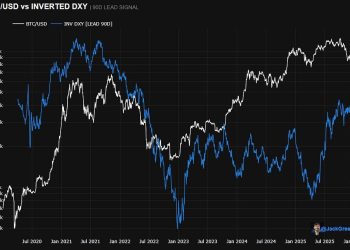

Bitcoin’s recent bounce may look like a sign of renewed strength, but the price action tells a more deceptive story. With downside liquidity still thin and support holding firm, the market appears primed for a move that draws in eager bulls rather than rewarding them. This rally could be less about recovery and more about setting the stage for maximum pain when sentiment flips.

Aligning The Mid- And Long-Term Bitcoin Outlook

During an in-depth technical and psychological analysis, Mr. Wall Street explained that his broader outlook on Bitcoin had already been clarified a week earlier, after some confusion around his mid and long-term stance. With those time horizons now clearly defined, he turned his focus to the short-term picture, outlining current market behavior.

Related Reading

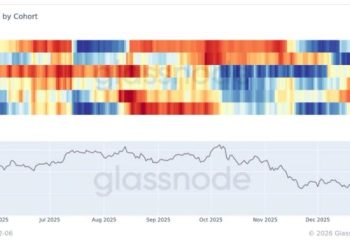

He reiterated that while his mid-term bias on Bitcoin remains bearish, the short-term structure has turned bullish. The reason centered on insufficient downside liquidity to justify market makers initiating the next major leg lower. This imbalance supported the case for a temporary relief move to the upside.

Thus, Mr. Wall Street placed long positions around the Value Area Low between $80,000 and $84,000 on a bounce that could later evolve into a bull trap. Shortly after, Bitcoin dipped and successfully retested the $84,000 level, which aligns with the weekly MA100, following several deceptive upside moves.

As a result, his long orders were filled as planned, leaving him holding a position from $84,550. The analyst noted that he plans to exit only in the $98,000–$104,000 zone, where a Fair Value Gap converges with heavy liquidity, making it an ideal area to take profit.

Being In Longs Doesn’t Change The Macro Bearish Thesis

Mr. Wall Street clarified that holding long positions does not signal a bullish shift on Bitcoin. The broader outlook remains bearish, with expectations for the next major downside move toward the $64,000–$70,000 region. In the short term, Bitcoin is sitting at strong support while downside liquidity is limited, which reduces the probability of an immediate continuation lower.

Related Reading

A more logical scenario involves market makers engineering a bullish move to attract retail participation. As late buyers enter long positions, they gradually become exit liquidity, setting the stage for a larger downside move once sufficient liquidity is built.

He also mentioned the $68,000–$74,000 zone had become too widely anticipated to function as a true “maximum pain” area capable of resetting market structure. For that reason, the downside target was revised lower to the $64,000–$70,000 range, with expectations that this zone could be reached in late Q1 or early Q2 of 2026. This level represents an initial major target rather than the final bottom.

Recent price action was highlighted as a clear example of these dynamics. Bitcoin’s rapid move from $87,000 to $90,000, followed by a sharp drop to $85,000 within hours, resulted in widespread liquidations. Many traders chased the upside and were quickly trapped, and fake moves in both directions are likely to continue as liquidity is built ahead of a larger move lower.

Featured image from Pixabay, chart from Tradingview.com