-

Bitcoin ETFs post $40.5 million outflow, fourth straight day of losses.

-

Bitcoin falls nearly 3% to $108,112 as crypto sentiment weakens.

-

BlackRock launches Bitcoin ETP in London amid market turbulence.

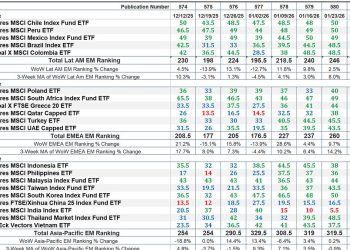

US spot bitcoin exchange-traded funds (ETFs) saw $40.4 million in net outflows on Monday, marking their fourth straight day of negative flows, according to data from Farside Investors.

BlackRock’s iShares Bitcoin Trust (IBIT) was the only spot Bitcoin ETF to register outflows during the session, with $100.7 million exiting the fund.

The losses were partly offset by inflows into five other ETFs managed by Fidelity, Grayscale, Bitwise, VanEck, and Invesco.

| Date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | BTC | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Oct 2025 | (100.7) | 9.7 | 12.1 | 0.0 | 9.9 | 0.0 | 0.0 | 21.2 | 0.0 | 0.0 | 7.4 | (40.4) |

| 17 Oct 2025 | (268.6) | (67.4) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | (5.6) | 0.0 | (25.0) | 0.0 | (366.6) |

| 16 Oct 2025 | (29.5) | (132.0) | (20.6) | (275.2) | 0.0 | 0.0 | 0.0 | (6.1) | 0.0 | (45.0) | (22.5) | (530.9) |

| 15 Oct 2025 | (10.1) | 0.0 | 0.0 | 0.0 | (11.1) | 0.0 | 0.0 | 0.0 | 0.0 | (82.9) | 0.0 | (104.1) |

The latest outflow follows Friday’s $366.6 million and Thursday’s $536.4 million withdrawals, extending a streak of negative sentiment that has persisted across digital asset funds since last week.

Meanwhile, spot Ethereum ETFs also recorded continued weakness, with $145.7 million in net outflows on Monday — their third consecutive day of redemptions.

Bitcoin retreats as crypto sentiment weakens

Bitcoin fell sharply on Tuesday, reversing its weekend rebound as cryptocurrencies lagged behind other risk assets that benefited from easing US-China trade tensions.

The world’s largest cryptocurrency dropped nearly 3% to $108,112.30, struggling to maintain the $110,000 level after a volatile start to October that erased roughly $500 billion in total crypto market capitalisation.

Traders cited the lingering impact of the early-October flash crash — which triggered widespread liquidations and heightened risk aversion — as a key reason for the muted recovery.

Market participants appeared hesitant to re-enter positions amid ongoing volatility and renewed concerns over ETF outflows.

Optimism surrounding “Uptober,” a term describing the crypto market’s historical tendency to perform strongly in October, has faded rapidly.

Bitcoin is now down more than 2% for the month, underscoring the loss of bullish momentum.

Broad crypto market decline

The broader crypto market mirrored Bitcoin’s slide, with most major altcoins trading lower.

Ether, the second-largest cryptocurrency by market capitalisation, fell 5.3% to $3,859.65, slipping below the key $4,000 threshold.

XRP declined 2.2% to $2.4145, showing little reaction to the announcement of a new treasury backed by issuer Ripple Labs.

Binance’s BNB token dropped 5.7%, while Cardano and Solana shed between 4% and 6%.

Among memecoins, Dogecoin fell 4.3%, and $TRUMP lost 3.1%, reflecting a broad-based retreat across the digital asset space.

BlackRock expands Bitcoin offerings in the UK

Amid the downturn, BlackRock announced the launch of a new Bitcoin-linked exchange-traded product (ETP) in the United Kingdom, following the Financial Conduct Authority’s (FCA) decision to relax restrictions on crypto-based investment vehicles.

The iShares Bitcoin ETP, listed on the London Stock Exchange on Monday, is structured as a Bitcoin-linked security that allows investors to purchase fractional units of Bitcoin through traditional brokerage accounts.

The product is designed to closely track BTC prices while operating within a regulated investment framework.

According to The Sunday Times, the entry price for the product will allow investors to buy fractions of Bitcoin for about $11 per unit, providing retail investors with exposure to the digital asset without direct ownership or the need to trade on crypto exchanges.

BlackRock remains one of the most successful issuers of Bitcoin-linked products, with its US-listed iShares Bitcoin ETF holding more than $85 billion in net assets, according to SoSoValue data.