As the year comes to a close, Bitcoin (BTC) is approaching a pivotal moment that could lead to increased market volatility. This Friday, December 26, more than $23 billion worth of Bitcoin options are set to expire, marking the largest options expiration in the cryptocurrency’s history.

How $23 Billion Roll-Off May Impact Bitcoin Prices

Market expert NoLimit took to social media platform X (formerly Twitter) to elucidate the significance of this event. Understanding options expiration is crucial to grasping its potential impact on the market.

In the expert’s words, options are leveraged bets on the future price of Bitcoin: call options anticipate an increase in price, while put options anticipate a decrease. When these options expire, one of two things happens: either they expire worthless, or they trigger hedging actions that necessitate buying or selling in the spot market.

With a massive $23.6 billion worth of Bitcoin options rolling off at once, a substantial amount of risk is being removed from dealer books in a single day. This clearing of positions is a primary driver of volatility.

For perspective, previous year-end expiries have been significantly smaller: around $6 billion in 2021, $2.4 billion in 2022, $11 billion in 2023, and $19.8 billion in 2024.

The sheer scale of this upcoming expiry highlights a shift in the market landscape, indicating that it is now largely shaped by institutional investors rather than retail traders.

The specificity of this Friday is particularly noteworthy. Dealers have strategically hedged their positions around key Bitcoin price levels, and as the options expiry arrives, these hedges will be unwound.

This process could lead to sharp price movements in either direction, especially given the current low-liquidity conditions in the market. The holiday season has resulted in diminished trading volume, which means that individual orders can impact prices more dramatically—potentially leading to violent price swings.

Key Price Ranges

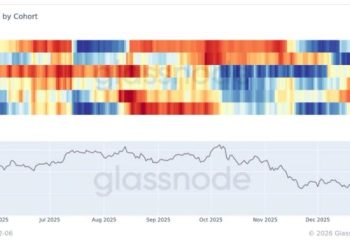

Adding to the complexity, fellow market analyst MartyParty highlighted that significant gamma exposure is clustered in critical price ranges, particularly between $86,000 and $110,000.

Estimates suggest that high gamma—around $238 million or more in notional sensitivity—will expire, amplifying volatility through delta-hedging flows as Friday approaches. The maximum pain point, where Bitcoin option sellers face the greatest loss, is pegged at $96,000.

Furthermore, analysts from CryptoQuant weighed in on the situation, noting that while downside positioning has eased with the open interest in $85,000 puts declining, there remains a notable presence of $100,000 Bitcoin calls.

This suggests a cautious but persistent optimism for a potential “Santa rally,” according to the analysts. The risk reversals also indicate a softening of bearish sentiment as Bitcoin’s spot price stabilizes.

At the time of writing, Bitcoin was trading at $87,292, having recorded a loss of 2.5% in the past 24 hours and a 30% gap between the current trading price and the record high.

Featured image from DALL-E, chart from TradingView.com