TLDR

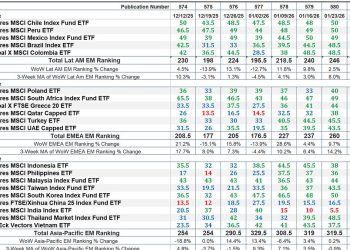

- Tom Lee says only 22% of fund managers are beating benchmarks this year.

- BitMine added 104,000 ETH worth $417M from Kraken and BitGo wallets.

- Trump will meet China’s Xi in two weeks to renegotiate U.S. tariffs.

- Crypto markets saw $1B in liquidations with $369M from Bitcoin alone.

As markets reel from fresh volatility, BitMine chairman Tom Lee sees an entry point. Meanwhile, U.S. President Donald Trump has confirmed a meeting with China’s President Xi Jinping to review existing tariffs. Crypto markets responded sharply, with over $1 billion liquidated in 24 hours. Lee, however, believes current market fear presents long-term value, especially as global economic talks intensify.

Tom Lee Sees Buy Opportunity Amid Market Pullback

Tom Lee, chairman of crypto investment firm BitMine, has described the recent crypto market decline as a “golden buying opportunity.” His comment followed a period of heightened volatility, during which Bitcoin and Ethereum experienced sharp corrections.

In a recent post, Lee explained that multiple factors, including U.S.-China trade tensions, credit market deleveraging, and typical October volatility are driving market stress. Despite this, he suggested that negative investor sentiment may signal a rebound ahead.

According to Lee, only 22% of fund managers are currently beating their benchmarks. He said this could lead many to begin “chasing performance,” which may lift asset prices. He stated, “BTFD — that’s our take,” implying his belief in buying during market dips rather than waiting on the sidelines.

BitMine Expands Ethereum Holdings During Market Dip

Backing his outlook, BitMine has increased its Ethereum holdings by $417 million. Blockchain data shows the firm moved over 104,000 ETH from exchanges Kraken and BitGo into new wallets.

This transfer suggests a strategic accumulation rather than a short-term trade. BitMine has continued to focus on long-term positions, and this latest move supports its stance that Ethereum remains undervalued in the current cycle.

During a recent podcast appearance, Lee also expressed optimism about Ethereum’s future. He said ETH could reach between $10,000 and $12,000 by the end of 2025. His view aligns with that of Arthur Hayes, co-founder of BitMEX, who also described the recent volatility as temporary.

Trump Confirms Meeting With China to Review Tariffs

Global markets are also responding to news that President Trump will meet with Chinese President Xi Jinping in two weeks. Trump said current tariffs on Chinese imports are “not sustainable” and suggested they may be reduced after the talks.

Speaking to reporters, Trump was asked whether the tariffs would stay in place. He answered, “No — we’ll be fine with China.” The announcement has raised expectations for changes in trade policy that could support broader market recovery.

The proposed meeting may lead to a reset of U.S.-China trade terms. Some investors see this as a possible relief for both traditional and digital asset markets, which have been sensitive to global economic pressure.

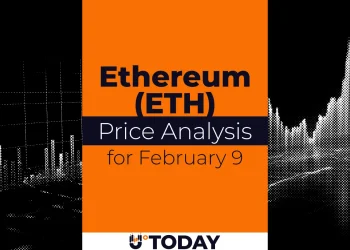

Fed Signals Rate Cuts as Crypto Faces Heavy Liquidations

At the same time, Federal Reserve Chair Jerome Powell has hinted at possible rate cuts during the recent FOMC meeting. Powell cited slower job growth and weak inflation as reasons for a more flexible monetary policy.

Crypto markets have seen sharp liquidations amid these developments. Data shows over $1 billion in total liquidations within 24 hours. Bitcoin was hit hardest, with $369 million in long positions closed, while Ethereum saw $262 million liquidated.

Analysts say economic pressure and investor uncertainty are driving the recent downturn. However, with signs of easing trade tensions and possible rate cuts, some believe markets may regain stability in the coming weeks.