Types of Tokenization on Blockchain

As blockchain technology continues to advance, tokenization has emerged as a pivotal innovation across multiple industries, particularly within the financial sector. The process of converting real-world assets into digital tokens allows for more secure, transparent, and efficient transfers of ownership while facilitating fractional ownership of traditionally illiquid or high-value assets. Here, we examine four primary categories of blockchain tokens: Utility Tokens, Settlement Tokens, Asset Tokens, and Investment Tokens. Each token type serves a distinct purpose, transforming industries ranging from finance to real estate, art, and beyond.

1. Utility Tokens

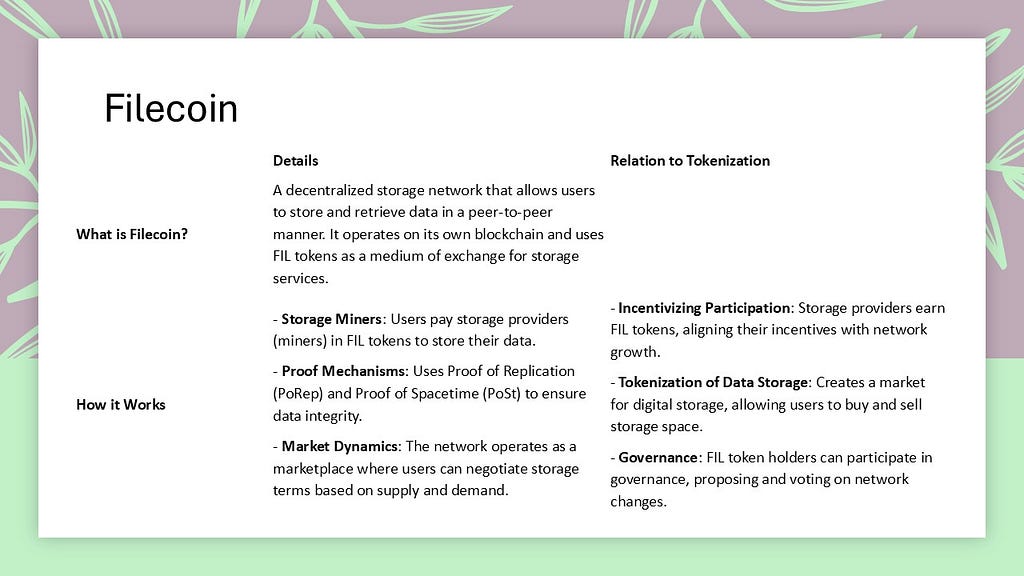

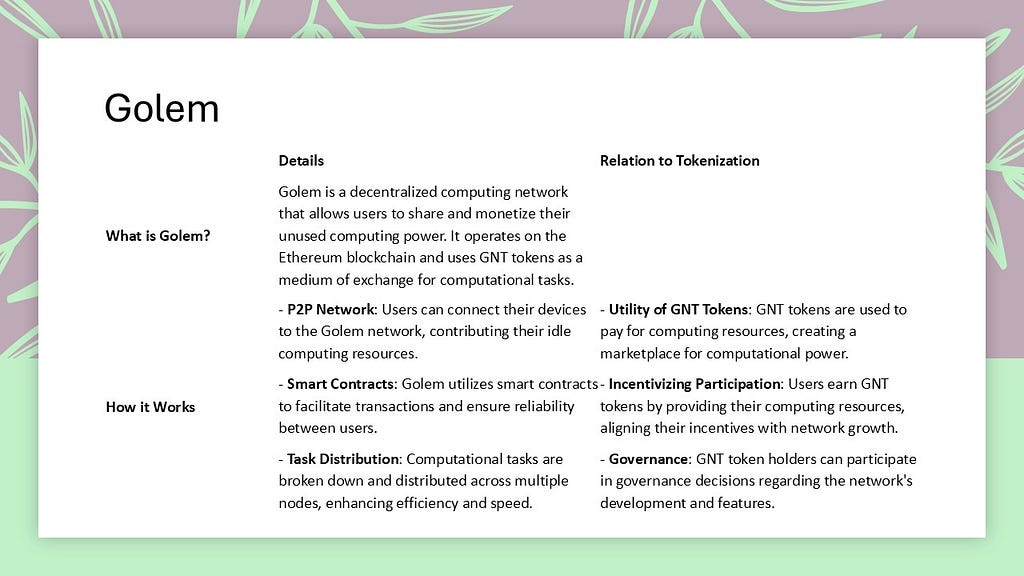

Utility tokens provide users with access to specific products or services within a blockchain ecosystem. Their primary function is to facilitate interactions on decentralized platforms rather than to represent ownership or serve as investment vehicles.

For instance, Filecoin (FIL) is a utility token used to purchase decentralized file storage services, while Golem (GNT) enables users to rent computing power on the Golem network. These tokens streamline transactions within their systems, enhancing user engagement and incentivizing participation. As decentralized platforms grow, utility tokens will continue to play a vital role in ensuring their smooth operation. However, regulatory clarity is crucial to ensure these tokens remain functional tools rather than being classified as securities due to the fact that utility tokens can be traded as long as there is a market presence to execute such trades at a fair price.

2. Settlement Tokens

Settlement tokens are designed to function as a stable medium of exchange within or across blockchain platforms. Typically backed by fiat currencies or other assets, these tokens maintain a stable value, making them ideal for transactional purposes.

Stablecoins — such as Tether (USDT) and USD Coin (USDC) — are currently the most common form of settlement tokens. They are widely used in cross-border payments, decentralized finance (DeFi), and remittance services, providing faster and cheaper alternatives to traditional financial systems. By offering stability and liquidity without the volatility associated with other cryptocurrencies, settlement tokens have become essential to the broader adoption of blockchain-based financial services.

Stablecoins are increasingly being used to facilitate cross-border trade. Businesses can leverage stablecoins to transfer funds between countries without relying on costly intermediaries, such as correspondent banks. Unlike traditional wire transfers, which may take several days to settle, stablecoin transfers can be completed within minutes. This acceleration benefits businesses engaged in global trade by improving cash flow and reducing the costs typically associated with currency conversion and transaction fees.

A key advantage of stablecoins in cross-border transactions is their ability to be quickly and easily converted into local fiat currencies via on/off-ramp services. These services enable users to deposit fiat currency domestically, convert it into stablecoins for international transfers, and then convert it back to fiat in the recipient country. This process eliminates the need for businesses and individuals to hold large amounts of volatile cryptocurrencies, providing a seamless bridge between digital assets and traditional financial systems.

3. Asset Tokens

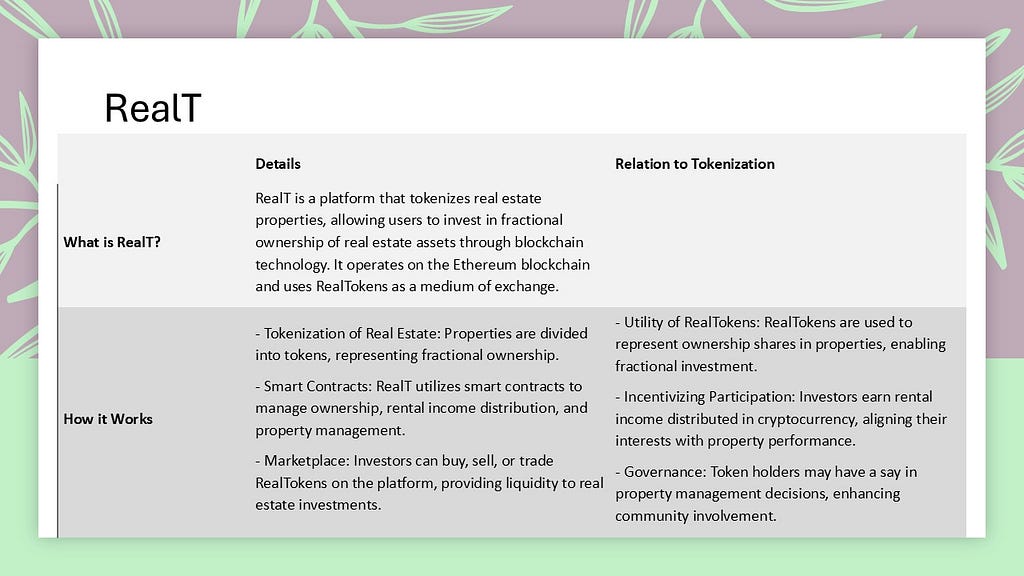

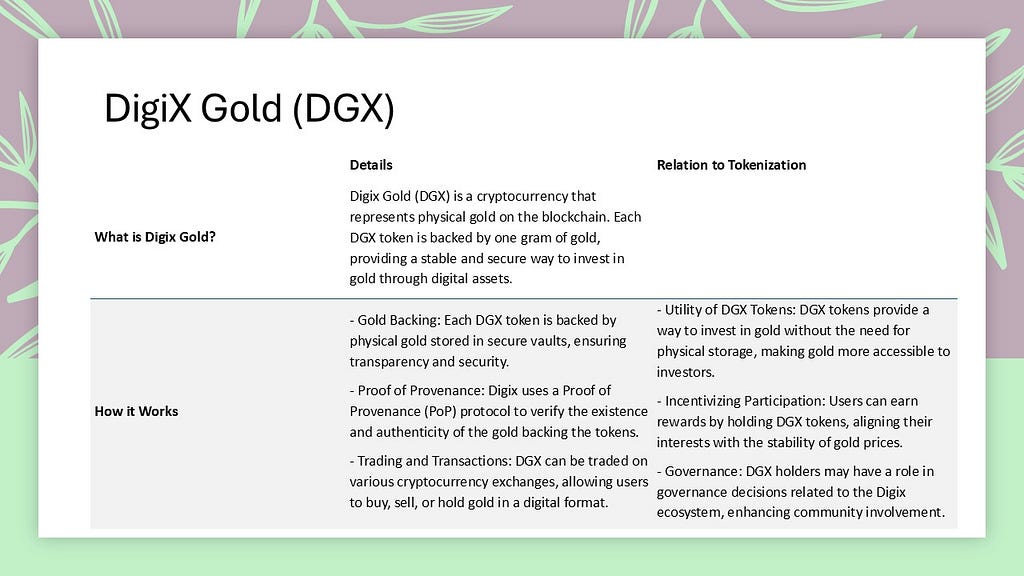

Asset tokens represent ownership of real-world assets, including tangible items like real estate and commodities, as well as intangible assets like intellectual property. These tokens are directly tied to the value of the underlying asset, making them a digital reflection of physical ownership or rights. Asset tokens offer significant benefits, such as increased liquidity, transparency, and accessibility to markets that were traditionally difficult to enter.

Real Estate and Commodities

In the real estate sector, platforms such as RealT allow investors to own fractional shares of properties through asset tokens, democratizing access to property markets. Similarly, Digix Gold (DGX) tokens represent ownership of physical gold, enabling fractional trading and improving liquidity in the commodities market. By tokenizing assets like real estate and gold, blockchain technology is making these markets more accessible and easier to trade while also enhancing transparency and the security of ownership records.

Non-Fungible Tokens (NFTs)

Non-Fungible Tokens (NFTs) are a unique subset of asset tokens that represent ownership of specific, one-of-a-kind digital or physical items. Unlike fungible tokens (such as cryptocurrencies), NFTs cannot be exchanged on a one-to-one basis due to their distinct characteristics, which makes them particularly valuable in sectors like art, collectibles, and intellectual property.

NFTs have gained significant attention in the digital art world, where they enable artists to tokenize their works, providing verifiable proof of ownership and authenticity. Beyond art, NFTs are also being used to tokenize virtual real estate (e.g., Decentraland) and intellectual property, creating new revenue streams for creators and offering a secure, transparent mechanism for ownership transfer.

The key advantage of NFTs lies in their ability to verify ownership and scarcity in the digital realm. Creators can monetize their work more effectively, while buyers gain confidence in the authenticity of the digital assets they purchase. As blockchain adoption grows, NFTs are expected to expand into new industries, offering novel applications for digital ownership.

4. Investment Tokens

Investment tokens, often referred to as security tokens, represent ownership in financial assets such as company shares, bonds, or real estate. These tokens are subject to securities regulations, ensuring compliance with the legal frameworks governing traditional financial markets.

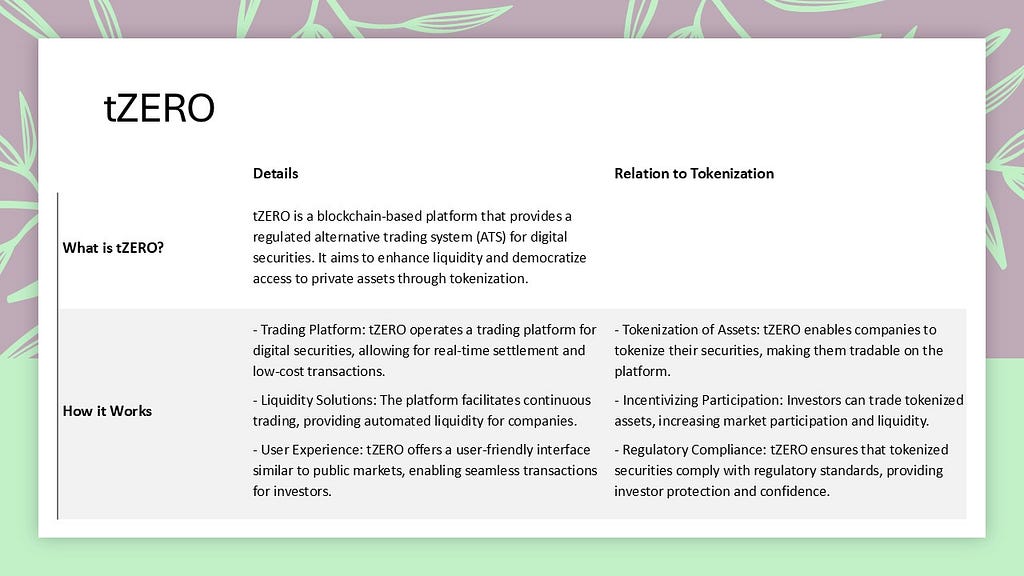

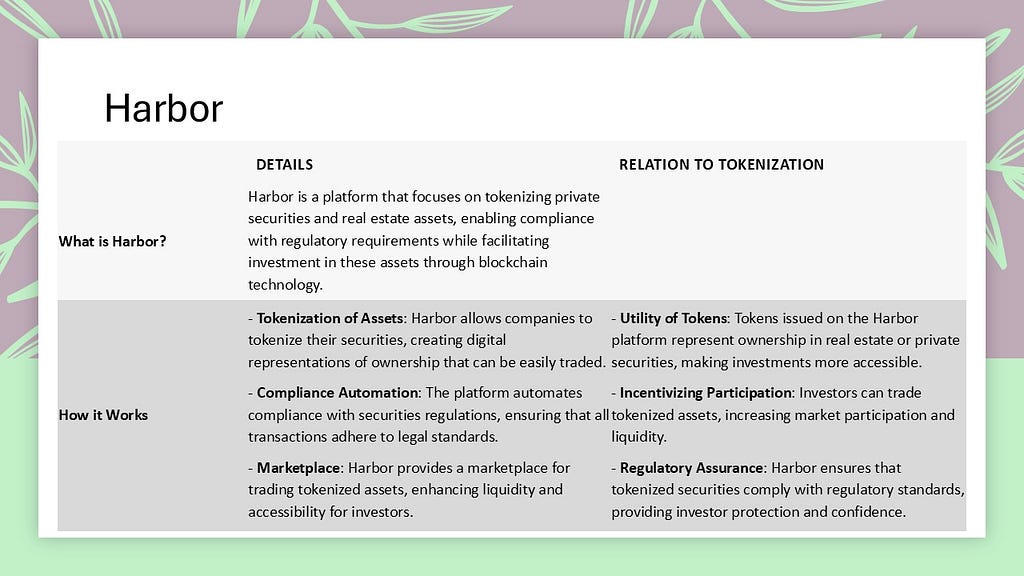

Platforms like tZERO and Harbor are leading the way in the tokenization of securities, allowing investors to trade regulated tokenized assets. Investment tokens offer several advantages, including increased liquidity, faster settlement times, and reduced transaction fees. By tokenizing traditional securities, these platforms are democratizing access to capital markets, allowing a broader range of investors to participate. For investment tokens to thrive, strict adherence to regulatory standards and investor protection mechanisms is essential.

What’s Next

The various categories of tokens on blockchain — utility, settlement, asset, and investment — are each revolutionizing different sectors of the economy. Utility tokens enable interactions within decentralized platforms, while settlement tokens provide stability for transactions. Asset tokens, including NFTs, democratize markets by allowing fractional ownership and making illiquid assets more accessible. Investment tokens are transforming the way financial securities are issued and traded, offering greater liquidity and efficiency in capital markets. Next, we will look into the acceptable media of exchange: Stablecoins.

References

- I just read this great article on getsmart check it out!

- 11 best stablecoin picks for B2B payments in 2023 [ranked & reviewed] | BVNK Blog

- What are Tokenised Deposits and how different are they from Stablecoins

- Asset Tokenization Explained – Chainalysis

- Tokenisation of securities and other investment products – what, why and key considerations in Hong Kong and China Mainland – KWM

- Investment Tokens: Characteristics, Functionality, and Use Cases

The Revolution of Tokenization: Transforming the Future of Finance (2 of 5) was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.