TLDR

- Matador Technologies aims to grow its Bitcoin holdings from 175 to 1,000 BTC by 2026.

-

The company secures $58.2M through a share issuance to boost its crypto reserves.

-

Matador Technologies’ Bitcoin strategy focuses on long-term accumulation and portfolio diversification.

-

The firm’s capital raise signals strong institutional confidence in Bitcoin as a treasury asset.

Matador Technologies, a Canadian publicly traded company listed on the Toronto Venture Exchange, has announced plans to raise $58.2 million. The capital will be directed toward growing its Bitcoin holdings, aiming to significantly increase its reserves from 175 BTC to 1,000 BTC by the end of 2026. This bold move highlights the growing trend of institutional investors and public companies strategically incorporating Bitcoin as part of their treasury strategy.

The company’s board has approved a new share issuance to secure the necessary funds. Matador Technologies intends to use a portion of the proceeds for its Bitcoin accumulation strategy, while the remainder will be allocated to general operating expenses. This plan shows a measured approach to balancing long-term growth in digital assets with the ongoing needs of day-to-day business operations.

Why Matador Technologies Is Betting on Bitcoin

Matador’s Bitcoin-focused strategy is part of a broader trend in which institutional investors are increasingly viewing Bitcoin not just as a speculative asset but as a strategic treasury asset. Many companies are adding Bitcoin to their balance sheets as a hedge against inflation and to diversify their portfolios. Bitcoin is also seen as a digital alternative to gold, offering protection against currency devaluation.

In a statement, Matador’s CEO, Deven Soni, explained, “Obtaining the receipt for our CAD $80 million base shelf prospectus is a critical step in maturing our capital structure.”

The company is positioning itself as a forward-thinking player in the crypto space, signaling confidence to shareholders and attracting institutional investors looking for exposure to Bitcoin.

Challenges and Strategy Behind Bitcoin Accumulation

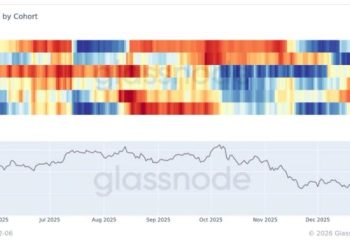

While Matador’s decision to expand its Bitcoin reserves is bold, it does not come without challenges. The most pressing challenge is market volatility. Bitcoin’s price can fluctuate significantly, meaning Matador will need to manage the timing of its acquisitions carefully.

The company is likely to employ strategies such as dollar-cost averaging to mitigate the effects of short-term price fluctuations during its accumulation phase.

Moreover, storing large amounts of Bitcoin securely and in compliance with regulations is another challenge. Matador will need to ensure that it uses secure and compliant custody solutions to safeguard its growing digital asset treasury. These considerations are essential as the company plans its ambitious Bitcoin acquisition strategy over the next two years.

Institutional Confidence in Bitcoin Grows

Matador Technologies’ decision to pursue a $58.2 million capital raise for Bitcoin expansion comes at a time when institutional confidence in Bitcoin is on the rise. Many public companies are following the lead of firms like MicroStrategy and Tesla, which have made significant Bitcoin purchases as part of their treasury strategies.

This trend signals a broader institutional shift toward embracing digital assets as a core component of long-term financial planning.

Mark Moss, Matador’s Chief Visionary Officer, emphasized that the new capital framework allows the company to take a measured, long-term approach to Bitcoin accumulation. The goal is to build a solid Bitcoin treasury while managing market timing and volatility. This reflects a strategic focus on increasing Bitcoin per share and supporting shareholder value over time.