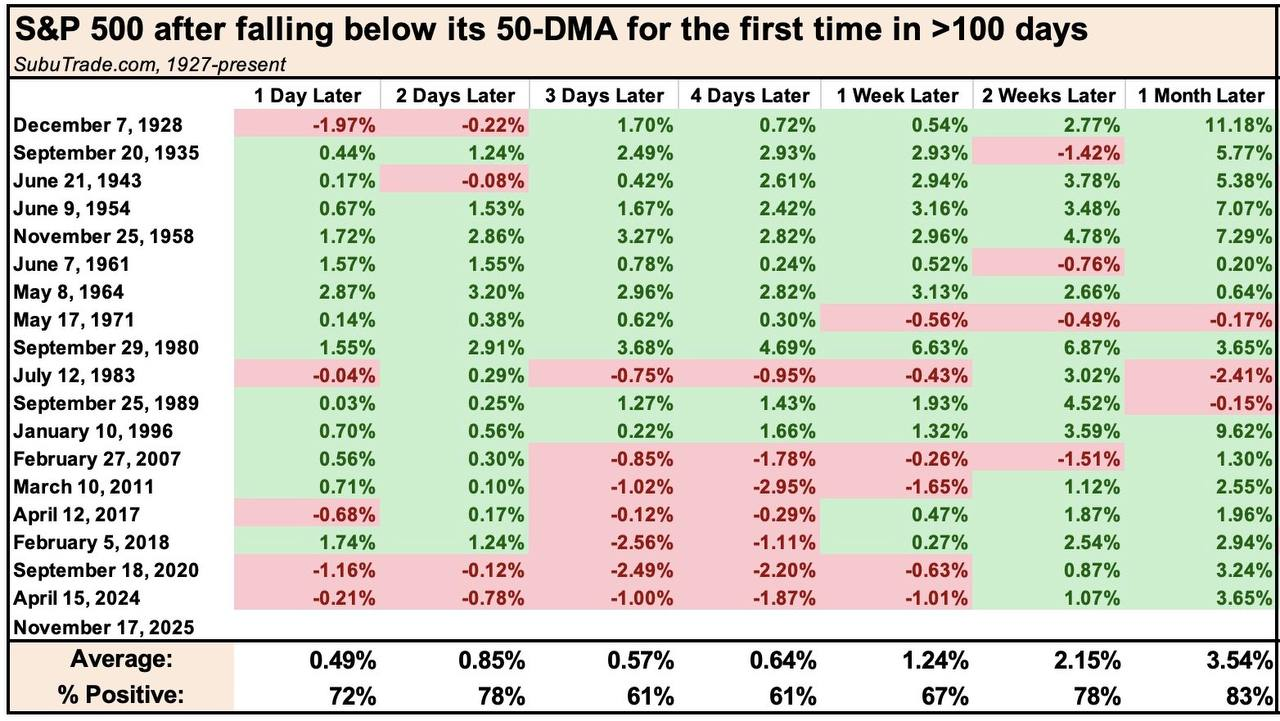

The S&P 500 recently ended a streak of 138 consecutive days closing above its 50-day moving average.

Here’s what the index has done in similar situations over the past 100 years: 100 or more days above the 50-day moving average and the first close below it.

Looking back over the past 100 years at similar cases, the takeaway is mixed: results are close to a coin toss on a weekly horizon, but remain positive on a monthly basis.

Given the current unusual market conditions, there’s a chance to see some FOMO from investors and managers who didn’t believe in the spring/summer rally and fell behind their benchmarks. Now they need to somehow catch up to the index.

In this scenario, another small downward movement and then a rebound by the end of the year are not out of the question, perhaps even reaching new highs.

That makes talk of a “bubble” premature. Major bubbles usually burst amid extreme euphoria, when investors believe “this time is different.”

That does not describe the current mood: the CNN Money fear-greed index was in extreme fear just weeks ago and has only recently returned to neutral. After a short pause and internal rotation, the market may continue rising in Q1–Q2 2026.

Strategy (MSTR): Bitcoin’s long way to institutional adoption

Today, Bitcoin is dominated by public companies and regulated products, rather than crowds fighting through government control, as they did in earlier eras.

Strategy alone controls 641,692 BTC, and Marathon holds 53,250 BTC, while Coinbase has 14,548 BTC. Even Tesla holds 11,509 BTC. Add the ETFs of BlackRock and others to that total and it becomes clear that a major proportion of the supply is now held by entities that are subject to disclosures, board approvals and internal policies rather than market instinct.

Brandt compares late 2025 to late 2021 in reverse: prices falling while traditional indexes like the S&P 500 remain stable. The main issue is that a lot of assets already trade as if rates are going to drop quickly. Crypto followed the same logic, ignoring that future cuts may already be in the chart.

Brandt’s main thesis is that Bitcoin’s explosive growth is slowing down over time. It is not dying, but it is maturing. This essentially means that each “bull cycle” is less powerful than the last.

Despite the slowing exponential growth, Peter Brandt predicted that the next major bull cycle could still carry BTC toward the $200,000 to $250,000 level. However, the massive rally will not happen in the near term, and Bitcoin might need to fall as low as $50,000 first to achieve this target.

On a more pessimistic side, Bloomberg analyst Mike McGlone is forecasting a severe downturn for Bitcoin. He argues that $50,000 will not hold as a floor, viewing it instead as just an interim level.

McGlone believes 2025 marked the cycle’s definitive peak and expects 2026 to bring a sharp “reversion to the mean,” with his current target near $10,000.

He also contends that the broader crypto asset class is inflationary and effectively unlimited, with constant issuance diluting capital flows into the space.

BTC/USD: 2026 prediction

The founder of CryptoQuant noted that large holders, popularly known as whales, have sold Bitcoin worth billions since the coin hit $100,000. Typically, whale selling creates supply overhang, meaning more BTC hitting the market than buyers can absorb, pushing prices down.

After Bitcoin hit its all-time high (ATH) of $126,025 on Oct. 6, the price has corrected roughly 20-30%. This is partly due to the supply overhang and is a classic sign of distribution in market cycles.

Considering the whale selling, Young Ju had previously suggested that the 2024-2025 bull run had peaked and flipped bearish. However, he pointed out that inflows from Strategy and Bitcoin exchange-traded funds (ETFs) canceled the bear market.

Some analysts remain optimistic in regard to potential Q1 2026 bull run.

Galaxy CEO Mike Novogratz has predicted that 2026 could potentially be a great year for crypto. Still, he acknowledges the technical reality that the asset is “stalled.” Novogratz claims that Bitcoin would need to reclaim $100,000 in order to start gaining momentum.

According to Novogratz, extreme apathy often indicates a bottom because it means all the sellers have likely already sold. He views this lack of hype as a bullish setup for 2026 because the market isn’t overheated.

In a recent report, Coinbase points to an earlier liquidity boost, with reserve growth expected to continue through April 2026. The Federal Reserve’s shift from balance sheet runoff to net injections could, according to Coinbase, support crypto markets.

Hunter Horsley, CEO of Bitwise, has also argued that the four-year cycle theory is effectively over. He expects a major bull run next year, saying, “Everything is lining up for a massive 2026. It’s stunning.”

Standard Chartered recently echoed this view, stating that Bitcoin’s traditional four-year halving cycles are no longer a reliable guide for price action. To confirm this shift, Bitcoin would need to break its previous all-time high of $126,000, which, according to Standard Chartered, could occur in early 2026.