TLDR

- Dogecoin price holds $0.13 support after liquidity sweep signals seller exhaustion

- On-chain data shows strong demand clusters at $0.074 and $0.12–$0.13

- Descending channel compression hints at a potential trend reversal

- Upside targets sit at $0.20 first, with $0.28 in focus if momentum builds

Dogecoin price is showing early signs of stabilization after a prolonged corrective phase, as technical and on-chain indicators point to easing downside pressure. Analysts highlight a defended support region near $0.13 and strong historical demand at lower levels. If current bases hold, projections suggest a potential recovery toward $0.20, with scope for a broader move toward $0.28 under favorable market conditions.

Dogecoin Price Stabilizes After Liquidity Sweep

Analyst BitGuru’s DOGE chart outlined a completed bullish cup formation that developed through mid-2025. After the breakout phase, the price entered a corrective pullback that respected the handle zone. A brief dip below prior lows triggered a liquidity sweep, flushing stops before reversing, a pattern often seen in volatile meme assets.

SOURCE: X

Moreover, Dogecoin price is now stabilizing around the $0.13 zone, with declining sell volume suggesting seller exhaustion. Additionally, early buying interest is emerging as volatility compresses. The analyst noted that if this base remains intact, a relief bounce could develop toward the $0.18–$0.20 resistance zone. Sustained momentum may open a path toward the previous highs near $0.28.

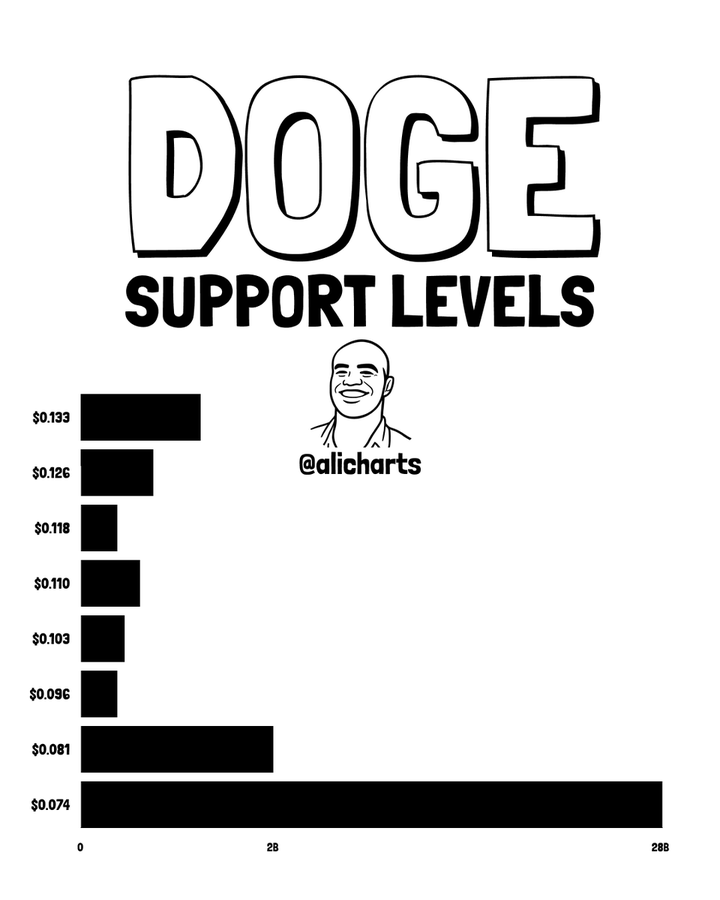

On-Chain Data Highlights Strong Support Clusters

Meanwhile, analyst Ali provided an on-chain view of Dogecoin price support based on historical token movement. The data highlights $0.074 as the most significant support level, where over 28 billion DOGE last changed hands. This zone represents a major cost basis for holders, increasing its importance as a defensive floor.

SOURCE: X

In addition, secondary support levels at $0.081 and the $0.126–$0.133 range show progressively lighter volume clusters. This structure implies that deeper pullbacks could attract aggressive buying near the lower levels, while recoveries may face lighter resistance until higher zones. Ali suggests that volatility could intensify if price revisits these levels, though the probability of a rebound remains elevated at major clusters.

Downtrend Compression Signals DOGE Price Reversal

Furthermore, price analysis focused on a longer-term chart shows Dogecoin in a descending channel after peaking near $0.32. The rejection zone around the highs reflects heavy distribution, while the steady decline rewarded short positions. However, the recent test near $0.13 produced an exhaustion wick, signaling weakening bearish momentum.

Additionally, volume has tapered during the descent, indicating reduced selling pressure. The current consolidation at channel support creates a potential inflection point. According to this view, a hold above current levels could invalidate the downtrend structure and trigger a short squeeze. Initial upside targets align near the channel midline around $0.20, with extension toward $0.28 if resistance breaks. Also, risk remains if the price slips below $0.10, though the risk-reward profile is shifting.

Dogecoin is approaching a technically sensitive zone where multiple indicators converge. Stabilization near key support, strong on-chain demand clusters, and compression within a descending channel all suggest that downside momentum is fading. While confirmation is still required, analysts say that a sustained hold could position DOGE for a recovery phase, especially if market conditions remain positive.