October 10th rewired behavior across the board. $19 billion vaporized practically instantly, leaving most altcoins stuck in limbo, and traders are not stepping in to bid.

XRP has slid back under $2.50 after failing to conquer the $3.00 wall. Sui continues to leak lower, and capital is shifting from stalled narratives to products with real-world adoption. Digitap ($TAP) is one of these products.

As altcoins continue to bleed out, the Digitap presale is smashing records and already boasts a live product and a Visa card for users globally. Here’s what investors should know.

Will Altcoins Ever Recover?

The liquidation flushed out leverage and exposed how fragile altcoin demand has become. Capital is quickly adjusting and shifting from momentum to utility.

Funds that once chased memes are now looking for cash flows. The result is a split market. Large caps still have liquidity, but the demand that usually flows towards speculation is scrambling to find tokens that look like operating companies.

It is a back-to-basics approach in every sense of the phrase for investors.

XRP: Failed Breakout

XRP spent weeks trying to clear $3. It never stuck. And now XRP trades back below $2.50. XRP is not ranging and chopping now, not heading for a decisive breakout. October 10th drained leverage and confidence at the same time. Since then, bids have been cautious, and hodlers are selling into any rallies.

The payments story still matters for XRP. But despite a long list of partnerships with major banks and plenty of test transactions, Ripple does not process any meaningful volume. That is despite being operational since 2012.

ETF talk helped for a moment, then cooled. Without a fresh catalyst that brings durable demand, XRP will continue to have limited upside. Until it becomes a product that normal people use, XRP believers will have to be patient.

Sui: Throughput But No Bid

Sui moves fast, and it is cheap. The devs keep shipping, but the price is telling a different story. Since the October reset, demand has thinned, and rallies are not holding. SUI risks falling out of the channel, which becomes no man’s land, and a recovery will take longer.

The core issue is that layer 1 is only as good as the applications built on top of it. No demand for blockspace means no demand for the native token. Sui above all needs a hit product that people use.

Without that hook, Sui is a strong infrastructure waiting for customers. And with the current prevailing sentiment, actual usage beats speed.

The Rise of Digitap

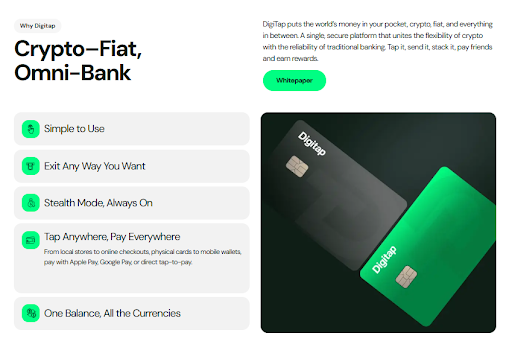

Digitap is an omni-bank—a banking app that looks like a neobank but with crypto engines under the hood. Fiat, stablecoins, and crypto sit in one place. Balances move between them. And the engine treats money like software, moving it in real time.

One account, many rails, and everything abstracted away for the end user. A leading feature is the Visa card that is bridging crypto to real life. Digitap issues virtual and physical versions with Apple Pay and Google Pay working out of the box.

If the jurisdiction allows, cards can be issued with KYC, and thanks to this card, crypto is now spendable globally. A user holding ETH, stablecoins, or BTC can tap at a checkout, and the merchant just sees Visa while Digitap’s smart routing engine finds the best conversion rate.

The bigger aim is cross-border payments. This is an industry that processes trillions of dollars of volume annually. Fees average 6.2% and take days to settle. Now with Digitap, the costs are reduced to less than 1% and these transactions take seconds. In many ways, Digitap is the front-end for stablecoins.

How $TAP Links Value Back to Holders

But why is the $TAP token seeing record inflows? Most of that comes from the tokeomics model. $TAP has a fixed 2 billion supply, and half of Digitap platform profits are used to purchase it. These purchased tokens are then burnt (50%) and distributed to stakers (50%).

Usage feeds profits, and the more Digitap scales and sees adoption, the better the $TAP token should perform. Its current price of $0.0194 looks like a discount, with a 38% increase to $0.0268 coming soon. The presale has smashed $750,000 since launching, and it is starting to look like one of the potential altcoins to invest in.

Could $TAP Flip XRP in 2026?

This market is rewarding real products. XRP is stuck under key levels. Sui keeps falling as demand thins. Capital is moving towards projects with high growth prospects and working solutions. Digitap fits that brief.

A real Visa card connects crypto to the real world. Given the advancements in stablecoin chains and Digitap’s ability to integrate them, there is even talk of $TAP flipping XRP.

The app feels like a neobank, offering users the familiarity they are comfortable with while enjoying the speed of blockchains. Digitap’s path forward to scale is clear, and the latent growth potential is enormous.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer

Please be advised that all information, including our ratings, advices and reviews, is for educational purposes only. Crypto investing carries high risks, and CryptoNinjas is not responsible for any losses incurred. Always do your own research and determine your risk tolerance level; it will help you make informed trading decisions.