TLDR

- Over $60B has flowed into Bitcoin spot ETFs, led by BlackRock’s IBIT.

- Exchange inflows hit record lows while Bitcoin reached all-time highs.

- Miner selling is now negligible compared to long-term holder activity.

- Bitcoin’s new bear market floor ranges between $75K and $80K in 2025.

Bitcoin’s four-year halving cycle is no longer the main driver of price. Institutional demand, ETF flows, and global liquidity trends are shaping a new market structure. Analysts now believe that long-trusted indicators like exchange inflows and Realized Price have lost their effectiveness. As Bitcoin trades above $100,000, investors are rethinking the old cycle playbook going into 2026.

Institutional Demand and ETF Dominance Shift Market Structure

Bitcoin’s traditional cycle, driven by miner rewards halving every four years, is being overtaken by demand from institutions. Since the launch of US spot Bitcoin ETFs, over $60 billion has flowed into the market. These ETFs are now the main source of price formation, as confirmed by Checkonchain Analytics.

James Check, co-founder of Checkonchain, said, “There is absolutely going to be some holders migrating from on-chain to ETFs… but the demand has actually been incredible and massive.”

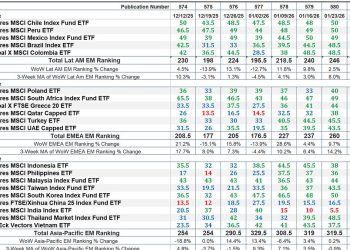

The US market leads in ETF adoption, with BlackRock’s IBIT gaining the most assets under management. IBIT also commands the highest volume in ETF-linked options, which has made it the dominant force in this space. US ETFs now account for 90% of global spot Bitcoin ETF holdings.

Exchange Flows and Miner Activity Losing Influence

In the current market, exchange inflows are at record lows even as Bitcoin reaches new highs. Analysts suggest that this data is incomplete because many wallets used by major exchanges remain unidentified. This reduces the reliability of exchange flow metrics as indicators of buying or selling pressure.

James noted, “You won’t see me actually use exchange data very often… it’s just not a highly useful tool.”

Miner selling, once considered a major influence, is now minimal in effect. Daily issuance of around 450 BTC is small compared to long-term holders who can sell tens of thousands of BTC during rallies. Checkonchain data shows that miner activity is nearly invisible on broader market charts.

This suggests that miners no longer control short-term or long-term price direction. Institutional inflows and long-term holder profit-taking now move the market far more.

Realized Price and Metrics Need New Context

Metrics like Realized Price have long helped investors identify market cycles. However, analysts say this is no longer reliable because it includes coins that are permanently lost, including early wallets such as those believed to belong to Satoshi Nakamoto.

The Realized Price currently sits around $52,000, but market participants now see higher price levels as stronger floors. James stated, “I don’t think Bitcoin goes back down to 30K… if we have a bear market right now, I think we would go down to something like 80,000.”

Current data shows cost basis clusters around $74,000 to $80,000. These clusters include ETF holdings and corporate treasuries, making them more reliable indicators of future support than older metrics.

MVRV Z-Score, another popular tool, also shows weaker signals compared to past cycles. While it still reflects market conditions, analysts caution that thresholds must be adjusted for current market depth and instruments.

Liquidity Conditions and Derivatives Are Now Central

Bitcoin now moves with global liquidity trends. As more institutional products appear, such as ETF-linked options, these instruments are driving much of the new demand. Vanguard is expected to follow BlackRock with its own offering, further strengthening the role of derivatives.

James said, “The most important thing is not the ETFs themselves. It’s the options market being built on top of them.”

Sovereign funds and pension managers are also showing interest in Bitcoin. Though still early, their participation introduces new variables. Most US ETFs are custodied with Coinbase, raising questions about concentration risk. However, Check says proof-of-work protects the network from structural risk.

Bitcoin’s role has shifted. It no longer moves only with crypto-specific events but now reacts to broader economic forces, global liquidity, and investor flows. As 2026 approaches, strategies based on previous halving cycles may not work. New approaches must consider liquidity regimes, derivatives, and institutional positioning.