TLDR

- TRON leads stablecoin transfers with $11.4B in USDT, reinforcing its position in crypto liquidity

- 91% of TRX holders are in profit, with large holders controlling 79% of the supply

- TRX price was at $0.2336-$0.2458 in early March 2025, showing mixed short-term performance

- Network activity reached a 2-month high with 2.94 million active addresses

- Analysts like Crypto Patel project TRX could reach $1 this bull cycle

TRON (TRX) has emerged as the leading blockchain for stablecoin transactions, recording $11.4 billion worth of USDT transfers. This development has reinforced TRON’s dominance in the cryptocurrency ecosystem as a preferred network for stablecoin movements.

Data shows that of this amount, $1.83 billion was sent to major centralized exchanges. These transactions make up part of the 1.89 million total USDT transactions on the TRON network.

TRON continues to be a popular choice for stablecoin transfers due to its efficiency and low transaction fees. The network’s appeal stems from its ability to process transactions quickly and at minimal cost compared to competitors.

The share of inflows through exchanges (6.17%) highlights TRON’s importance for market liquidity. This data suggests that TRON-based stablecoins play a key role in overall cryptocurrency market operations.

As of early March 2025, TRX was trading at around $0.2336-$0.2458, with mixed short-term performance. The price showed a 4.11% decrease over 24 hours but a 1.46% increase over the week.

The market capitalization stood at $20.12 billion with a 24-hour trading volume of $1.37 billion. These figures place TRON among the top cryptocurrencies by market value.

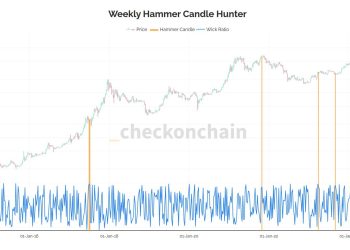

Technical indicators suggest potential price movement in upcoming trading sessions. The Bollinger Bands are tightening, indicating a possible change in volatility.

The current resistance level is at $0.2369 while support is at $0.2259. Analysts note that if TRX breaks above resistance, it could target the $0.25 mark.

Stochastic RSI at 58.30 shows moderately bullish sentiment. Meanwhile, the Aroon indicator is strongly bullish at 71.43%, having moved past a strong downtrend.

On-chain data reveals that 91% of TRX holders are in profit, with only 5% at a loss. This suggests most investors purchased at lower prices and may be less likely to sell their holdings.

Large holders control approximately 79% of TRX’s total supply. This concentration can act as a market stabilizer but could also introduce volatility if major holders decide to sell.

TRON’s price movement shows a low correlation with Bitcoin at just 0.22. This indicates that TRX follows different market trends than the leading cryptocurrency.

Whale and institutional activity remains high for TRON. The transaction volume for trades over $100,000 in the past seven days reached $2.13 billion.

Exchange net flows show $68.72 million moving out of exchanges. This is typically considered a bullish indicator as investors move cryptocurrency from exchanges to private wallets for longer-term holding.

Network Activity

Network activity for TRON has surged, reaching a 2-month high of 2.94 million active addresses. Analyst Ali Martinez highlighted this increase as a sign of growing market interest in the project.

Some market analysts have made bold predictions about TRON’s future price. Crypto analyst “Crypto Patel” suggested that TRX could potentially reach $1 during this market cycle.

$TRX hit our 200% target as predicted but Forgot to share Profit Update here 🚀

#TRON is showing strong momentum, and I still believe $1 is possible this bull run!Best buy zone: $0.180 – $0.160 (if we get it).

Who’s holding TRX to $1?

RT & Like if you’re bullish! 🔄 https://t.co/b5C1ZQxPrg pic.twitter.com/zpxn7ltrGO

— Crypto Patel (@CryptoPatel) March 5, 2025

According to Patel, TRON currently shows strong momentum and has solid support at the $0.140 level. The analyst identified $0.160-$0.180 as the optimal “buy zone” should prices retrace.

It’s worth noting that Patel previously predicted a 200-300% surge in TRX price in October 2023. At that time, TRX traded around $0.16, and it later reached $0.426 by early December 2024.

The broader cryptocurrency market recovery appears to be supporting positive sentiment for TRON. Recent pro-crypto developments in the U.S. have boosted market confidence.

Recent speculation has emerged about TRON’s potential role in former President Donald Trump’s digital asset strategy. TRON founder Justin Sun has hinted at this possibility, though no official confirmation has been made.

Trump recently announced plans for a strategic cryptocurrency reserve that includes Bitcoin, Ethereum, XRP, Solana, and Cardano. Market participants are watching closely to see if TRON might be added to this list.

Justin Sun recently posted “TRON to the SUN” on social media, generating enthusiasm among TRON supporters. This comes as the broader market shows signs of recovery.