Market analysts at Orbisolyx say investors should prepare for a potentially pivotal day on Wednesday, Oct. 29, when the Federal Reserve concludes its next policy meeting. The decision and more importantly, the language that accompanies it, could set the tone for markets heading into the year’s final stretch.

The end of October is already shaping up to be a high-volatility window. While no one can predict exactly when the stock market will make its next big move, Fed decision days consistently rank among the most eventful sessions for traders. Policy shifts, subtle wording changes, or unexpected commentary from Fed Chair Jerome Powell can each send stocks, bonds, and currencies swinging in minutes.

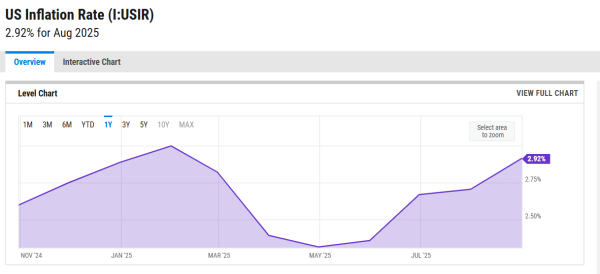

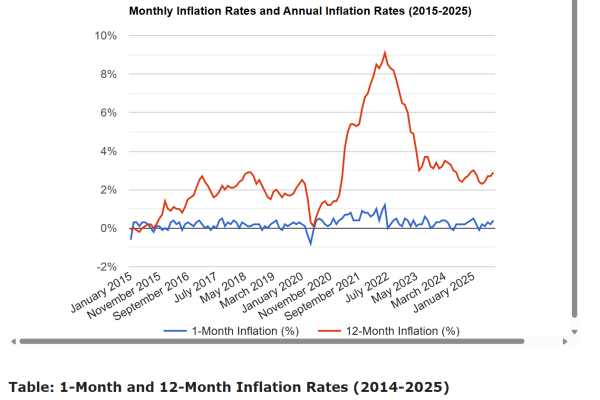

With economic uncertainty still hovering and inflation pressures slowly easing, analysts believe Oct. 29 may deliver the kind of market action investors haven’t seen since early summer.

What the Market Expects

After a run of mixed economic data and dovish signals from policymakers, Wall Street is overwhelmingly betting on a rate cut. The CME FedWatch Tool now shows a 94.6% probability that the federal funds rate will be lowered by 25 basis points (0.25%), while only 5.4% of traders expect no change at all.

That near-consensus creates what Orbisolyx calls a “predictability trap” when markets are so aligned around one outcome that even a minor surprise can cause outsized reactions. Whether the Fed decides to pause, signal a slower pace of cuts, or issue cautious guidance, the effect could ripple through every major index.

What Could Move the Market

While the rate decision is the main event, it’s only one of several catalysts that could move markets on Oct. 29:

- The Rate Decision

Any deviation from the expected 0.25% cut would instantly shock markets. A pause could spark selling, while a larger 0.50% cut might spark a short-lived rally before investors reassess what it implies about the economy’s strength. - The Economic Projections

The Fed’s official Summary of Economic Projections (SEP), which outlines forecasts for GDP, inflation, and unemployment, won’t be released this time. Still, traders will look for indirect clues about the future rate path through Powell’s comments. - The Statement

The FOMC statement released with each decision is parsed down to the word. Even subtle changes, replacing “gradual” with “measured,” or “appropriate” with “necessary” can reveal shifts in policy direction. A softer tone could fuel equity gains, while firmer wording might tighten financial conditions. - The Press Conference

Fed Chair Jerome Powell’s press conference begins 30 minutes after the announcement and often determines the day’s final market direction. Powell’s tone, phrasing, and willingness to hint at future moves have repeatedly proven to be market-moving moments.

How These Signals Interact

These factors rarely operate in isolation. A hawkish cut where rates are lowered but guidance sounds cautious can limit gains, while dovish language can offset a smaller-than-expected move. Analysts highlight that “markets don’t trade the number, they trade the nuance.”

Even the Q&A session during Powell’s press conference can flip market sentiment within minutes. Traders will watch closely for references to inflation persistence, labor softness, or global growth risks, all potential clues about 2026’s rate trajectory.

Why It Matters for Investors

This meeting lands at a delicate moment. Stocks have regained some ground after a rocky September, but inflation worries, global trade frictions, and election-year uncertainty continue to weigh on sentiment. A measured rate cut could extend the year-end rally, while a hesitant or unclear message could stall momentum heading into November.

Investors should also note that Fed announcements often cause cross-asset ripple effects from Treasury yields to cryptocurrency volatility. The combination of a policy shift and Powell’s tone “can trigger algorithmic reactions across multiple asset classes within seconds.”

Expect heightened volume and wide intraday ranges starting around 2:00 p.m. ET, when the official decision drops, and again at 2:30 p.m. ET as Powell begins speaking.

Bottom Line

Even with expectations firmly set for a 0.25% rate cut, Oct. 29 is shaping up as one of the most consequential trading days of the year. Whether it delivers relief or turbulence will depend not just on what the Fed does but on what it says next.

As some analysts summed it up:

“When the Fed speaks, the market doesn’t wait to interpret; it reacts.”

For investors, that means the coming weeks could offer both risk and opportunity. Staying informed, flexible, and ready to act after the Fed’s announcement may prove just as important as the decision itself.