Welcome to this week’s publication of the Market’s Compass Crypto Sweet Sixteen Study #215. The Study tracks the technical condition of sixteen of the larger market cap cryptocurrencies. Every week the Studies will highlight the technical changes of the 16 cryptocurrencies that I track as well as highlights on noteworthy moves in individual Cryptocurrencies and Indexes. As always, paid subscribers will receive this week’s unabridged Market’s Compass Crypto Sweet Sixteen Study sent to their registered email Sundays*. Past publications including the Weekly ETF Studies can be accessed by paid subscribers via The Market’s Compass Substack Blog.

*I am sending a delayed taste of the complete Sweet Sixteen Crypto Sweet Sixteen Study to my free subscribers today that went out to my Paid subscribers on Sunday.

An explanation of my objective Individual Technical Rankings and Sweet Sixteen Total Technical Ranking go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select “crypto sweet 16”. What follows is a Cliff Notes version* of the full explanation…

*The technical ranking system is a quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. The TR of each individual Cryptocurrency can range from 0 to 50.

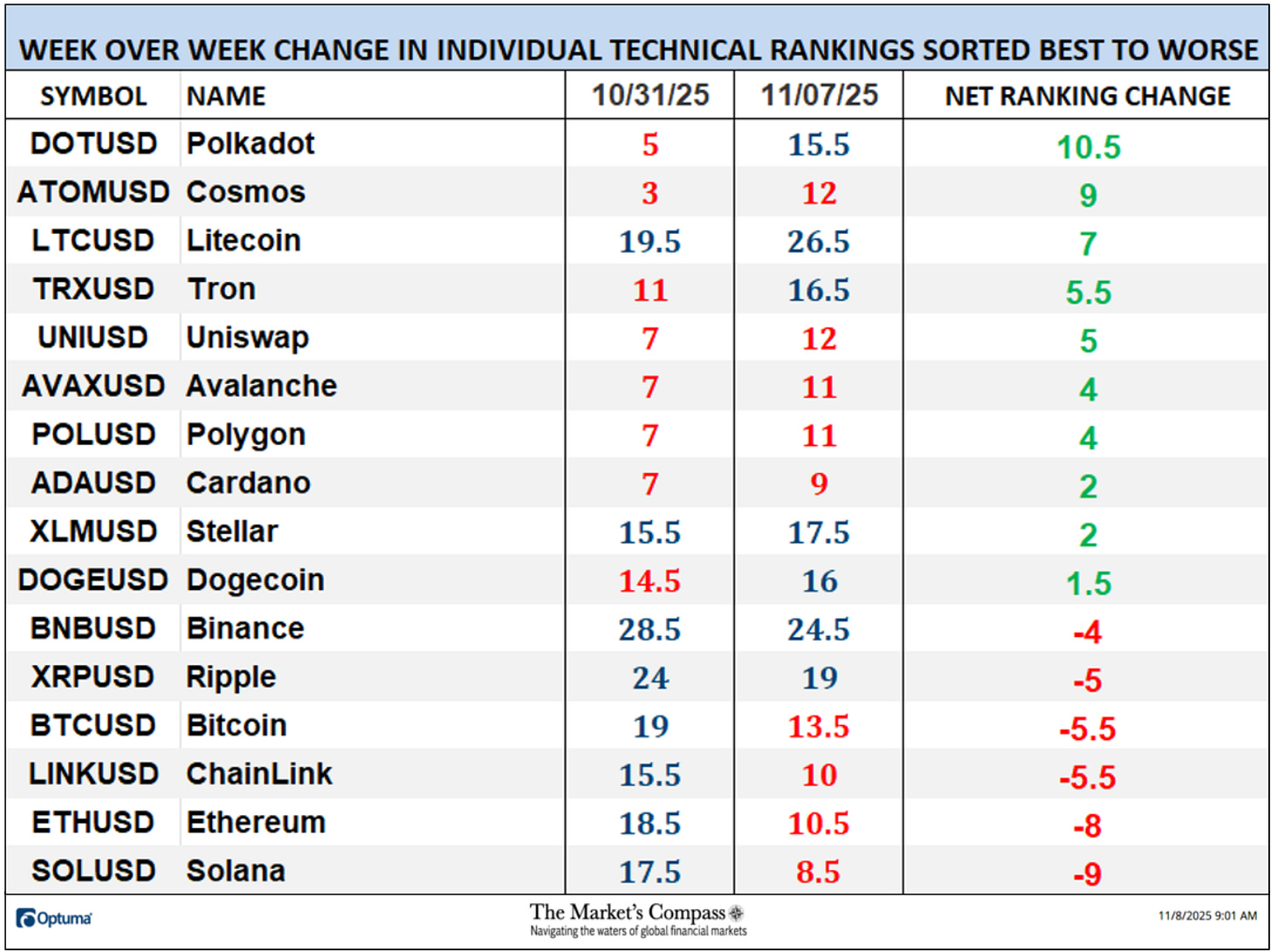

The Excel spreadsheet below indicates the the objective Technical Ranking (“TR”) of each individual Cryptocurrency and the Sweet Sixteen Total Technical Ranking (“SSTTR”) as of last Friday*. The second Excel spreadsheet indicates the week over week change in the “TR” of each individual Cryptocurrency.

The SSTTR rose 6.15% last week to 233 from 219.5, which had fallen -10.59% from the previous week’s reading of 245.5.

Ten of the Sweet Sixteen marked gains in their TRs last week, six moved lower. The average Sweet Sixteen TR gain was +0.84 (thanks to Friday’s turn higher in a number of the ALTs) vs. the average loss of -1.63 the previous week. None of the crypto currency TRs I track ended the week in the “green zone” (TRs between 35 and 50). Seven ended the week in the “blue zone” (TRs between 15.5 and 34.5) and nine were in “red zone” (TRS between 0 and 15). The previous week there were eight in the “blue zone” and eight were in the “red zone”. Smells more like rotation more than anything else.

*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

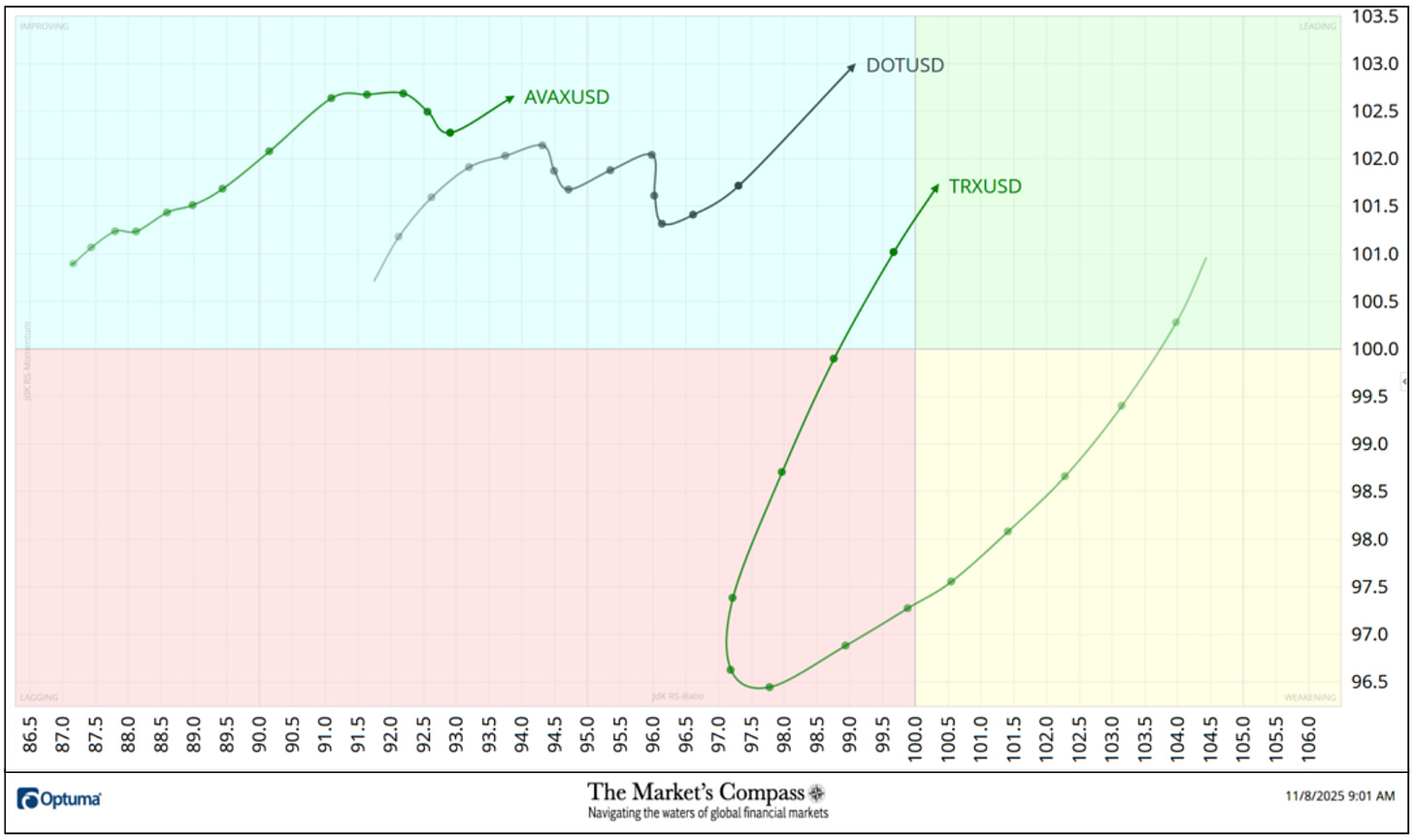

The chart below has two weeks, or 14 days, of relative data points vs. the benchmark, (the CCi30 Index) at the center, deliniated by the dots or nodes. Not all of the Sweet Sixteen are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain.

A week ago, Tron (TRX) fell out of the Leading Quadrant and through the Weakening Quadrant ending up in the Lagging Quadrant, but it reversed sharply last weekend exhibiting exceptional Relative Strength Momentum (note the distance between the daily nodes). At the end of last week, it climbed through the Improving Quadrant and ended the week back in the Leading Quadrant in a complete round trip. Polkadot (DOT) had been “waffling” sideways in the Improving Quadrant until last Friday newfound Relative Strength Momentum. Avalanche (AVAX) had started to roll over in the Improving Quadrant last week until Friday when reignited to the upside.

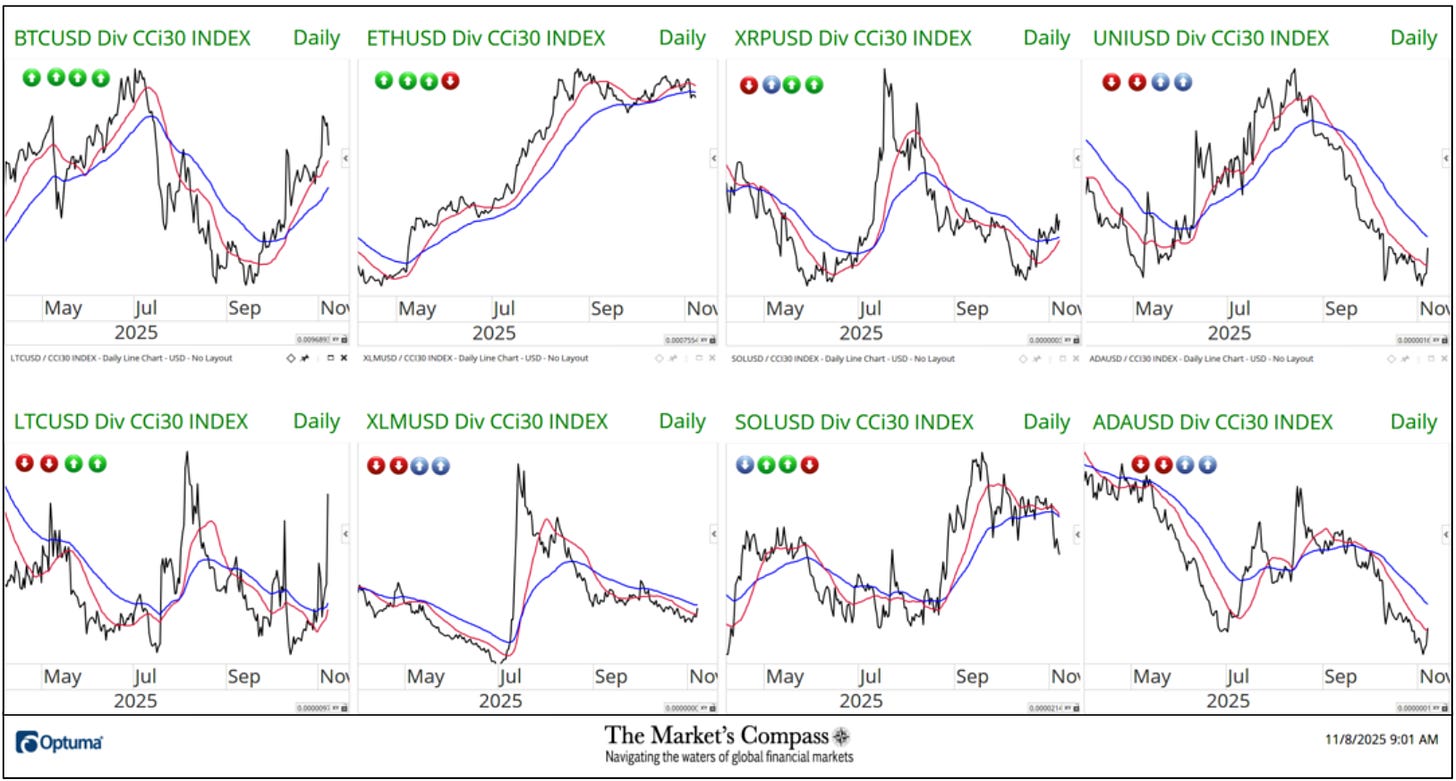

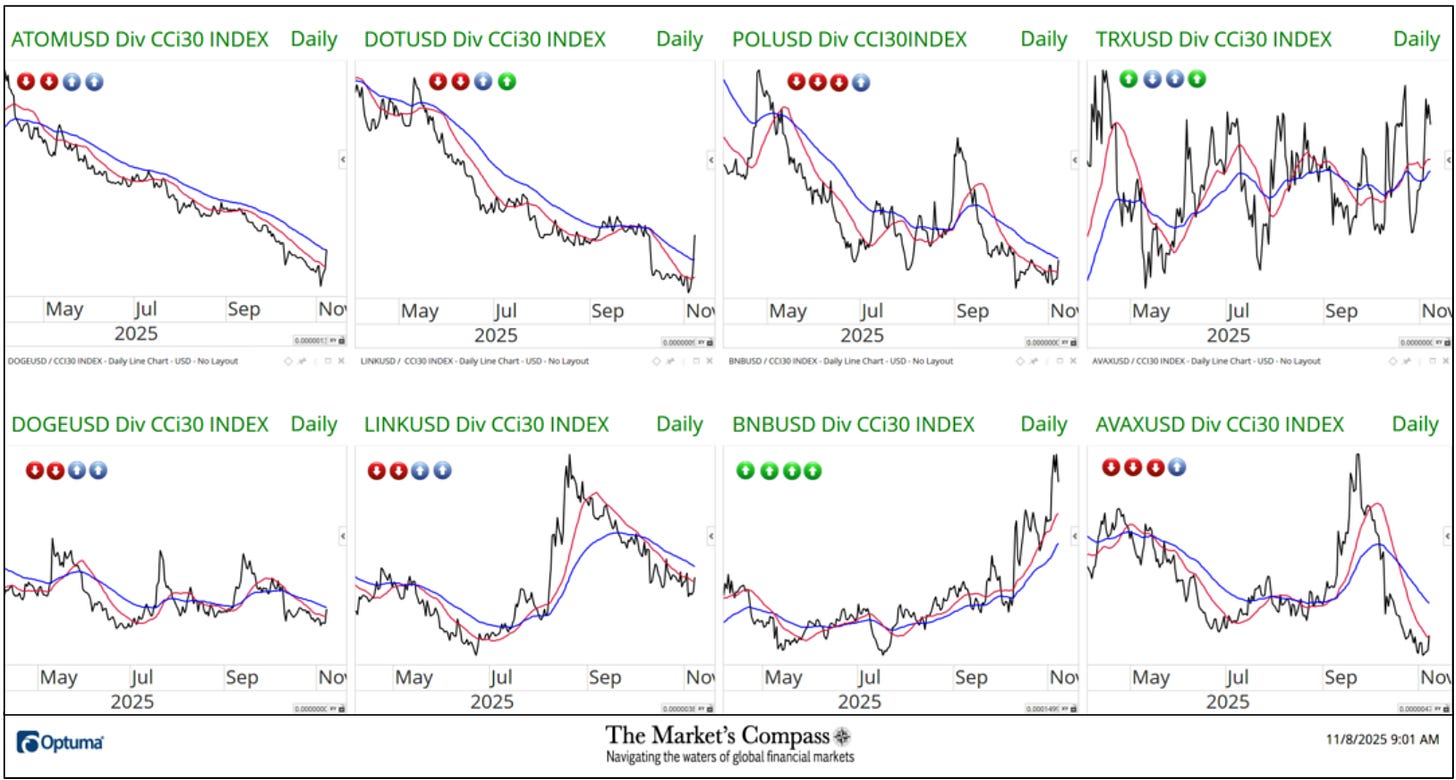

The two panels below contain longer term line charts of the Relative Strength or Weakness of the Sweet Sixteen Crypto Currencies vs. the CCi30 Index that are charted with a 55-Day Exponential Moving Average in blue and a 21-Day Simple Moving Average in red.* Trend direction and crossovers, above or below the longer-term moving average, reveals potential continuation of trend or reversals in Relative Strength or Weakness.

I have added a fourth week of directional ratings to the chart. The left hand notation in the circle on the chart now references the directional rating from four week ago. The right hand circle reflects the directional rating at the end of last week.

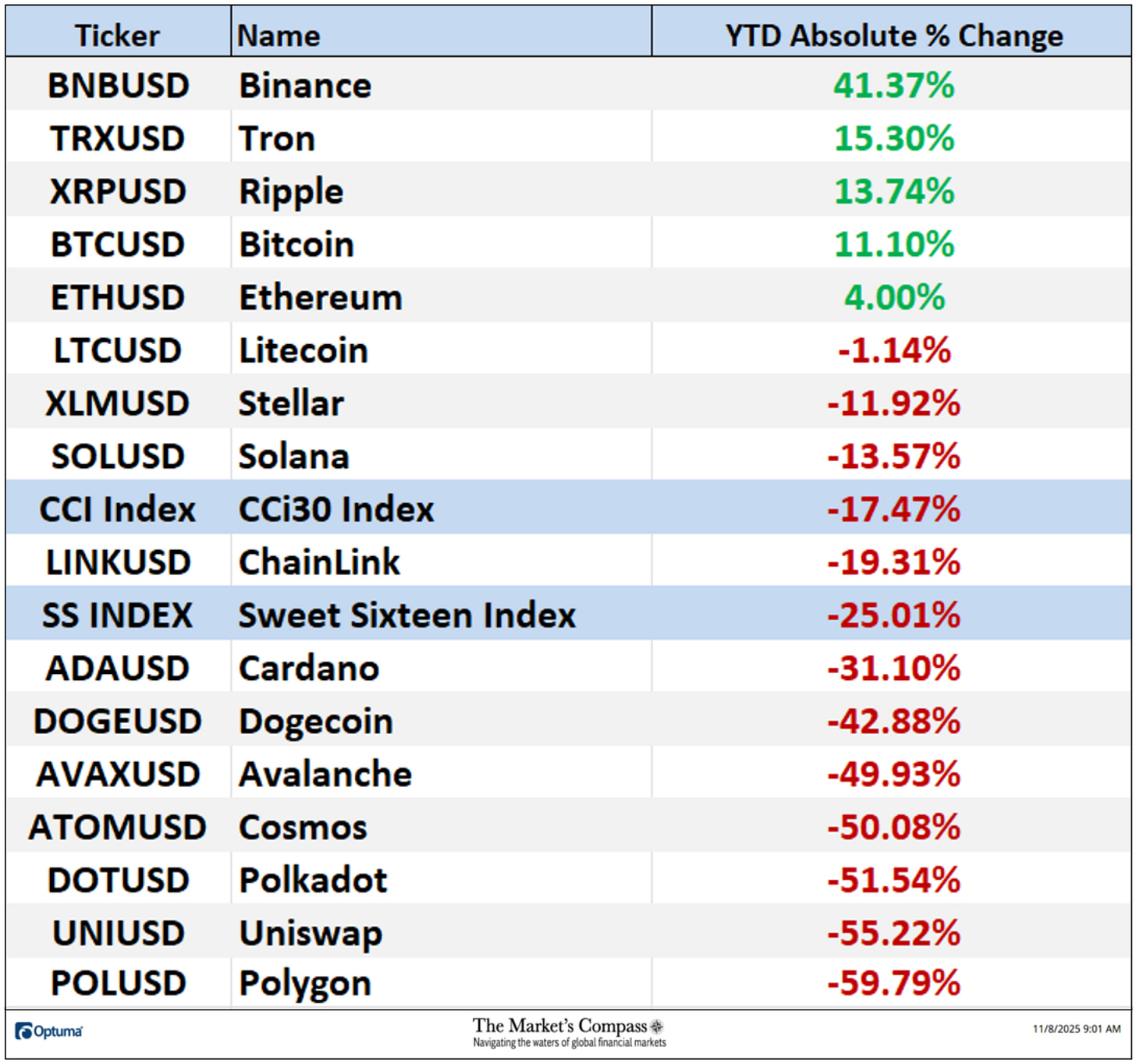

Bitcoin (BTC) and Binance (BNB) have been displaying positive Relative Strength vs. the CCi30 Index for the past four weeks by continuing to rise and remaining above both moving averages.

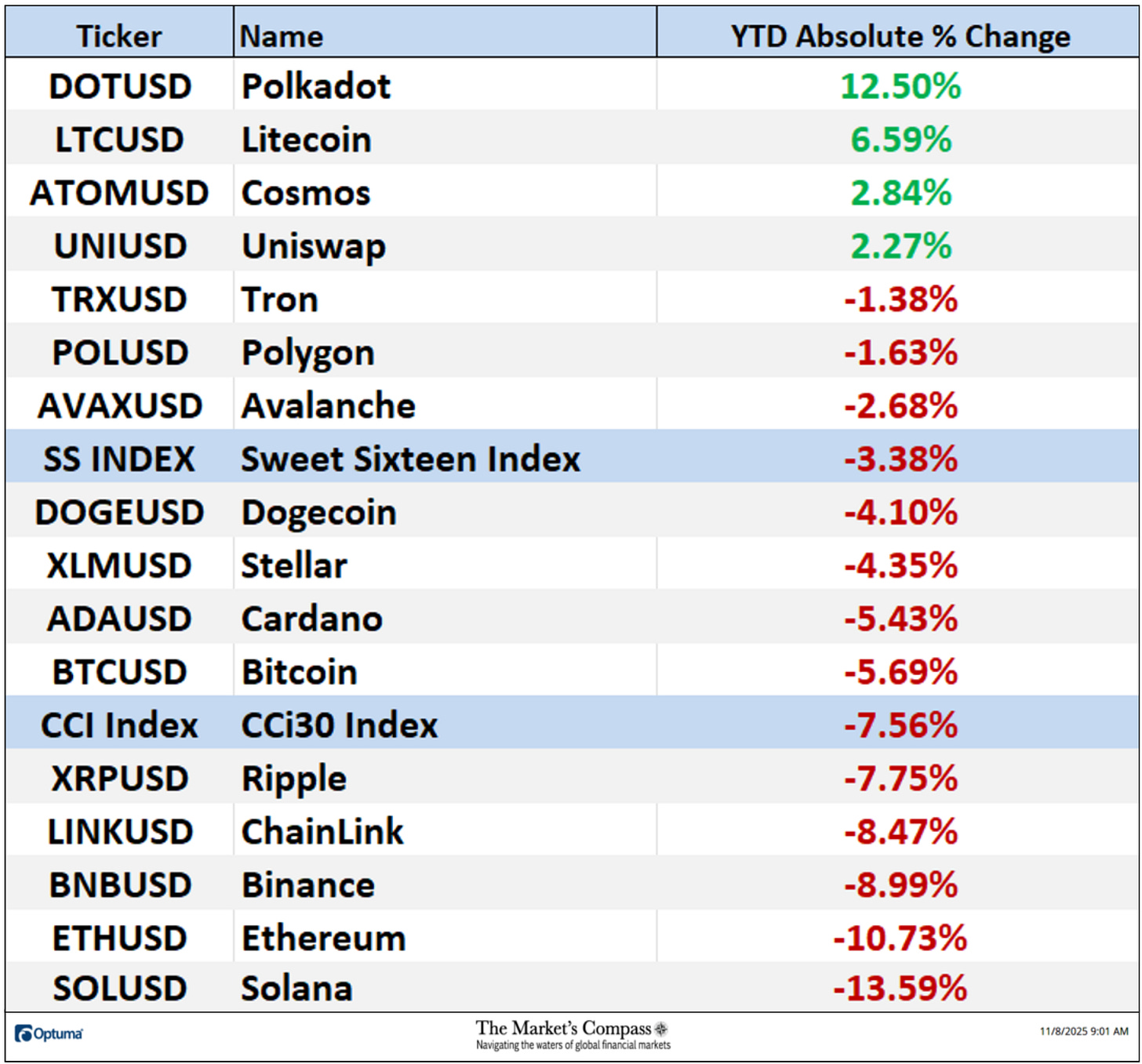

Twelve of the Crypto Currencies I track lost absolute ground over the past seven days and four gained absolute ground. The seven-day average absolute price loss was -3.16% adding to the -4.15% average loss two weeks ago when only one marked an absolute gain. Both weekly average moves exclude the two Indexes.

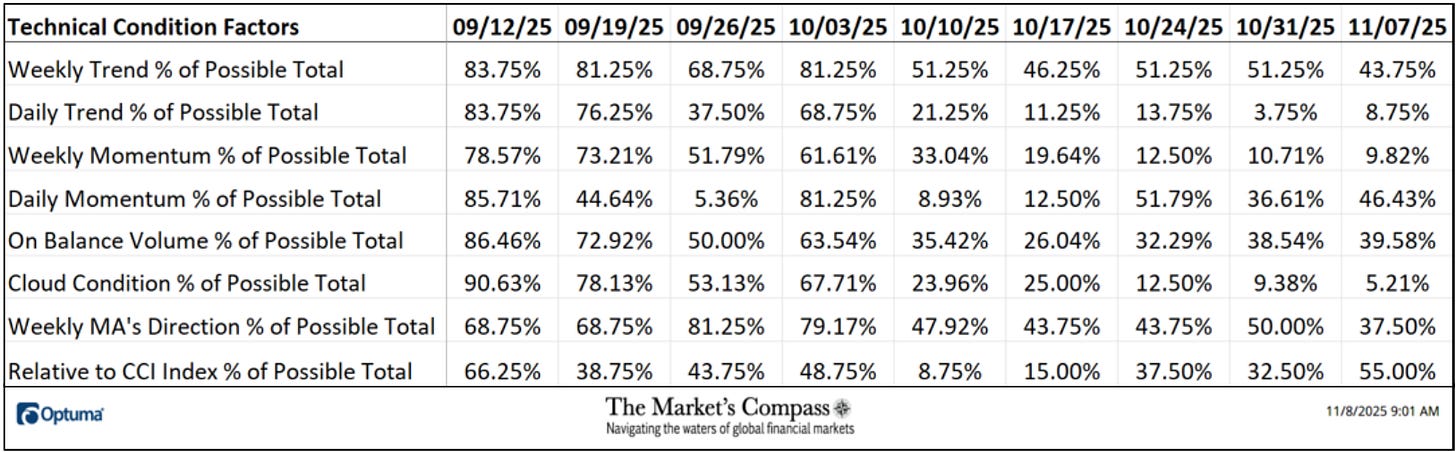

*The Technical Condition Factors are utilized in the calculation of the Individual Crypto Currencies Technical Rankings. What is shown in the excel panel below is the total TCFs of all sixteen TRs. A few TCFs carry more weight than the others, such as the Weekly Trend Factor and the Weekly Momentum Factor in compiling each individual TR of each of the 16 Cryptocurrencies. Because of that, the excel sheet below calculates each factor’s weekly reading as a percentage of the possible total.

A full explanation of my Technical Condition Factors go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select Crypto Sweet 16.

The Daily Momentum Technical Condition Factor or “DMTCF” rose to 46.43% or 52 out of a possible 112 at the end of last week from a reading of 36.61% or 41 the week before thanks to Friday’s trading action

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 16 Cryptocurrencies are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the TCFs fall on a week over week basis, more of the “Cryptos” are deteriorating on a technical basis confirming the broader market move lower. In an even split last week four TCFs rose, and four fell.

*The “TSSTCF” Oscillator tallies the eight objective Technical Condition Factors into one overbought / oversold indicator that ranges between 0 and 8.

The CCi30 Index fell below Cloud support intra-week after three weeks of being capped by the confluence of the Kijun and Tenkan Plots at 19,450 but recovered by Friday to close off the weekly lows (which fell short of challenging key support at 15,265 and almost overtook Cloud resistance (both are mior technical positives). The “TSSTCF” Oscillator has not moved a measurable amount and remains oversold. My technical stance remains unchanged; “I remain unconvinced that the lows are in”. Only if the index can overtake broken price support at the 19,450 level at the Kijun and Tenkan Plots and return to the confines of the Schiff Modified Pitchfork (red P1 through P3) will it lead me to temper my cautious view”.

For a explanation on how to interpret the Sweet Sixteen Total Technical Ranking or “SSTTR” vs the weekly price chart of the CCi30 Index in the lower panel, go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select Crypto Sweet 16. A brief explanation follows…

The Sweet Sixteen Total Technical Ranking (“SSTTR”) Indicator (bottom panel in the chart below) is a total of all 16 Cryptocurrency Individual Technical Rankings and can be looked at as a confirmation/divergence indicator as well as an overbought/oversold indicator.

The CCi30 index successfully tested support at the Median Line (gold dotted line) of the longer-term Standard Pitchfork (gold P1 through P3) and closed the week off the lows. That said, there is nary a sign in MACD which continues to track lower below its signal line suggesting there has not been a turn in longer-term negative price momentum. That as well as the shorter-term Stochastic Momentum Index which also continues to slip lower below its signal line. One potentially positive technical feature is that the Sweet Sixteen Total Technical Ranking marked a very short-term positive non-confirmation as it remains in deeply oversold territory but as I have reminded my readers ad nauseum, price action supersedes all secondary indicators and only a rally that drives prices back above the 20,200 level and the Median Line (violet dotted line) of the Schiff Modified Pitchfork (violet P1 through P3) would suggest that the index may be out of the woods.

I have added a new shorter-term Standard Pitchfork (gold P1-P3). Last Friday the broader crypto index (boosted by a upside reversal in several of the ALTs) retook and closed above the Median Line (green dotted line) of the longer-term Standard Pitchfork (green P1-P3), but there are several technical hurdles to be overcome to begin to consider that the correction has run its course. These include the Tenkan Plot (red line), broken price support at 18,260.00, the Median Line (gold dotted line) of the new Pitchfork, and the Kijun Plot (solid green line). All three secondary indicators suggest that last Tuesday’s low may have marked a short-term selling climax.

Last week the YTD Absolute % Price Change fell back to end the week at -18.81% from -15.25% the week before.

The following links are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…

An in-depth comprehensive lesson on Pitchforks and analysis as well as a basic tutorial on the Tools of Technical Analysis is available on my website…