The long-term downtrend on the market is clearly not something that can last forever. The exhaustion of sellers is a real thing, and multiple assets show those signs. There is a realistic possibility of a rapid retrace that can kill the bearish momentum sooner than traders will realize.

Shiba Inu’s downtrend exhausted

The structure of the move indicates that the downtrend is closer to exhaustion than continuation, but Shiba Inu has been trapped in a protracted corrective phase that has erased about half of its value from local highs.

Over the past few weeks, price action has shown SHIB declining at a slower rather than faster rate. That’s an important distinction. Strong bearish trends typically culminate in sharp breakdowns, increasing volume and panic. Instead, SHIB is displaying fatigue and compression.

Technically speaking, SHIB is still below all of the major moving averages, which keeps the overall trend negative on paper. But the gap between those averages and the price has stopped growing. Every bounce in earlier downward legs was vigorously sold, quickly driving the price back below short-term averages. That conduct has become weaker.

Sellers are no longer pressing as hard, and recent declines have been shallow. This interpretation is supported by volume. Selling spikes have decreased, and declines are happening more frequently when participation is low. This usually indicates a drying up supply rather than a further collapse in demand.

The lack of buyers entering the market early is what has caused the most recent red candles, rather than strong selling pressure. That’s a significant distinction. Markets decline when sellers lose interest rather than when buyers flood the market.

Additionally, momentum indicators are leveling off. For a considerable amount of time, the RSI has been close to oversold territory without declining. During a downtrend, prolonged oversold conditions frequently precede basing behavior rather than its immediate continuation.

This Ethereum signal is nothing

On the daily chart, Ethereum recently displayed a death cross, where the short-term moving average fell below a longer one. On paper, that seems dramatic. This particular signal does not necessarily indicate that ETH is on the verge of a severe or uncontrollable collapse, and it actually means far less than the name implies.

After months of distribution, this is not a clear-cut, trend-defining death cross. It is a miniature death cross that developed after a powerful earlier advance, during a corrective sideways-to-down phase. These kinds of crosses usually show up later in corrections rather than at the beginning of significant bear markets. A large portion of the downside pressure has frequently already been applied by the time the cross triggers.

Secondly, panic is not supported by price structure. A declining moving average and a rising local trendline are currently compressing ETH. It’s not a breakdown, but a classic squeeze. You would anticipate impulsive selling, expanding red candles, and rising volume to the downside if the market were actually approaching a beginning-of-the-end scenario. That is not taking place. There is little follow-through on downward moves, and selling pressure is managed.

Behavior related to volume supports this. There was no accompanying increase in sell volume when the death cross emerged. That is crucial. Participation validates strong bearish signals. Weak ones appear in quiet conditions, which is precisely what Ethereum is doing at the moment.

Additionally, momentum indicators provide a more subdued narrative. RSI is not oversold, neutral, or showing a bearish divergence. ETH is not declining at a faster rate. It is waiting for guidance, pausing and grinding. Instead of capitulation, that is consolidation behavior.

Is it possible that Ethereum will continue to decline? Another leg down would be possible if there was a break below the existing ascending support. However, it is a lazy analysis to attribute that risk to a miniature death cross. This cross is not a new cause of a future collapse; rather, it is a lagging reflection of previous price action.

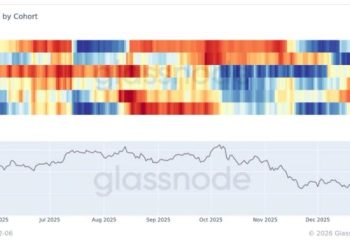

Bitcoin has to decide

From a structural standpoint, Bitcoin’s recent decline toward the $80,000 area appears to be far less dramatic than the headline figure suggests, but it has rekindled the typical discussion about whether this is a significant breakdown or just another reset before continuation.

The decline started when Bitcoin rolled over from the $100,000-$105,000 range after failing to hold above important moving averages. It was not a subtle rejection. As leveraged positions were flushed out, the price lost momentum, trend support gave way and Bitcoin accelerated lower.

But right now, it does not matter where Bitcoin originated. What matters is how it is acting as it gets closer to the lower end of the spectrum. The $80,000 range is not chosen at random. It is consistent with demand pockets that are visible, psychological support and previous consolidation zones.

Selling pressure has so far decreased as the price has dropped. During the first breakdown, volume spikes were front-loaded, and subsequent downside pushes have demonstrated decreasing follow-through. The appearance of a clean trend failure is not like that. Within a wider range, it is more reliable with a corrective leg.

It is supported by momentum indicators. RSI is declining but leveling off. It is not plunging into extremely oversold territory. This implies that instead of gaining control, sellers are losing urgency. Put differently, the market has already completed the emotional portion of the transaction.

Whether Bitcoin can base here will determine what happens next. The narrative swiftly changes from breakdown to reset if the price stays above the $80,000-$82,000 range and begins to form higher lows. A recovery toward $90,000 becomes feasible in that case.