SharpLink Gaming (SBET) said it plans to deploy $200 million in ether on Consensys’ Linea over multiple years, using Anchorage custody with ether.fi and EigenCloud to seek on-chain yield.

SharpLink framed the plan as a phased, risk-managed program to make its ether treasury “more productive” on a Layer 2 aligned with Ethereum. According to the company, Linea’s zkEVM design offers faster settlement, lower fees and composability with the broader ecosystem, which SharpLink says are prerequisites for institutional workflows. The company emphasized that the $200 million figure is a multi-year allocation target, not an immediate transfer.

The release says the strategy combines multiple yield streams.

First, SharpLink intends to earn native staking returns on ether. Second, it plans to use ether.fi to access staking and restaking, which the company characterizes as institutional-grade offerings. Third, it expects incentives from Linea and partner programs.

SharpLink also links part of the return profile to EigenCloud, described in the release as a set of services built on EigenLayer that pay rewards for helping secure “autonomous verifiable services,” including AI-related workloads that are designed to inherit Ethereum’s security.

Custody and execution, SharpLink said, will run through Anchorage Digital Bank, which the company presents as a qualified custodian suited to public-company treasury operations. SharpLink describes this setup as a controls-first approach meant to align yield seeking with governance, compliance and stockholder expectations.

The announcement includes supportive comments from several counterparties.

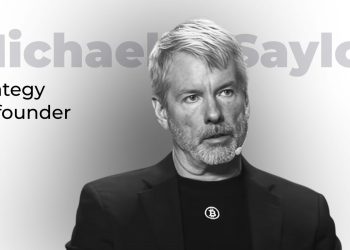

Co-CEO Joseph Chalom said the goal is to unlock staking, restaking and DeFi incentives without sacrificing safeguards. Consensys founder and CEO Joseph Lubin — who is also SharpLink’s chairman — said Linea aims to make ether deployments more productive and suggested the model could be adopted by other institutions.

SharpLink also outlined a broader roadmap with Consensys to co-develop what it calls capital-markets “primitives” on Linea, including on-chain capital raises, programmable liquidity tools and tokenized equity strategies. Those items are presented as future work, not products available today.