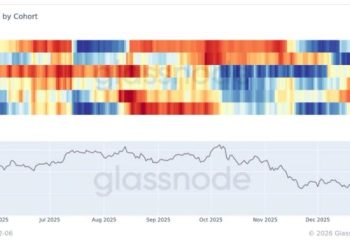

Macro trader plur daddy (@plur_daddy) argues bitcoin’s 2026 setup is less about crypto-specific catalysts and more about whether US liquidity conditions normalize after what he described as an unusually tight few months for risk.

His central claim is that repo “plumbing” has been strained by a shortage of bank reserves as leverage in the economy grew faster than the Fed’s balance sheet, and that the resulting stress showed up in broader markets — “very choppy and rotational dynamics in equities” — alongside “a quite adverse environment for crypto.” Going into the new year, he expects a set of incremental shifts that could move conditions from tight back toward neutral, even if they do not create a new “loose” regime.

4 Macro Themes Will Be Crucial For Bitcoin

The first lever is the Fed’s reserve management purchases (RMPs). “Since the Dec FOMC where they announced $40bn/mo in RMPs for 3 months (and an undefined lower amount thereafter), this liquidity has been flowing in. The Fed has already purchased $38bn of the first month’s allocation,” he wrote. “So far we haven’t seen a huge impact as this was being offset by year end liquidity factors as broker dealers close their books and reduce risk for the year end, but this should change.”

Related Reading

He stresses that the program is meant to relieve funding pressure, not fuel a risk-on melt-up. “I’ll add in the disclaimer that this is not QE, this is a targeted tool to unblock a clogged pipe in the financial plumbing matrix, so don’t get too carried away by the impact this can have,” he wrote. “It can help shift a tight environment back to normal, but it will not shift a normal environment to loose.”

On sizing, he calls it imprecise but meaningful: “Gauging the deficit is more of an art than science, but gut feeling it is probably around $100-200bn (dovetails with the announced RMP size), so 1 month of RMPs is not going to plug the whole thing, but it should have a meaningful impact.”

Second is fiscal incrementality. He expects a modest re-widening in the deficit: “My work suggests an expansion of $12-15bn/mo starting on Jan 1 from the OBBBA impacts,” he said, adding, “We are in a fiscal dominance regime.”

The analyst ties recent softness to the opposite impulse, arguing deficit contraction — which he attributes to tariffs — has weighed on markets, and that even a partial reversal matters: “$12-15bn/mo is not enough to overcome the tariff impacts, but it is incremental vs. Nov/Dec, and I believe incrementality is what matters.” He also flags the eSLR change effective Jan. 1 for early adopters as a smaller tailwind, with broader banking deregulation “on deck for the 2026.”

Third is disinflation and the policy path. He points to falling market-based inflation expectations, citing the one-year inflation swap, and frames the mix as a “goldilocks setup.” “The disinflationary environment creates a goldilocks setup,” he wrote. “The economy is weak but not too weak, and softer inflation gives the Fed air cover to keep cutting.” He notes markets are currently conservative — “a Jan cut at only 13%” and “a total of 2 cuts priced into the curve for the whole year” — then lays out his own baseline: “I’d expect something closer to 4 cuts assuming orthodox policy, and more than that with a Trump takeover.”

Related Reading

Finally, he argues politics could matter via the Fed chair. “Trump will ultimately value loyalty over all,” he wrote, because he believes Trump felt “betrayed by Powell.” He adds: “The Fed Chair is especially important on this dimension, since Trump lacks the authority to fire them, unlike other positions.” In his view, Kevin Hassett is “very likely” given that relationship. He also sketches market sensitivity: “Gold in particular will benefit from a Hassett nomination. Equities might have some heartburn initially but also think they will ultimately go up.”

For bitcoin, his conclusion is cautious but directionally constructive if these macro pieces line up. “In terms of crypto, in theory all of this should benefit it,” he wrote. “I probably won’t play it, as I favor gold here, and crypto is increasingly a tough bet when you factor in the drains on mental capital.” Still, he leaves a timing tell: “However, there is a case to be made that if you were going to be bullish, somewhere around here is the time. Don’t be a hero, look for shifts in character and a positive response as liquidity conditions improve.”

At press time, BTC traded at $87,053.

Featured image created with DALL.E, chart from TradingView.com