A Chinese e-commerce giant’s shares have more than doubled this year, creating a $250 billion rally that’s forcing global fund managers to reconsider their allocation strategies. The financial broker at FTMX Global explores why this AI-driven surge represents more than just a momentum trade and whether the stock still offers value despite its dramatic ascent.

The Numbers Tell a Compelling Story

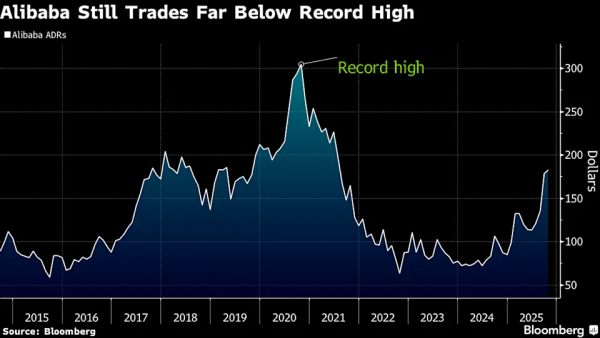

US-listed shares have climbed over 100% in 2025, yet the company remains more than 65% below its all-time high reached in 2020. This creates an unusual dynamic where substantial gains coexist with significant room for recovery compared to historical peaks.

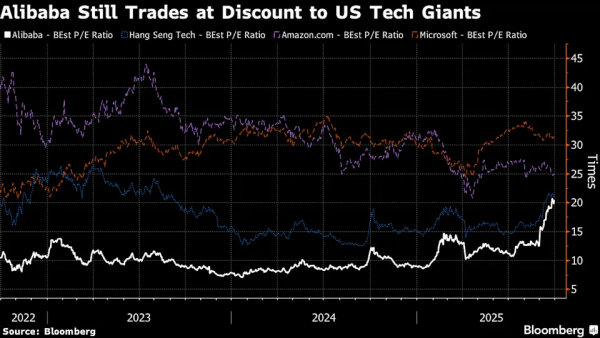

The Hong Kong-listed shares trade at approximately 22 times forward earnings, double their three-year average but still aligned with the Hang Seng Tech Index. This multiple sits well below the stock’s 2020 peak of 29 times and current valuations for Amazon and Microsoft, suggesting potential upside if the company can demonstrate sustained growth.

Positioning and Investment Flows

International funds remained underweight the stock by 1.3% versus its MSCI China Index weighting as of late August, according to Morgan Stanley data. This positioning creates mechanical buying pressure if managers decide to close their underweight positions to match benchmark allocations.

Onshore investors have shown greater enthusiasm. Domestic shareholders owned 11% of shares as of September 30, up from 8.6% just one month prior, based on Hong Kong exchange data. This rapid accumulation by local investors signals confidence in the AI transformation narrative that Western funds have been slower to embrace.

Notable foreign managers are changing their stance. Cathie Wood reopened positions in the company’s American depositary receipts last month for the first time in four years, marking a significant shift from her previous avoidance of Chinese technology stocks.

Jian Shi Cortesi, a fund manager at GAM Investment Management, expects underweight positions to reverse and sees “significant upside” remaining. She suggests that fear of missing out on continued gains could accelerate capital inflows as the rally extends.

The AI Infrastructure Investment Thesis

Chief Executive Officer, Eddie Wu, announced plans to expand the previously projected AI budget of $53 billion over three years, though he provided no specific increased figure. This spending commitment, while substantial in absolute terms, pales compared to the four major American hyperscalers expected to deploy over $344 billion this year alone on AI infrastructure.

The company’s cloud division posted a 26% revenue jump in the latest quarter, becoming the fastest-growing business unit. This performance validates management’s strategic pivot toward artificial intelligence and cloud computing services as core growth drivers.

The January DeepSeek breakthrough demonstrated China’s ability to produce competitive AI technology at lower costs than Western counterparts. This development shifted investor perceptions about the viability of Chinese AI capabilities and reduced concerns about technological inferiority relative to American competitors.

Richard Clode, who manages Janus Henderson’s $6 billion Global Technology Leaders Fund, stated that “no one will be calling the valuation egregious anytime soon,” explaining why global investors feel comfortable entering positions at current levels.

Competitive Advantages in a Target-Poor Market

The Chinese AI investment landscape differs dramatically from American markets, where numerous companies compete for capital. Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management in Paris, highlights this scarcity premium: the company is “one of the few that have world-leading large-language models, capable access to AI chips, proven experience in cloud infrastructure, and data-rich core business all at once.”

Only Tencent Holdings and unlisted ByteDance possess similar comprehensive AI capabilities within China’s technology sector. This concentration creates a natural funnel for investors seeking exposure to Chinese artificial intelligence development.

The e-commerce operations generate vast quantities of consumer data that feed machine learning models and AI applications. This data advantage, combined with established cloud infrastructure, creates barriers to entry that protect market position against smaller competitors.

Domestic price wars in food delivery temporarily interrupted the rally and remain a concern. Cutthroat competition in core Chinese markets could pressure margins and limit the capital available for AI investment, potentially undermining the growth narrative.

Technical Signals and Market Sentiment

The 14-day relative strength index indicates shares have entered overbought territory, suggesting near-term consolidation or pullback risk. Short interest in Hong Kong-listed shares surged to 0.47% of free float, the highest level since shortly after the 2019 listing, reflecting skepticism about sustainability at current prices.

Options traders paint a different picture. Trading volume has increased substantially as speculators bet on continued gains. The cost of bullish options wagers sits near its highest level since 2022 relative to the Hang Seng Tech Index, while outstanding contracts reached record levels before the latest monthly expiration.

Sell-side analysts have reached unanimous buy recommendations, a rare consensus that sometimes signals peak optimism. When Wall Street research departments align completely, contrarian investors often view this as a contrary indicator, suggesting limited upside remains.

The financial broker at FTMX Global notes that shares rose as much as 1.7% on Friday to the highest level since August 2021, bucking broader Hong Kong market declines. This relative strength demonstrates investor conviction despite regional headwinds.

The post China’s AI Comeback: Why a $250 Billion Rally Has Fund Managers Rethinking Strategy appeared first on Visionary Financial.